General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

Celebrating the glorious 75 years of Independence – Azadi ka Amrit Mahotsav

The tales of our brave freedom fighters and their over-the-line selfless deeds are always an inspiration to the whole nation. One can never entirely express gratitude for their sacrifices for our nation’s independence from the British Raj. As we get farther from the year 1947, our gratefulness only grows more and more. This year on March 12th, in honour of our 75th Independence Day celebration, the Government of India started a national initiative to celebrate the glorious years of freedom – “Azadi Ka Amrit Mahotsav”.

This campaign is an attempt to cherish the relentless work of the citizens who contributed to India's evolutionary path to success and prosperity. This movement carries the ability to allow the vision of unleashing India 2.0, driven by the ethos of Atmanirbhar Bharat, a seed sown that is now a tree and bearing fruits. The campaign starts precisely 75 weeks before our 75th Independence Day that falls on 15 August 2023.

The main objective of this campaign is to hold a series of events to celebrate the success of Atmanirbhar Bharat in all sectors nationwide. India has marked its supremacy in Technology, Governance, Development, and Reformation through unmatched efforts empowering it to be a global superpower soon.

Several socio-cultural programs are conducted in conjunction with the Amrit Festival of Independence. These programs shall run on regional and state levels for educational and cultural aspects aiming to positively influence the lives of Indians and foster the development of India on a global scale. Various states and institutions have shown their enthusiastic participation in the campaign in multiple ways, including a 350 km run for defence staff members, an ITBP cycle rally, various exhibitions, and many more.

Another significant move towards the campaign was launching a mobile app this November. The Government of India unveiled the Azadi Ka Amrit Mahotsav app to provide a single source of all information pertaining to India's 75th-anniversary festivities. The app is accessible for all smartphone users and contains information on the AKAM-sponsored happenings. According to a statement released by the ministry of culture, the main page allows users to overview the app's unique and diverse content. This app is a digital library of wonderful experiences showcasing various sections, from highlighting the inspiring stories of our unsung heroes to embracing the noteworthy achievements made by our country.

The effort taken by the government to acknowledge the courage of our warriors will surely warm our hearts. This campaign displays a strong message to the world about the spirit of Indians and embarks on the splendorous journey of India from battling for independence to celebrating it. With such a strong nationwide initiative, the least we can do is play our part in it. So, let’s drench our hearts with patriotism and come together as one big family to contributing to the Mahotsav in any possible way. The entire nation is looking forward to unbinding the future of the new India- India 2.0! Jai Hind!

5 Best riding destination in Mumbai!

With the rain slowly subsiding and the roads getting clearer, Mumbaikars can finally get on their bike for a nice, pleasant ride. Now, you can finally say goodbye to the cloud-laden sky, dust off your bike, and hit the road for some hot cutting chai as you delve into the sceneries that your trip is going to offer. So without further ado, let’s look at the five best riding destinations in Mumbai. However, before you set out on your ride, make sure that you have access to the best two-wheeler insurance in India so that you can stay out of legal trouble.

1. Durshet

Durshet is located 64 kilometers from Mumbai and is known for its jungle safari and water sports. It’s hidden well in the laps of the Sahyadri mountain range and is covered in lush greenery. While you are here, you can take a dip into the shimmering cold water of the Amba river to refresh your senses. If you are someone who finds pleasure in visiting holy sites, then there are several temples around for a good morning walk that will fill you with a sense of devotion — the astounding nature only adds up to the serenity of this place.

2. Mulshi Dam

This dam is located 127 kilometers from Mumbai and is known for its several forts. It is a perfect place to get your camera out and click some amazing pictures that will decorate your gallery. The dam, which is constructed on the Mila river, works as a hydroelectric plant. The monsoon is particularly a good time to visit this place as you can see the river at its full flow while the mist fills the atmosphere, mesmerizing you with its beauty.

3. Malshej Ghat

Located serenely in the Sahyadri range, the Malshej Ghat is located at a distance of 154 kilometers from Mumbai. A bike ride here will offer you the naturally decorated view of lakes and valleys. It has some unique flowers that will make you take your camera, and perhaps never put it back. During the rainy season, you can even spot a few flamingoes perching, feeding themselves. It is a must-visit if you are into trekking, bird-watching, and hiking.

4. Vihigaon Waterfalls

The Vihigaon waterfall is located at a distance of 115 kilometers from Mumbai city. It is known for having the highest peak in Maharashtra — the Kalsubai. It is hidden in the greenery and can offer you some great treks that have some mesmerizing views. You can dive deep into the calmness which this place offers, which makes for an ideal spot for having a picnic with your friends and family. On top of everything, the waterfall offers a great view. It is a perfect escape from the hustle and bustle of city life.

5. Thoseghar Falls

Thoseghar Falls is located at a distance of 230 kilometers from Mumbai, which makes it a great place for bike rides, as you will be spending enough time on the road. The place receives abundant rainfall, and during monsoon, the waterfalls gush at high speed which makes it a pleasant sight. You can either sit around the lake or take a dip in it or merely gaze — there’s always enough to do at this place. With so many places to go around all you have to do is top up you fuel tank and hit the road. However, make sure that you get the best two-wheeler insurance in India so that safety becomes a top priority.

Drive Safely _ Your family needs you

Driving is an adventure! You hold the steering wheel, buckle your seatbelt, get on the road, and roar your way through. The experience is even better on the highway where you have the chance to speed up. However, when on the road, one must watch out while speeding — as the popular saying goes: speed thrills, but kills! Driving safely is essential for many reasons. First and foremost, it is for your safety — you have to get back home to safety, a home where your family waits for you. Besides, driving is just not about trying not to overspeed to avoid accidents; it is also about having your car papers (insurance and registration) right so that you do not land into any legal trouble. You can start with getting your documents in proper place as it is mandatory to have registration and car insurance in India) Here, we will look at a few reasons why you should consider driving more safely than ever. .

Driving safe is eco-friendly

Driving an engine which lets out smoke, in the first place, is not suitable for the environment. However, more often than not, it is unavoidable. So if you do not want to leave large carbon footprints behind you, the best you can do is drive safely, economically — making sure that you use less fuel which also cuts down on carbon emissions. When you are driving carefully in economy mode, you will use less fuel, which indeed is good for the environment in the long run.

Financial gain and safety

Besides the fact that safe driving cuts down on fuel usage, it also helps you save money on your car insurance. If you have not made a single claim during your term of your car insurance in India, then you end up paying less money on your insurance premiums. You will also be earning more with the No Claim Bonus (NCB) on your car insurance if you do not meet with an accident within your insurance term.Another significant part of driving safe is that you will avoid any road accidents. According to a report, more than 1,50,000 people are killed annually in road accidents every year. The best you can do to avoid such circumstances is drive safely.

Sets a good example

If you drive safely, you also set an excellent example for others. For example, if you have a teenage child, then you will want them to drive safe too. If you explain to them the importance of driving safely and practice it on the road yourself, then it is highly likely that your child will learn from you and follow your footsteps. By looking at you, young drivers can be ‘peer pressured’ into driving safely, and this will be good for everyone. With so many reasons to drive safely, it is crucial that you make a safety note for your car as well. It becomes important that you get good car insurance in India. Magma HDI car insurance comes with numerous features that make it a popular choice for car owners. With a Magma HDI insurance, you get a personal accident cover and access to additional legal liabilities. Besides, you get access to other features such as access to anti-theft devices, no claim bonus, and a discount on your insurance premiums, among others.

Is riding a two-wheeler easy

For a lot of us, learning how to ride a two-wheeler involved tripping and falling, messing up the gears, and what not! Initially, it required someone to sit behind us to make sure that we do not accelerate much and that the bike does not go astray. The day you realized that you learned to ride was the day when you kissed freedom. The feeling was new, enthralling. A single, gentle twist at the accelerator could send you roaring. Learning how to ride can be challenging. However, before you begin your learning endeavors, it is essential to make sure that you have got your bike insurance in place. Having two-wheeler insurance online in India can save you much trouble as you maneuver your way with your first bike, trying to master its control. Here, we will look at a few hacks for new two-wheeler learners so that their learning curve is smooth and hassle-free.

Don’t put weight on the handle

It is easy to assume that a tight grip on the handle will make riding more comfortable, but it is not quite so. When you have a tight grip on the handle, it becomes hard to steer the bike. The trick here is to have a loose grip on the bike’s handle. Most of the time, you don’t even have to turn the handle. When you are cruising at a moderate speed, a little bit of weight-leaning through the handle does the job of steering.

Watch out on your brake technique

There is one rule which goes with putting on the brakes: when you brake your bike, do not brake all of a sudden, unless of course there’s a bovine in front of you, which could be highly likely while driving around Indian towns. Make it a point to practice braking on both the front and rear wheel together — this will make the bike slow down more smoothly.Also, remember that you should avoid using the clutch while braking, as the chances are that your bike might skid and fall. Holding on to the clutch while putting on the breaks can have disastrous consequences on slippery roads.

Accelerate gently

Do not accelerate your bike all of a sudden. It will just waste fuel and work up your engine for no good. Besides, a sudden increase in speed could make the bike go out of hand. The ideal way around it is accelerating slowly, gently. Moreover, it will also help you maintain that balance as the bike slowly gains speed.

Before you set out on the road, it is essential to make sure that you have good insurance at hand. Magma HDI two-wheeler insurance online in India comes with long-term insurance plans that can help you stay away from any legal trouble while you master your riding skills. A Magma HDI bike insurance stands out as it has support for anti-theft devices and. Among other features, you also get access to personal accident cover, which ensures your financial safety as well.

How to make claims for multiple Health insurance policies?

Medical Science has grown by leaps and bounds, so has medical expenses. With the rise in medical costs, a common man can no longer hope to provide his family with quality medical treatment without a health insurance policy. Health insurance is important as it takes away the financial burden in times of such despair. You should always remember to renew health insurance online or offline before it expires, as per your preference. Nowadays having single health insurance is no longer sufficient though. Even though medical costs keep increasing over the years, insurance policies have not kept up with that pace. Many insurers don't provide medical cover over a certain amount, which sometimes is not sufficient.

Thus, individuals are allowed to hold multiple health insurance policies as long as both the insurers are privy of it. All the insurers must know that you have multiple health insurance policies, else they might be deemed void, or your settlement may be reduced. While there are no problems over holding multiple health insurance policies. Many people don't know how the situation will play itself out. There are various things to remember so you may not face any unnecessary obstacles in claiming your entire settlement amount: -

- When a claim does not exceed the sum insured under a single policy, it is up to your discretion to choose which insurer to approach to settle the amount. Various things like NBC benefits must be taken into consideration while making up your mind on which insurer to approach. There are no specific guidelines that you need to follow and you have entire liberty in this matter.

- When claim exceeds the sum insured under a single policy, it is up to you to decide whom to approach first. The insurer you approach first will settle the claim up to the limit stated in your agreement with him. The rest of the claim amount will be settled by the second insurer.

- You cannot gain raise a claim for more money than your expenses. That means you cannot ask both insurers to settle the maximum amount of your policies.

- In case of a cashless settlement, TPA will agree to settle your expenses to the maximum amount that can be settled, rest you have to pay by yourself. Later on, you can submit proper bills to the second insurer and will be reimbursed for your expenses.

- To make the claims, you must submit several important original documents to the insurer. They are general bills and receipts, discharge form, prescriptions, diagnostic tests, and X-rays and other scans. The documents must be attested. To make multiple insurance claims, you must make sure to receive multiple attested copies of all the documents from the hospital.

With all these points, you will face no issue claiming multiple insurance covers. Having multiple insurance policies is generally beneficial as they might have different clauses regarding critical illnesses. You can better secure your future by holding multiple insurance policies instead of one. Also, you must renew your health insurance on time; accidents can happen anytime. You can do so from the convenience of your home and mobile phones as now you can marine cargo insurance policyrenew health insurance online. Still, you must never forget that precaution is better than cure. Just because you have good coverage on health insurance does not mean you stop taking care of your health. Some things when lost can never be regained.

Roadtripping on your favorite ride, here's what you need to do to gear up

Road trips on a car are enthralling. These drives fill our camera rolls with memorable moments that we recall with much fondness. If you are planning a road trip this season, congratulations — you have made the right decision. You have to take care of certain things before you decide to hit the highways to make sure that you drive is smooth. To start with, you should first get the best car insurance in India so that you do not land into any legal trouble. That done, you will have a big burden taken off your mind. Here, we will look at a few ways through which you can better gear up for your next road trip.

1. Paper and digital maps

Make sure that your phone has an active internet connection so that you do not miss out on those essential twists and turns, and those much-needed shortcuts while travelling. However, you cannot wholly rely on digital maps. Several regions may not have a cellular network, and this is where a physical map might come handy. Carry a detailed map so that you never get lost while you throttle you way down the highway.

2. Extra money

Financial planning is essential before a road trip. You will need cash for food, lodgings (if you are staying overnight at a motel), and other miscellaneous expenses. Do not solely rely on plastic money, as there will be several places that will accept only cash. Also, make it a point to carry a decent bit of extra cash in case something unfortunate happens, such as your car breaking down. Breaking dows, well — this also brings us to our next point.

3. Carry spare parts and a toolkit

Highways are long, and often there are miles between service shops. Make sure that you carry a spare tire in case you meet a puncture. You should also carry a toolkit and a service manual to make sure that you can fix the basic problems that you might run into. It would help if you also made yourself comfortable with the basic repair guide so that the task of repairing the car does not turn out to be overwhelming.

4. Carry enough water

In the worst of scenarios when you get stranded, there is one thing that you will need the most — water! Things might get quite nasty if you get stranded in a place where there are no water sources, Always make it a point to carry a few large bottles of water to keep yourself going while you try to get yourself out of the mess.

5. Carry a first aid kit

You never know when things might go off-road and you meet with a small accident. This can happen off-road as well. To deal with the consequences, make sure to carry a first aid kid which will help you get through before you receive medical attention. With these basic points in mind, you can be assured that your trip will be smooth. If you are worried about the best car insurance in India, then you can opt for Magma HDI car insurance as it offers a host of features, such as additional cover, discount on premiums, access to and access to anti-theft devices, among others.

Tips before going on a bike trip

Long bike rides are relieving to the soul. They teach us many lessons, test our patience, and brings the best version of us on the road. There is much for the sight to behold — the steadiness of the highway, the slopes of the mountains, the glimmer of the rain, and the kiss of the wind. If you are planning a bike ride alone or with your buddies, then congratulations to you — you have made a great decision. However, before you start, there are a few things that you should keep in mind. Start by getting your papers — the bike’s registration and insurance — right. Yes, it is mandatory to have registration and two-wheeler insurance in India. Once you have the documents in place, you can move on to the other steps.

Choose a comfortable bike

You might not want to for a bike trip on any engine. Pick a bike which can burn those miles without stressing its engine. You would want to have a cruiser so that your sitting posture does not give you back pain later. If you are worried about the budget, then pick a fuel-efficient bike. Several mid-range Indian cruiser bikes offer an excellent highway experience in India. It would help if you get a proper bike gear so that you are well-prepared for harsh weather conditions. Carry essential spares and tools for unforeseen circumstances.

Pack and eat light

You would not want to carry much luggage on your back while you are riding. It will add extra weight to your ride. Try to pack light — just the essentials. Try to fit the essentials in a pack and tie it up behind your bike, as you would not want to carry a load on your back while you are riding. Try to start early in the morning on a light stomach. A heavy meal takes a lot of energy to digest, so if you have a hearty meal before setting on the ride, then you might feel drowsy on the way.

Take breaks to stay motivated

Long bike rides may never seem to end. Riding constantly may tire you up. Try to take short breaks every hundred kilometres or so. This will help you feel refreshed. Keep this in mind that the trip will come to an end, and that more than the destination, the journey is what you are looking for — the sound of the wheels humming on the highway. India has mesmerising landscapes so there will be enough to see on the way, and all these sights will keep you motivated throughout your ride. If you are worried about getting good two-wheeler insurance in India, then your search could end with Magma HDI two-wheeler insurance. Magma HDI bike insurance comes at an affordable price and provides features such as personal accident cover. It also has support for anti-theft devices, so you can keep on riding, roaring on the road without worrying about anything at all.

How to Stay Financially Healthy?

One of the major determinants of how you live your life is your financial condition. It cannot be emphasized enough that you need to carefully plan out your finances not just for the near future but also for your old age. If you find yourself in a financial fix, the chances are that things might just get worse from there and it might take a lot to turn that situation around. One of the best ways to ensure you live a worry-free life is to properly manage your finances. Here are few ways in which you can stay financially healthy: -

- While a large number of people depend on a card to make payments, it is a smart choice to say goodbye to credit cards. Since you need to pay for the expenses you make on your credit card, you can always run the risk of going into debt. As more purchases and interests keep adding up, you might find it difficult to pay your credit card bills. Instead, maybe use a debit card since the money will directly deduct from your bank account every time you make a purchase, and you don’t need to pay any debit card bills.

- Begin thinking about a retirement savings fund. Since you can only work for so long, it is important to plan in advance. Start saving money from today itself and add it to a retirement fund, so you are financially secure when you grow older. Not having any money saved for old age could prove to be a major headache especially if there are medical bills to pay.

- One of the simplest ways to become financially healthier is to cut out any unnecessary spending. This might be very common advice, but it is easier said than done. You need to keep in mind that your financial situation could change any second and that you should always be prepared. All expenses ultimately reduce your savings, so spend your money wisely, only on what you really need, with a few occasional indulgences.

- Think about insurance. Now, insurance is a broad category. There is vehicle insurance, health insurance, travel insurance, property insurance, etc. You can never really foresee any adversity, so it is best to be prepared. Make sure to go over the terms of the various insurance policies and keep renewing them regularly to avoid having to pay large amounts of money from your pocket when the situation arises. For example, there are many online health insurance companies that you can check out. You just need to find one that suits you best.

- Another easy way to be financially healthy is to make a budget. At the beginning of every month, plan out a budget based on your account and normal economic activities and try to stick to it. If you can manage to spend just as much money as you had planned for, you will end up saving a ton of money in the long run since you would have avoided any unnecessary expenses throughout the month.

Whether it is finding a good online health insurance company, switching to debit cards, looking for further sources of income, investing your money, you must contemplate your financial decisions thoroughly. Money is extremely important to determine the quality of your life and must be used very, very carefully to avoid any complications in the future.

Why choose a long term two-wheeler insurance policy

Bike rides are thrilling — the wind teasing your hair, the sound of the motor groaning, bringing in a sense of movement, a much-welcome change. If you have a bike then you know how important it is for you — it is your friend, one which doesn’t let you down, ready to go with you on every walk of life. As a bike owner, it is your job to make sure that your riding experience is forever smooth, that there are no troubles attached to it. To begin with, you have to make sure that your paperwork (registration and insurance) is in proper place. Indian law makes it mandatory to have a two-wheeler insurance policy. If your bike insurance has lapsed for even a day, it could land you into some legal trouble! To make sure that your bike-riding experience is smooth and hassle-free, you must opt for a long term two-wheeler insurance policy. Besides, having long term insurance for your bike has its own sets of benefits. Here, we will look at some of the reasons why you should opt for a long term policy for your motorbike.

● Discount on premiums

When you opt for long-term two-wheeler insurance online for your bike, you get the option to avail discount on your premiums. Insurance companies provide you with discounts and incentives since they save on administrative costs if you opt for a long term policy.

● Avoid risks that come with non-renewal and policy lapse

If your insurance policy is not renewed on time, then you are exposed to certain risks. For example, if your bike meets with an accident, or is stolen, and if the policy is not in action, then you would have to bear the entire financial loss yourself. However, if you purchase long-term insurance, such problems can be easily avoided. Besides, if the policy lapses and you intend to renew it later, several insurance companies ask for an inspection of the bike to determine its condition before they decide to renew the policy. If you opt for extended two-wheeler insurance online for your motorcycle which extends for years can easily help you avoid such situations.

● Earn higher No Claim Bonus

No-claim bonus (NCB) is a discount that insurance companies offer on the premium if you have not made a single claim during the insurance term. When it comes to NCB, long-term two-wheeler policies have the upper hand over short-term policies that last for one year. The NCB slab structure for more extended policies is also different from short-term policies. Besides, the NCB discount is additional to any upfront discount which you get on the purchase of a long-term policy.

● Get rid of the paperworke

Choosing a short-term policy makes you liable for much paperwork. You will receive new documents at the end of each policy year. And searching for new and better deals also takes much time — something which not all of us have. If you are someone who doesn’t like the hassle which comes with paperwork, then you should opt for a long-term insurance policy.When it comes to choosing the best bike insurance, Magma HDI two-wheeler insurance policy stands out as they come with a host of benefits. You get additional cover for injury and death, which makes sure that the cover is not just limited to your bike, and extends to you as well. Besides, if you have installed an anti-theft device (approved by the Automotive Research Association of India) in your two-wheeler, you have the option to avail a 2.5 percent discount (or up to Rs 500) on your own-damage (OD) premium. With minimal paperwork and a hassle-free claim process, opting for a Magma HDI two-wheeler insurance online is one of the best options that you have for your long-term bike insurance.

Important Terms in Health Insurance That You Should Know

The term “health insurance” is something that you must have heard multiple times. Both the government authorities, as well as the insurance companies, are aggressively creating awareness regarding health insurance. But what exactly is health insurance, and why do you need to get one immediately? Health insurance is essentially insurance that will cover complete or part of the medical expenses if you were to fall seriously ill, had a major accident or require a medical surgery of any kind.

- Since these situations would otherwise require you to spend a substantial amount of money, it is always a good idea to subscribe to a comprehensive health insurance policy. Not only should you have a health insurance policy in place, but it is also essential that you pay attention to timely health insurance policy renewal as well. Before availing a health insurance policy, here are some terms you must understand well: -

- Deductible: In simpler words, it is the part of the medical bills or expenses that you pay on your part while the insurance company pays for the rest. Based on the percentage of the risk you are willing to cover, the company will decide the deductible and the amount it will pay.

- Premium: Premium is the amount that you would pay to the health insurance company for subscribing to the insurance policy as well as for its renewal. Depending on the insurance company, the premium could be paid every month, once a quarter, or once in a year. In case you are part of a group insurance policy at your workplace, your employer will most likely pay the premium. Failure to pay the premium could lead to termination of the policy and forfeiture of any accumulated benefits.

- Grace period: - In case you are unable to pay your health insurance policy renewal premium by the due date, the insurance company will offer you a grace period of up to 30 days. If you pay the premium during this period, your health insurance policy will stay in force, but if you fail to pay the premium during this period as well, the policy will be terminated, leaving you unprotected.

- Floater Plan: - This is a comprehensive health insurance policy that covers multiple persons in the family. Yourself, your spouse, kids, and parents can be included under the cover of this plan. Having a floater health insurance policy removes the need for having separate insurance plans for every family member.

- Free-look period: - Also known as the cooling-off period, this period specifies the number of days you have since the issuance of the policy to cancel it. In case you are not satisfied with the new health insurance policy and cancel it during the cooling-off period, the insurance company will refund the premium amount after deducting some costs. But once this period has lapsed, no premium will be refunded by the company if you decide to cancel the policy.

When applying for a health insurance policy, it is of utmost importance that you fully understand all the terms, which also include co-payment, coinsurance, etc. Since it pertains to a very serious aspect of your life, you must make an informed decision when choosing a health insurance policy and you must keep in mind the terms of the health insurance policy renewal too.

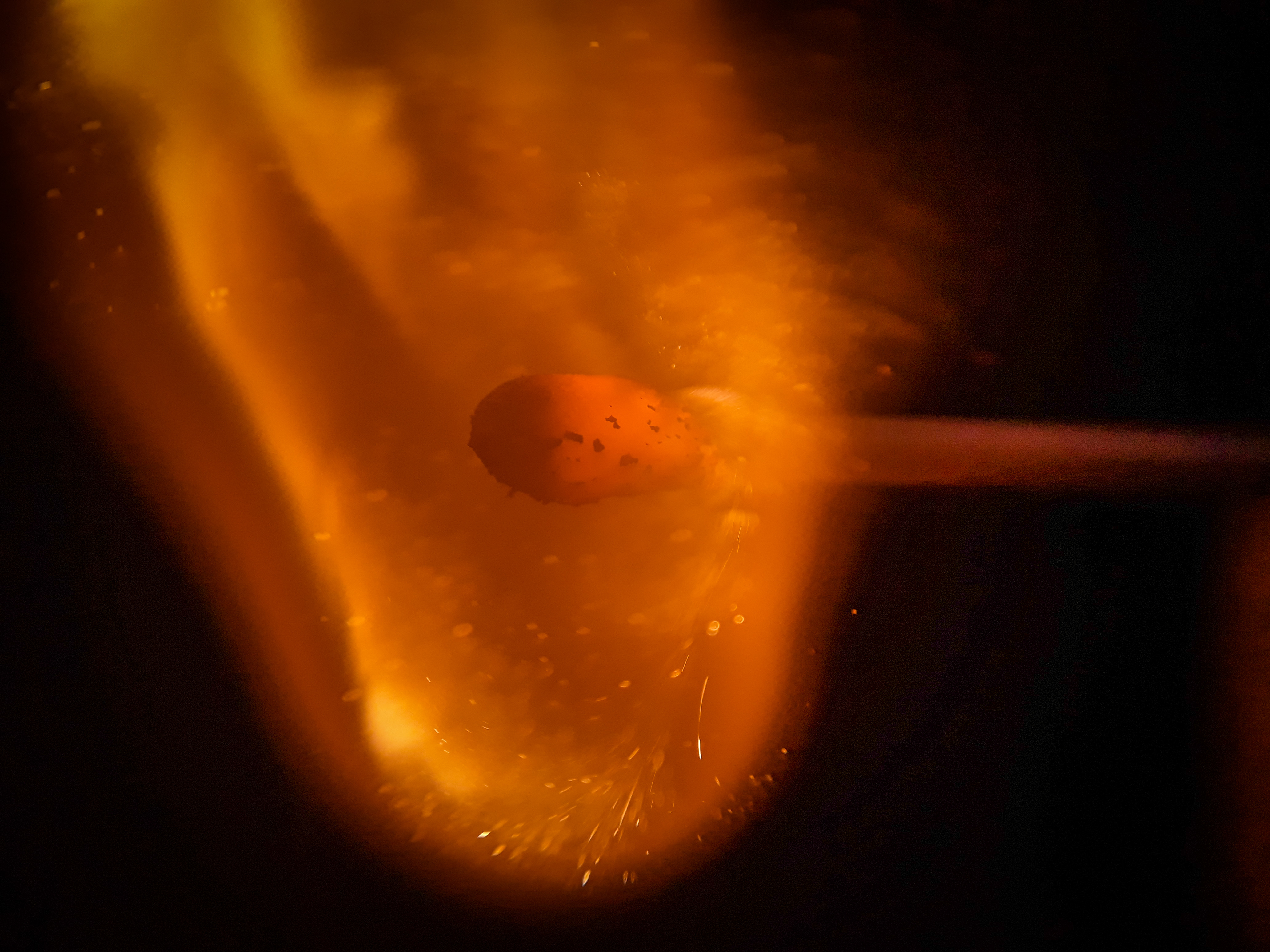

What are the features of fire insurance in India?

Fire is a serious risk for pretty much all physical structures, whether it's your house or your shop. This is why insurance is essential to mitigate the loss to building, machinery, goods, furniture and fixtures, plumbing, electrical appliances and other assets in the event of a fire. Fire insurance is an indemnity based contract, where the insurer agrees to compensate for any loss or damage during the policy term, not exceeding the maximum amount for which the premium is being paid. Here are some features offered by fire insurance companies in India that you should know.

Coverage

As per section 2(6A) of the Indian Insurance Act 1938, in addition to fire, other hazards are also clubbed with the insurance plan known as the ‘Standard Fire and Allied Perils Policy’. The policy also covers losses on account of lightning, storms, flood, earthquakes, landslides, bush fire, explosions, aircraft damage, riots or malicious damage, impact damage, bursting or overflowing pipes, missile testing, etc.

Policies available

There are different types of policies one can opt for while purchasing fire insurance in India. A comprehensive policy even covers theft or burglary whereas a floating policy is useful for businesses that have assets or stocks in different places. Thus, allowing you to pick a policy based on your individual needs.

Add-ons

Insurance providers such as Magma HDI also offer covers on fire insurance policies such as compensation for architect or surveyors fee, temporary removal of assets, loss of rental income or rent for an alternative accommodation till you rebuild your home or business.

Uberrimae Fidei

Fire insurance is based on the principle of Uberrimae Fidei or utmost good faith, where the insured party makes full and honest disclosure of all facts. Failure to do so can render the policy void and absolve the insurer of any financial responsibility.

Insurable interest

The insured party must have an insurable interest in the asset not only at the time of purchasing the policy but also at the time of the incident. For example, you insured your house but later sold the house to someone. The place catches fire while the policy is active, but you cannot make a claim because you have no insurable interest in the property anymore.

Policy tenure

The tenure of coverage is clearly stated in the policy document. Usually, the insurance does not exceed one year so make sure you renew timely it for continued coverage.

Exclusions

Like any other insurance policy, fire insurance also has its exclusions. Damages caused by normal heating, own fermentation or spontaneous burning; loss or damage of the property due to nuclear perils, electrical or mechanical breakdown and terrorist act, war and warlike operations are some common exclusions of fire insurance companies in India. Fire insurance ultimately provides you with financial security for your home or business to help you get back to your normal life as soon as possible.

What is a personal accident cover, and how does it benefit you?

As per an official report released by the government, an astounding 469,910 road accidents were reported in 2017. Even though the number of accidents have been steadily declining over the past few years, an estimated 53 people get injured on Indian roads every single hour! Accidents are unfortunate, and there is no way to be prepared for them. However, while a personal accident cover (PAC) can’t alleviate the risk of accidents, it definitely covers the financial risk arising out of death, permanent or partial disability.

What does it cover?

A PAC covers any physical injury from a road, rail, air incident, burn injury, animal bite, injury due to collision or fall, drowning, poisoning, etc. It is available as an add-on option from insurance providers such as Magma HDI.

What are the types of PAC?

There are a few different types of PACs. While you can purchase a stand-alone policy, usually the coverage comes bundled as a rider with a life insurance plan. You could also buy limited period PACs when booking air or railway tickets. However, in the case of auto insurance, availing a PAC is mandatory as per the Motor Vehicles Act, 1988.

What are some advantages of a PAC?

1. It helps your insurance portfolio: Many health insurance plans do not cover accidental medical emergencies. As an add-on cover to your health or motor insurance, a PAC helps you cover all bases. As far as add-ons are concerned, a PAC truly helps make your plan comprehensive.

2. Cost-effective: The premium for a PAC is minimal and affordable for all. For example, a 30-year-old male would have to pay less than Rs 1000 per annum for a Rs 10 lakh coverage. Thus, it gives you essential coverage without the hassle of a hefty additional fee.

3. Ease of availing: A PAC only needs your basic personal information. There is no need for a medical check-up or follow up documentation. It can be availed in a matter of minutes as it is simply added to your new/existing policy.

4. Hassle-free claim settlement: If you ever need to avail the benefits of PAC, all you would need to do is inform the insurance company of the time and date of the accident, your policy number and contact details. The claim settlement process is initiated immediately after that.

5. Children’s education benefit: For families, a major concern is taking care of our children in our absence. Some insurers also cover the education of dependent children, in case of death or permanent disability of the insured person to ensure a secure future for them.

What should you keep in mind before purchasing PAC?

Personal accident covers are also subject to exclusions like your insurance policy. Some of these are losses arising out of acts of war or terror, injuries resulting from participation in adventure sports etc. Make sure you read your plan's policy wordings thoroughly for a smooth experience if you ever do need to make a claim. When looking out for a PAC, choose one that offers worldwide coverage and other add-on benefits like Magma HDI’s individual personal accident cover.

Know the Top 5 bikes of 2020

If you prefer bikes over cars, either because you are looking to save money or just because you like the feel of whizzing past the many cars, there are many options for you. There are many out there just like you, and to cater to their needs, the motorcycle industry is constantly coming out with new bikes, each with their own special features. However, while it might be fun to ride a bike because of the thrill it offers, it is of utmost importance that you drive within the speed limit, always wear and helmet, don’t get too adventurous (especially amidst traffic) and are have an insurance in place to cover any damages that may occur in the future. If you are looking to buy a bike this year, here are the top 5 bikes to look forward to in 2020: -

- Honda CB500X: Built for the adventure lovers out there, the Honda CB500X comes with a free-spinning two-cylinder engine, long-travel suspension, and a diamond-tube frame which makes it easy to handle and balance. At the height of 830mm, the seat offers excellent visibility and makes the riding position quite comfortable as you’d be able to sit upright. The bike is made in such a way that you can drive it on any kind of terrain. Also, it comes with a clear information panel to give you exact details about mileage, speed, fuel etc.

- Suzuki SV650: Since the introduction of this model in 1999, it has gone through a series of improvements to make it what it is today. With a polished powerplant, the bike has low emissions, great fuel economy, and overall excellent performance. The bike has a trellis-style frame built with high-strength steel tubes, which make it lightweight. The bike is built in such a way that it offers manoeuvrability, plenty of lean angles along with great comfort.

- Yamaha XSR 155: Do not be confused by the slightly retro look of the bike. It has been designed in a way that gives you support, comfort, control and speed. The bike, much like its previous counterparts, has a Delta-box frame which makes it lightweight. The seat, made in leather, is a single-piece seat. The handlebars are slightly raised, which is what adds to its retro look. You can see where the single-cylinder engine is on the bike and the tank is slim.

- Honda CB650R: The bike comes with a four-cylinder engine, which makes riding smoother and provides a lot of power during the rev range. The seat makes it more comfortable to stay upright, especially if you are riding for a long time. Along with this, the neo-sport style of the bike makes it look sleek. Other features of the bike include wide handlebars, LED lighting in the front and back, and waterfall-style headers.

- Aprilia RS 660: This sporty bike comes with a parallel twin-cylinder engine. With a refined frame, this bike is lightweight and easy to manoeuvre. Some notable features of the Aprilia RS 660 include cruise control, dual-channel ABS, easily adjustable brake settings, traction control amongst others.

Again, when looking to buy a bike, you must take every precaution to avoid getting into an accident, especially since it does not offer the kind of protection a car does. A great way to ensure that you have any unforeseen accidents or costs covered is by private car/vehicle insurance in india.

Where are we heading? That is where is the general insurance industry heading

Things change. It is the law of the universe, and we, along with everything that we do, are a part of it. To resist change is to combat the natural phenomenon of things. When you accept change and plan things in accordance with it, then things have a habit of place. Otherwise, things may just fall apart. Indeed, no one can stop the changes in life, and the same applies to the insurance sector as well. There has been a lot going on in the insurance industry in the past ten years. According to the data provided by the Indian Brand Equity Foundation (IBEF), the insurance industry in India is expected to $280 billion by FY2020. The overall penetration of insurance policies in India increased from 2.71 percent in 2001 to 3.69 percent in 2017. The gross insurance premiums that were collected in India during FY19 reached Rs 5.78 trillion (US$ 82.8 billion). In this, 4.08 trillion (US$ 58.5 billion) came from life insurance whereas Rs 1.69 trillion (US$ 24.3 billion) came from non-life insurance.

Ease in the insurance process

One of the highlights of the changing insurance industry has been the ease of access. Now, everything can be done online, and the data is available at disposal, thanks to the growth and penetration of technology. The internet has created a trusted business model that provides value to all stakeholders. You also get free online support if you face any queries while exploring your insurance options.

Paperless process

The general insurance in India has become entirely paperless. From buying the policy to paying the premium — everything can be done online with nos risks at all. Since the whole insurance industry has taken an online shift, it is much easier to compare insurance policies and choose the best option. Now, it has become easier to explore deals across insurance companies and choose the one that fits your interest the most.

Low risk

With things going paperless, there are no risks involved. Even if you lose your insurance documents, you can easily claim them back by filing your issue online. Earlier, it was difficult to keep track of all the documents physically. However, with the onset of smartphones, everything can be accessed online without any hassle and the need of carrying physical files. The facts and numbers of general insurance prove that the insurance industry is booming. As a customer, it becomes crucial that you get access to the best insurance service. If you are looking for general insurance in India that comes with online support, then Magama HDI general insurance could be the answer. Magma HDI insurance provides you with the option to buy insurance online, and it also comes with the option to file claims online — all at your fingertips.

Top 5 Cars to Buy in 2020

As part of their New Year goals, a lot of individuals decide to purchase a new car. Now, cars aren’t cheap, even if you don’t consider luxury brands such as Audi or Jaguar, and you have probably saved up a bit of money so you can buy a decent car. So, when making a choice, it is important that you put a lot of thought into the car that you wish to buy. Do not go by word of mouth; do your research and compare the different features of the cars before you make the purchase. Another factor to keep in mind while buying a new car is insurance. To avoid having to pay a hefty amount from your own pocket in case of an accident or damage, find good car insurance in India. Here are the top 5 options you could choose from when thinking of buying a new car in 2020: -

- Tata Altroz: Considered to be Tata’s first premium hatchback car, the Altroz comes in a variety of colours including Skyline silver, Midtown grey, Avenue white, and others. Whether it is a petrol or diesel engine, both will have a 5-speed manual gearbox. The car comes with projector headlamps, fog lamps (both in the front and back), along with a rear defogger. Also, the driver seat is 4-way adjustable while the front passenger seat is 2-way adjustable. When it comes to the safety features, the car has dual airbags, a seatbelt reminder, and an auto door lock system.

- Fifth Generation Honda City: The car is believed to be wider and longer than the fourth-generation Honda City but slightly shorter and with less wheelbase. It comes with BS6-compliant petrol and diesel turbo engine. When it comes to the exterior, the car has a gloss black front grille, DRLs, defoggers in the front and back, LED headlights and alloy wheels. Other features include dual airbags, vehicle stability assist, speed sensing auto-lock system, a touchscreen infotainment system, adjustable seats, etc.

- Renault Triber AMT: The car has an Energy engine with a capacity of 999cc and a mileage of 20.5kmpl. In terms of safety features, the car is equipped with front airbags, rear parking sensors, speed alert warning, pedestrian protection, amongst others. The Renault Triber AMT is a 7-seater car and has electric power steering, an engine start or stop button, a touch screen, and adjustable seats.

- Hyundai Sonata: One of the best sedans in the market, the Hyundai Sonata has a 4-cylinder engine. It has a sporty look to it with a seamless hood and a fastback rear design. The car comes in many colours like the Stormy Sea, Calypso Red, Quartz White, etc. Depending on the exact model of the car, it comes with 8-inch touchscreen audio, lane-keeping assistance, heated front seats, remote smart parking assist and an effective airbag safety system.

- BMW 5X: Now, this might be worth more than you are willing to pay, but it is still a great car, nonetheless. It is a midsize SUV that comes with three different types of engines, LED headlamps, lane departure warning, driving assist, adaptive cruise control, an entertainment system, a well-equipped airbag system that makes the car very safe and other features. The car is believed to be the most balanced BMW car and is very easy to ride, handle, and is very comfortable.

Buying a car is a major decision that must not be taken lightly. You will end up spending a lot of money on the car, whether at the time of purchasing it or during repairs. It is advisable to go over all the options and to compare them to find the car best suited for your needs. Again, take the time to find good car insurance in India for protection against losses.

Let's talk claims

While choosing an insurance policy, the claim settlement ratio of the insurer is a major factor to consider. An insurance claim is filed to get coverage for the losses or damages you sustain due to the occurrence of an event as specified in the policy. Hence, proper claim settlement is an essential pre-requisite in your risk management system. When selecting an insurance company, you must check if it provides timely and easy settlement of valid claims.

Process to file claims

Step 1: Reporting the incident

When an event occurs, the claimant should submit a written intimation to the insurer for initiating the claim process. The faster you set the ball rolling; the sooner will be the settlement. Here, you should also make sure that your policy covers the event for which you’re filing the claim.

Step 2: Complete the documentation

For a smooth claims process, you need to submit the right documents within the stipulated timelines. Most of the insurance companies have online claim filing system where you can send the forms and upload images for ratification.

Step 3: Evaluation process

Before settlement of the claim, the insurance company will evaluate the veracity of your claim through an external investigation. Hence, you should be clear about the facts when filing the claim.

Step 4: Settlement of claim

As per the regulations of IRDA, the insurer has to settle a claim within 30 days after receiving documents and verification or pay interest. If any claim requires further investigation, the process should be completed within 6 months from the date of the written filing of the claim.

Technicalities that may occur when filing a claim

When filing your claim, you should be aware of common problems and technicalities that may impede the process. That includes:

If there’s any pre-existing ailment

Any ailments that a policyholder had before the issuance of the first policy are called pre-existing ailments. These conditions and diseases must be declared when buying the policy. If the company discovers them during claim settlement, it can restrict the entire process.

If nominee details aren’t updated

The legal battle between the nominee and an heir can be prolonged due to incorrect nominee details. You should update the nominee information as it changes over the term of your policy.

If the policy lapses

When you fail to pay premiums on time, the policy will lapse automatically. Some insurance companies give a grace period for payment of premiums beyond the due dates but your vehicle is not covered for that period of time. So, you should adhere to your payment schedule, or else it can lead to repudiation of your claim later on.

The right insurer

An insurance policy is an excellent financial product, and claim settlement is the main component of this product. Hence, you should select the right insurer after checking their claim settlement ratio.

Remember, the claim settlement ratio represents the total number of claims made by the customers against the total claims settled by the company. Compare the top insurers on this factor to make so you can pick the best car insurance in India.

Thus, you can use claims as an effective tool to determine the performance and reliability of an insurer.

Top 5 Destinations in and Around Mumbai

Mumbai and its nearby locations have always been regarded as some of the best places to explore in the country. Besides being the financial capital of the nation, there is a lot to explore for travellers in the city of Mumbai. While a private tour package might seem like the easier option, it is way better to explore on your own. This way, you will be able to spend as much time as you like at every destination without having to hurry up and catch up with the rest of the group. Since the city is notorious for its traffic, many travellers, as well as locals, opt for a motorcycle or a scooter to go around. In case you go for this option, make sure that the vehicle has a suitable insurance policy in place. You can easily buy a new or renew the two-wheeler insurance online in India.

Here are the top 5 destinations in and around Mumbai that you can explore: -

- Gateway of India: If you visit Mumbai, it goes without saying that you must see the Gateway of India. Constructed facing the Arabian Sea in Colaba, it was built to welcome King George V and Queen Mary to Mumbai. The best time to visit this attraction is either early morning or late evening when there isn’t a huge crowd. It is located right next to the Taj Mahal Palace, another notable attraction in Mumbai.

- Juhu Beach: If you are looking to get away from the busy city for a little while, Juhu Beach is a great option. Since it is quite renowned, there will most likely be a lot of people there but the gorgeous sunset and the cool breeze in the evening will be worth it. Just put on a pair of flip-flops and take a nice, long walk on the beach as you marvel at the magnificence of the waves hitting the shore. .

- Marine Drive: Officially known as the Netaji Subhash Chandra Bose Road, this destination located in Chowpatty is very well-known. A curved promenade that runs for kilometres, Marine Drive is the perfect place to sit and enjoy a breath-taking view of the beach and enjoy the cool sea breeze.

- Chhatrapati Shivaji Terminus: Built during the British colonial period in 1888, Chhatrapati Shivaji Terminus is a UNESCO World Heritage Site and is said to be the second most photographed location in India after Taj Mahal. It is a terminal train station built in a Victorian-Gothic style of architecture and attracts many who come to marvel at the splendid edifice.

- Elephanta Caves: Located on a small island called Gharapuri, east of the Gateway of India, the Elephanta Caves is a collection of caves, all adorned with intricate carvings. A UNESCO World Heritage Site, these cave temples have been linked to the Kalachuri dynasty and also the Hinayana Buddhists. Take a ferry from the mainland and go explore the Elephanta Caves situated somewhere in the Arabian Sea.

Mumbai as a city is massive and has a lot to offer, both for tourists as well as those looking to move to a new city. Besides the above-mentioned destinations, you can also visit Film City, Sanjay Gandhi National Park, the Taj Mahal Palace, Siddhivinayak Temple, Hanging Gardens, and many others. If you do plan on ditching a car and taking a scooter or bike to go around the city, make sure that you buy a suitable two wheeler insurance online in India for the vehicle.

General Insurance: Know your rights and duties

It is important to have general insurance as it protects you against several unforeseen circumstances and comes as a financial aid in times of distress. However, it is often that people who buy insurance policies are unable to make the best out of their insurance plans are they are quite unaware of what their insurance policy has to offer. It is the job of the general insurance company to settle your claims, and as someone who has purchased the insurance, it is your job you be aware of your rights and duties.

Rights of a policyholder

● If the terms and conditions mentioned in the policy documents do not match with what you were promised at the time of buying th policy, then you can cancel or return the policy within a timeframe of 15 days. After cancellation, your insurance premium will be refunded to you after the deduction of processing costs, such as stamp duty, medical charges, et cetera.

● The nominee of the insurance policy gets the right to file a claim on the insurance in case of the unfortunate death of the policyholder.

● Depending on the insurance you have opted for, you get the option to modify it. You can change the mode of payment, the sum assured, the premium paid and the policy tenure of your insurance policy.

● If you have chosen a United Linked Insurance Plan (ULIP), then you have additional rights on your insurance policies that involve making partial withdrawals, switching funds, and surrendering the policy after completing the lock-in period.

Duties of a policyholder

● You must spend time researching about the insurance, such as looking at the benefits it offers, the premium you have to pay, and the type of cover you will get, among others. It would help if you also compared your policy with other insurance providers to ensure that you are getting the best deal.

● Make sure to fill your details correctly in the policy documents

● After buying the policies from a general insurance company, you must make sure that you are paying the premiums on time. It is better to opt for an automated payment system, so you do not miss any dates.

● If you move places, make sure that you share the information about your address change with your insurance company.

● If you want to change your nominee, you can do so by filling up by ‘change of nominee’ form. If your nominee is a minor, then you can get an appointee to sign an acknowledgment on their behalf.

● In case you lose your insurance policy, you can identify your insurance service provider about it and get a duplicate document.

It is important to cooperate fully with your insurance company, as it makes sure that your experience is smooth and hassle-free, and your queries are resolved on time. If you are looking for a good, reputed and trusted insurance company, then your search could stop at Magma HDI insurance. It offers products for everyone and comes with prompt customer service. Besides, it also has a hassle-free claim processing service which eliminates frequent rounds to the insurance office. With a vision to be the most preferred, vibrant, and responsible insurance company, fulfilling the aspirations of all its stakeholders, Magma HDI general insurance company could be your one-stop for all your insurance needs.

How pollution can affect riding two-wheeler?

One of the most important questions asked these days is, “Do the health benefits of riding a bike outweigh the bad effects of air pollution on the health of the rider?” If this question was asked a few decades back, the answer would have been yes, but if you ask this question to someone in the present time, the answer would most probably be a big fat NO. The rising pollution levels are a very big concern in most of the important cities of India with the worst case being in Delhi where the pollution levels crossed the level of 1000 in the Air Quality Index of measurement of air pollution during the period after Diwali.

Even if you cycle to work or use a cycle to go to different places thinking of cause less pollution then also you are faced with a lot of pollution that is caused by other vehicles. Heavy smog and low visibility are some of the biggest dangers for someone riding a two-wheeler because they breathe this harmful air directly. People inside closed vehicles have their windows closed and they zoom away from the heavy smog areas while contributing to the pollution that affects the two-wheeler riders. In Delhi alone, nearly 85 lakh private vehicles are registered of which around 55 lakh are private two-wheeler vehicles. All these vehicles contribute to the heavy pollution that affects the whole of the city, making it one of the most polluted cities in the world.

One of the most prominent reasons for air pollution caused by vehicles is the usage of more than a decade old vehicles on the road. Such vehicles have old engines and generally do not undergo proper maintenance which makes them unsuitable for plying on roads. Most of them are running on dirty and old BS4 engines and fuels and some even older, thus contributing a lot to the pollution of the air. Most of these vehicles do not have any insurance and the owners do not even make an effort to buy two wheeler insurance online for their vehicle. The pollution that is caused by such two-wheelers or four-wheelers or any other vehicle is faced by none other than the two-wheeler riders. The two-wheeler riders are constantly exposed to such high levels of pollution which have a detrimental effect on their health. Walking, biking or using public transport to your destination are some of the best alternatives to protect the environment but each of these comes with the risk of high air pollution.

Along with the severe levels of pollution that are shown by the extremely high levels on the AQI, heavy smog and haze also reduce visibility which makes it very difficult for riders to ride two-wheelers. One of the most common problems that are faced by people due to air pollution is respiratory problems such as asthma, emphysema, chronic pulmonary diseases among numerous others. Not only respiratory problems, being exposed to constant high levels of poor quality air affects the internal body of people as well and affects different organs of the body that can lead to cancer, especially of the lung. While riding through this highly polluted air, the riders may face headaches, anxiety and may even feel exhausted while riding through places with high levels of pollution. This not only affects the lungs, which are an internal body part but also irritate the eyes, nose, and throat. These pollutants settle on water bodies and the ground and they may even reach the food chain through one way or the other. If consumed in such a process as liquid water or as food, they harm the body and can lead to many severe diseases.

Air pollution affects the two-wheeler riders at a massive scale but it also affects the other people on the roads as well. No one is safe, and people must start taking care of the environment and one of the best ways to do so is to take proper care and maintain the vehicles that they use daily to commute to and fro.

Is it preferable to buy a house or rent one?

A home is something every individual requires and aspires for. A place you can come back to after a long and stressful day but purchasing a house is no child's play. It requires a certain degree of commitment and a lot of financial resources. In case you do not have adequate financial arrangements to buy a home, you would rather want to take a house on rent. But if you do have the required resources but are indecisive about buying a new home or renting it, then the following factors determine whether you should buy your own how or rent one: -

●Total income - The basic requirement for buying a house is a steady income. If you wish to buy your own house, you definitely need a high level of income to pay for it. On the other hand, if your income is quite less or irregular, you can opt to rent a house instead of purchasing as rent amount is always less than instalments of the house.

●Loan repayment - The above point brings us to a loan and is quite similar to this one. Let's say you obtain a loan from a reputed bank to buy a house. But would you be able to pay the EMI along with the amount of interest? Do you have enough loan repayment capacity while meeting other necessary expenses? If the answer is yes, then go ahead and buy your house. If no, then renting a house can be the best option.

●Duration of time - A huge factor in the decision of buying a house is the time you plan to live there. If you know that you want to settle in a particular city or region, you can buy a house. However, if the case is not so, you should stay in a rented property to avoid any extra costs.

●Security - If you wish to have a stable base instead of constantly looking for houses or being under the fear of having to empty the property you are currently living in, you should buy a house. You can ensure that your children too would have a strong backup plan if they long for their own house.

●Job certainty - If you have a job that requires you to travel from one place to the other or is not stable, you should avoid buying a house as real estate is not a current form of asset. It might hold you back from changing cities or changing jobs. You cannot predict the growth of downfall of real estate. Thus, buying and selling might not go as per your wish. In such a scenario, renting a house is the best choice as it does not bind you.

●Maintenance expenses - If you own a house, the responsibility of maintaining it falls upon your shoulders. No doubt, you can buy the best home insurance in India, but the damage occurred cannot be undone. Other than that, repairs of leakage inside the house, renovation, repainting and other maintenance expenses would have to be borne by yourself. However, if the house is rented, you need not worry about any such things as the owner will take care of them all.

● Other expenses - If you intend to buy a car, travel extensively, spend on your children's education, make strong retirement plans, or have any sort of other long or short term expenditures, you should take a house on rent. That way you would save some money by not paying instalments of the house and be able to fulfil all other expenses.

Whether you plan to buy a house or rent one is completely your call but do make sure that in either case the property is secured with the policies of best home insurance in India. This way, you can be stress-free and live life peacefully.