General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

Should you opt zero depreciation add-on for your bike that can increase your settlement amount

When looking to purchase bike insurance coverage, there are a variety of options available. A comprehensive policy with zero depreciation add-on coverage is among the most used motor insurance policies.

This post will discuss the advantages of purchasing the zero depreciation add-on, how it improves coverage, and most importantly, whether the higher price is justified. To learn more, keep reading.

What is zero depreciation on bike insurance?

As a policyholder, you must be informed of the numerous crucial provisions of bike insurance. The depreciation component is one of them. Depreciation is nothing more than a loss in value that occurs over time. The bike and its components experience normal wear and tear over time. The result is depreciation.

When you file a bike insurance claim, the depreciation factor comes into play, and your claim amount is reduced. This is why you want to think about acquiring zero-depreciation two-wheeler insurance. You can purchase this add-on coverage along with the complete bike insurance plan. No matter how old or the bike has depreciated, the insurance company will pay out the entire claim amount when you have a zero depreciation cover.

The benefits of bike insurance with zero depreciation.

● More compensation: With a zero depreciation add-on, the cost of repairing your bike is covered without accounting for the bike's diminished worth. Consequently, you are reimbursed for the entire coverage.

● Saving money: You pay a higher cost with a zero depreciation add-on. But it's also true that your insurer will pay you more when you file a claim. Additionally, if you get insurance from an insurer that permits limitless zero depreciation, you can save money each time you file a claim for your motorcycle.

● Abundant coverage: Every bike owner can benefit from a zero depreciation add-on cover, valid for inexperienced and seasoned drivers. This acts as additional insurance to handle any financial problems arising from any catastrophe with your bike.

● Restrictions on out-of-pocket charges: With this add-on coverage, you can limit any additional costs that an insured person would otherwise be required to pay as depreciation charges. The depreciation value will not be considered when settling your claim, though, if you already have this add-on coverage.

● Reduces mental stress: The zero depreciation add-on cover provides a second layer of protection, which gives you more peace of mind by reducing your financial stress to a large extent.

When is a zero depreciation add-on cover required?

1. If you've only just started riding:

Compared to seasoned bike riders, new riders are more likely to make mistakes that result in collisions and bumps. Therefore, a zero depreciation cover would benefit you if you have just started riding two wheels.

2. If you purchased a new bike:

Since new bikes are so expensive, you should cover them as much as possible with protection. You may aid yourself at this point and preserve your bike in excellent shape for longer by getting a decent zero depreciation cover.

3. If you drive a pricey automobile:

If you possess an expensive bike, you should purchase the zero depreciation rider. A costly motorcycle requires a lot of money for repair and maintenance. Thus, you should be reimbursed for the total cost of each repair each time.

4. If your neighbourhood is dangerous:

Some neighbourhoods are crowded or prone to accidents. Acquiring zero depreciation insurance will benefit you if you live in such a location.

Reminders regarding the zero depreciation add-on cover.

Keeping the zero depreciation add-on cover in mind will help you recall the following:

● It is offered for new bikes up to two years old

● This addition does not waive the required deductibles

● Most insurance companies permit claims with no depreciation addition twice per year

A comprehensive bike insurance policy provides additional financial security if the bike sustains damage. Furthermore, a zero depreciation add-on to comprehensive insurance strengthens and adds more security when you file a claim. The most incredible thing about this addition is that by avoiding depreciation reductions, it can raise the amount of your claim. If the zero depreciation add-on is offered when you renew the bike insurance plan, you should consider opting in.

Click HERE to buy the best bike insurance plan in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Read the insurance fine print if your bike has a high engine capacity

Over the years, there has been a significant and gradual increase in the demand for luxury goods globally. In the automotive industry, superbikes are an excellent example of the shift from only necessities to splurging on comforts and luxuries. Once considered only for racing enthusiasts, high-capacity motorcycles with an engine capacity of over 150cc are now being used for recreational purposes and commuting.

However, the recent cases of rejected claims by motor insurance companies for accidents involving superbikes have raised concerns over the technicalities of insurance contracts and their effectiveness in shouldering financial losses.

Read on to find out about one such case, the aftermath, and some tips to ensure that your policy covers all such damages if your bike has a high engine capacity.

Case study:

This claim settlement case involved a bike with an engine capacity of over 340cc, which faced an accident, resulting in the rider's demise. The motor insurance company denied the claim since the bike insurance policy included a clause that stated that it should not cover personal accident claims involving bikes or scooters with over 150cc engines.

While the claim was initially denied, the motor insurance company later released the sum to the insured's family and clarified the issue. The insured was covered under an outdated policy that they had since updated to include personal accident cover.

This brings us to our question, is a high-engine capacity bike not covered under bike insurance?

While the case in question may make you believe that superbikes are not included under the provisions of bike insurance policies, it is not the case! The legal requirements of an insurance contract are constantly tweaked to provide maximum benefit to the insured while ensuring that the motor insurance company is aware of all the facts regarding its client to ensure that no insurance fraud occurs. While the old insurance clause excludes personal accident covers, potential policy buyers should read the fine print of their insurance documents to ensure that they are provided with the most recent version of the insurance policy that maximises inclusions.

General engine capacity and usage inclusions as per the old rule:

The old rule prevents the insured from lodging personal accident claims for motorcycles with an engine capacity greater than 150cc. Generally, 2-wheelers with an engine capacity of less than 150cc are used for commuting purposes only. They are, therefore, less risky and more profitable for the insurer since accidents are relatively fewer when compared to bikes with high engine capacity. High cc bikes are expensive, have lower mileage, higher premiums, and have less fuel efficiency.

Tips to ensure that all relevant damages are included in your policy.

As a prudent mechanism, insurance protects the insured in most cases as long as the circumstances are not stated as exclusions from the policy.

1. Read the fine print:It may seem tedious to go through the minute details of your insurance, but it is the safest way to ensure that your motor insurance company is providing you with the latest version of the policy with the most inclusions.

2. Consider purchasing an add-on: Despite close inspection, if specific clauses restrict the scope of potential claims, it is advisable to buy add-on facilities such as zero depreciation cover to keep your expensive possession safe.

3. Compare your alternatives: Before committing to an insurance provider, it is highly advised to compare the existing options and choose a plan with the most inclusions and justified premium with a high claim settlement rate.

4. Renew your policy on time: Delayed renewals and outdated coverage plans are significant issues that potential policy buyers must avoid.

Bikes with higher cubic capacity deliver a powerful performance, making it a worthwhile investment for motorcycle and speed enthusiasts to get their adrenaline rush. Since their cost and insurance premium is more significant than lower cc engine bikes, it is necessary to check the specifications your motor insurance company provides thoroughly. Read all the terms and conditions before making a final decision.

Click HERE to buy insurance from the best motor insurance company.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Is it compulsory to purchase public liability insurance

Public liability insurance shields policyholders from lawsuits brought by third parties for their injuries, damaged property, or other damages due to the insured's negligence. Many people, particularly owners of small businesses, are still determining whether getting public liability insurance is required. We'll look into the answer to that question in this blog post.

General liability insurance may, however, be mandated by law as part of the licensing or registration requirements for specific businesses or professions. Let's dive deeper and understand why purchasing public liability insurance would be better for you.

Reason 1:

It is strongly advised that you consider getting public liability insurance even if your profession or industry does not mandate it. This is because accidents can occur at any time and can be highly expensive to handle. For instance, you can be responsible for paying a customer's medical bills, lost earnings, and other damages if they slip and fall on your property. You would have to cover these expenses out of your pocket if you didn't have public liability insurance, which might be extremely expensive.

Reason 2:

Public liability insurance helps shield your and your brand's reputation. If a client or a public member is hurt or loses something due to your company's negligence, it could hurt your reputation and generate bad press. By having public liability insurance, you can show your clients that you care about their security and well-being and that you have the resources necessary to cope with any mishaps that might happen.

What should be considered while purchasing public liability insurance?

1. The amount of coverage you require should be carefully considered before buying public liability insurance. The level of risk involved and the kind and size of your organisation will determine how much coverage is necessary. For instance, a tiny home-based firm would need essential protection. In contrast, a larger company with many employees and risky operations might need higher security.

2. To make sure you know what is and isn't covered, it is also crucial to carefully read the terms and conditions of your public liability insurance policy. Before acquiring insurance, it's critical to be informed of any exclusions or coverage restrictions that might apply. Although you will depend on the insurance provider to cover any potential claims, ensuring they have a solid reputation and sound financial position is also crucial. Therefore, when buying public liability insurance, it's vital to carefully examine the degree of protection you require, review the policy's terms and conditions, and select a reputed and financially sound insurance provider.

3. Cost should be considered when selecting public liability insurance. The price of public liability insurance will change depending on the level of protection needed, the size and type of your business, and the insurance provider you select. Even if cost is a crucial element, it shouldn't be the only factor you consider. In addition to the protection, comparing the insurance cost to the possible costs of a claim or litigation is crucial.

In conclusion, even though many businesses do not think about acquiring public liability insurance, it is strongly advised that you consider doing so. Accidents can occur at any time, and if you don't have public liability insurance, you may be responsible for significant losses and costs.

Also, by acquiring public liability insurance India, you can show your clients that you care about their security and well-being and that you have the necessary resources to cope with any mishaps that may happen. Therefore, explore your options and purchase the best public liability insurance, which would cater to your organisation's and your client's needs in the best way and add the layer of security as required.

Click HERE to learn more about the benefits of purchasing public liability insurance India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Let's decode the BH series number plates in India

We have seen cars with various types of number plates. Usually, the number plates of vehicles include the vehicle's registration and the state in which it was registered. There are VIP number plates too, which have digits in a unique combination and cost much more than the regular number plates.

In this blog, let's decode the BH series number plates that have been quite talked about recently in India.

1. What are BH series number plates?

In layman's terms, a car with a BH series number plate will not have to get a new registration card upon moving to a new state. These BH or Bharat series number plates were brought into execution in 2021 by the central government of India. It allows the vehicle owners of non-cargo automobiles to shift from one state to another without worrying about getting a new registration for their cars, two-wheelers, etc.

2. How are these BH series number plates useful?

The BH or Bharat series number plates have proven helpful for people in the government sector who frequently have transferable jobs, for people in the defence sector, or the private sector who regularly have to change their location to cater to the demand of their work and the companies they are employed in. These number plates allow them to avoid the hassle of exhausting themselves by running to the RTOs (Regional Transport Office) and getting a new registration for their non-cargo four-wheelers and two-wheelers.

3. Some information about number plates is essential.

The regular registration of a non-cargo vehicle involves limiting it to one state. The initial two letters of the number plates denote the state the car was registered in. For example, GJ for Gujarat, BR for Bihar, TN for Tamil Nadu, DL for Delhi, MH for Maharashtra, etc. The two digits next to the letters depict the district of the state of registration.

However, for regular registration, when a vehicle is shifted from one state in India to another, it is permitted to use its old registration and number plate for up to twelve months. After this period of one year, the vehicle needs to get a new registration at the RTO of that particular location. This new registration includes a NOC certificate, additional charges, and taxes, which will be informed upon your visit and consultation. The vehicle owner will be fined according to the costs of the new state if they fail to complete this process in time.

However, the registration process for BH series number plates began on the 15th of September 2021, and is entirely digital. Therefore, all your application work has to be done online. This avoids the struggle of commuting to the assigned government office and getting in line for your work to be completed.

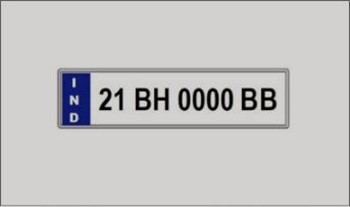

A BH or Bharat series number plate will look something like this:

XY BH $$$$ XX

XY is the registration year, BH is the Bharat series code, $$$$ is the registration number of the vehicle (ranges from 0000 to 9999), and XX are alphabets from AA to ZZ indicating the category of the car.

The introduction of BH or Bharat series number plates provides a huge relief against this tiring and lengthy process for the people who have to move their families and house setup from one state to another quite often.

We hope this blog gives you insights into something new that benefits you or clarifies the BH series number plates. And while we are on the subject of cars, you must already be aware of the necessity of getting car insurance to safeguard your car during unfortunate circumstances which might lead to hefty damages. To choose which car insurance to buy, one of the most critical factors is to look at the standard car insurance price in India and compare different plans and their coverages accordingly.

Click HERE to learn more about the average car insurance price in India and which insurance would be beneficial for you.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.