General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

Stinky car interiors? Here's how to get rid of the foul odour

Everyone wants the shiny look of their cars. But what about the smelly interiors? Stinky car interiors can negatively affect your mood and make you feel awful. So, to get rid of foul odours, in this post, we have mentioned some quick tips to help you have a refreshed car and a happy mood while commuting.

1. Vacuum the fabrics:

Most of the time, solid particles tend to get trapped in the car's interior and removing them can be a daunting task. These particles get deep into the fabric. Even after cleaning your car, you still wonder where the smell is coming from.

To get rid of the foul smell, use a vacuum cleaner to clean all the seats and the fabric of your car. This will suck all the gunk and dust particles from your vehicle, leaving your car clean and fresh.

2. Avoid smoking in the car:

If you smoke in your car, you might know how unpleasant the smell is. Smoking leaves behind tar which can stick to the interiors. The smoke can even get in the vent ducts of your air conditioner and become nearly impossible to remove.

To get rid of this, you can wipe off your car with a solution of water and vinegar in a 1:1 ratio with a few drops of liquid detergent added to it. This will remove all of the gunky substance and leave the surface of your car clean. In addition, you can spray some air freshener in the air ducts of your air conditioner to combat the odour.

3. Use baking soda for unpleasant food spills:

Sometimes, you tend to drop something on the carpet or your car's fabric, and the spills being left for a long time start to stink. Even after wiping it, the pungent smell may remain.

To remove the smell of the leftover spill, you should mix a tablespoon of baking soda and three tablespoons of vinegar and use this mixture to rub the mat or car fabric. This mixture will clean your fabric and remove all the unpleasant smells coming from it.

4. Use car deodorants and air cleaners:

This is one of the simplest and quickest ways to keep your car smelling fresh. All you need to do is pick your favourite car perfume and spray it in your vehicle. The air spray molecules will trap the pungent smell and give your car a fresh aroma. There are other similar products that you can explore, like odour patches, air- filters, etc.

5. Get your car a spa:

This will be your last resort if any of the ways mentioned above are not working for you or if the smell is very foul. Next, you should take your vehicle to a professional car cleaning service. The cleaners will clean your car from inside to the outside by washing your seats, mats, air ducts, food trays, etc., making your vehicle look and feel brand new.

We all know how bothersome stinky cars can be. You can follow the tips mentioned above to get rid of the bad odour in your vehicle. But it is not always the dirt that causes the smell. Sometimes these smells can be from leakages. If not addressed correctly, these issues can cause severe damage. So, we would suggest you have car insurance by your side to cover all repairing costs at the garage. Reliable car insurance will keep the stress off your pockets and give your possession the benefits to have a long life.

Click HERE to buy the best car insurance plan.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Action camera for your bike travel: Nine tips to film the best videos

Action cameras have become a new trend among bikers. You must have seen the riders with one fastened to their helmets or handlebars. One reason being, India is adapting well to the vlogging, thanks to all the biker communities and influencers. With the evolution of action cameras, millennials are interested in capturing their bike rides and sharing the content on social networking websites.

There are some easy steps for you to produce the best-looking shots from an action camera, regardless of riding ability. Read these nine best tips to film better videos through your action camera.

• Choose a suitable device; you may not require an expensive camera and instead need something easier to transport and manage and friendly with all weather conditions.

• Plan out your videos; consider the video's objective, surroundings, the route you'll take, and how you'll film it. Take into account the lighting, the weather, and even the background music.

• The mainstream camera technology can record at 24 FPS (frames per second) for regular speed and at least 60 FPS for slow motion. However, extra-slow motion does not kick in until at least 120 frames per second, and filming at greater frames per second may lower the resolution.

• Set the white balance to auto, although you may set it to specific numbers corresponding to different lighting circumstances (for example, 5500K = daytime). We find that letting the camera make such adjustments for you is always the best option for shooting true colours on a motorcycle.

• With the voice command feature, you can start recording at any time throughout the ride and stop whenever you choose. Even better, you can snap 'Still Photos' while moving.

• 4K recording requires more memory, drains the battery faster, and can be difficult to edit or playback on a computer.

• An SD card in your action camera is always not sufficient. You should keep at least two or more if you're going on a long journey or simply want to capture more films.

• The typical rule of shutter speed is that it should be twice as fast as the frame rate. A shutter speed of 1/60-1/96, on the other hand, is more helpful because it avoids the sickening amount of 'Motion Blur' that might occur when riding a bike.

• To avoid water drops damaging your footage, use a water-repellent glass treatment spray like Rain-X.

Motorcycling has forever changed as a result of action cams. With the rising trend of sharing content on social media platforms, people use action cameras for incredible filming. However, driving bikes on roads brings the great responsibility of getting the proper protection for you and your bike. You can replace your cameras but not your life, so invest in good 2 wheeler insurance.

These tips for getting better footage are only a starting point; if you have something else that works for you, go for it. Beyond any camera setting, position, or attachment, the most important thing to remember is that the one who presses the record button is the real star.

To get the best 2 wheeler insurance, click HERE.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

The complete guide to start learning carpentry

Often people think they need to invest years in mastering the art of carpentry. However, that's not entirely true. With the right mindset and tips, you will learn carpentry in no time! This specialized craft, believed to be one of the world's oldest professions, is commonly employed even today.

Here we have composed a detailed guide for you that will help you in your lessons while you are learning carpentry.

1. Learn about different types of carpentry:

When it comes to carpentry, the only thing that comes to an individual's mind is furniture. But that's not the real deal. There are different types of carpentry, and you can study each one and then pick the one suited for you.

• Formwork: Formwork in carpentry is designed to construct the structure of the object. It comprises the mould in which the concrete is poured while making stairs, walls, pillars, etc. Formwork, made with wood and steel, can be temporary or permanent.

• Framers: Framers work upon repairing and restructuring wood or wood-derived products. The task that you are to do as a framer is to measure, cut, and assemble the wood for industrial or household purposes.

• Cabinet designers:

This form of carpentry requires proficiency with woods and mastery of tools. The job of a cabinet maker is to build, repair and modify wooden structures and furniture.

• Joiners: Joiners, also popularly known as 'finish carpenters,' are more inclined towards wooden ornaments, fine woodworks, and fitting of doors and windows.

2. Take safety precautions:

While working with tools and woodwork, you must learn safety measures like first aid training and have all the safety accessories like gloves, glasses, helmets etc.

3. Measure like a pro:

Measurement is one of the essential skills you need to learn while practising carpentry. You will be cutting several wooden blocks and pieces most of the time. Therefore, double-check your measurement before doing anything.

4. Learn to use carpentry tools:

Tools make a carpenter's work easier, but only if they know how to use them. Carpenters use various tools like handsaws, chisels, mallets, etc. Therefore, it would be best to learn to use them rightly and understand which woodworking activity necessitates what type of equipment.

5. Get trained:

There are plenty of paths to carpentry, and some of these do not even require any qualifications, only skills.

6. Get working experience:

Working on-site on a live project can be one of the best ways to get into the carpentry industry. You can gain plenty of knowledge and skills while you are at work. Apart from that, you can even get into different roles like general construction operations and work with professional carpenters.

7. Take up courses:

There is an abundance of specialized courses you can sign up for learning carpentry. These courses typically provide you with hands-on and theoretical training to make you a better carpenter.

Carpentry is an excellent skill to learn and practice, and you can excel at it if you choose to continue with passion. Although being a skill, it still poses a threat while working. You may get hurt while using a tool or working with heavy objects. So, it is suggested to have the best personal accident policy in India to safeguard your wellbeing and put less stress on your pockets.

Click HERE to find the best personal accident policy in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Ten best holy places to visit with your family

Inhabited by some of the most highly religious communities and cultures, India is the world's largest multi-ethnic and religiously diverse republic. The air in the land carries the essence of Dharma and Karma to welcome your spiritually thirsty souls.

Here, we've compiled a list of India's most exquisite holy sites to visit with your family or by yourself to find serenity, knowledge, and peace.

1. Shirdi:

Practitioners of several religions visit the Shirdi Temple in Maharashtra - home of the famous guru Shri Sai Baba. The devotees believe that Sai Baba's 'Dwarkamai' is the place that will solve all their problems.

2. Golden temple:

One of the most significant pilgrimage sites for Sikhs is the Harmandir Sahib Gurudwara in Amritsar. One distinct feature of this Gurudwara is its Langar (meal service), which bagged the honour of being one of the most extensive operating kitchen services. The Langar is open all day for the devotees to enjoy delicious prasad and make their visit more memorable.

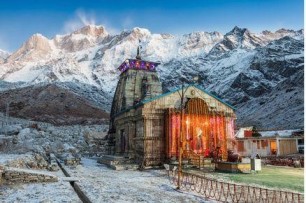

3. Kedarnath:

The Hindu temple of Kedarnath in Uttarakhand praises Lord Shiva. It is one of India's Char Dhams. According to the mythology of Skanda Purana, Kedarnath is considered the abode of Lord Shiva.

4. Amarnath:

The sacred Amarnath shrine is located in Jammu & Kashmir. Devotees can only access it after a few days of strenuous hiking. This temple does not contain an idol. Instead, a Shivling forms when water flowing from the cave's top solidifies and rises upwards. This natural phenomenon is the highlight of this holy place. Amarnath is also known as one of the 18 Mahashakti Peethas.

5. Vaishno Devi:

Located in Jammu and Kashmir's Trikuta mountains lies the temple of Vaishno Maa. It is a Shakti Peetha and one of India's most prominent religious sites. Moreover, it is associated with a thrilling story highlighting the victory of good over evil. After visiting the Vaishno Devi, visiting the Bhairavnath temple is a must.

6. Badrinath:

As famous as Kedarnath, Badrinath is one of the Char Dhams for Hindus in the state of Uttarakhand. Lord Vishnu was believed to have come here to meditate and call this location home.

7. Temple of Jagannath:

According to Hinduism, the Jagannath temple in Odisha's Puri is an important pilgrimage site as it conducts the annual Rath Yatra here. Many devotees of Vishnu and Krishna participate in the yatra and celebrate the event like a festival. In addition, this temple is famous worldwide for its architectural magnificence.

8. St. Francis church:

Situated in Goa, it is acknowledged as India's first minor basilica. It houses the bones of St. Francis Xavier in a coffin and is only opened to the public once every ten years. It is also renowned for its gothic architecture.

9. Dargah of Haji Ali:

Dargah of Haji Ali is one of India's most famous Islamic holy sites. Situated in southern Mumbai, it consists of a mosque and Pir Haji Ali Shah Bukhari's grave. The Mughal style architecture influences the dargah, with beautiful white domes and minarets.

10. Bodh Gaya:

Located in Bihar's Gaya district, Bodh Gaya is one of the significant pilgrimage locations for Buddhists. It features three monasteries and several organizations that offer classes on Buddhist philosophy and an 80-foot-tall Buddha statue. It is also home to the Mahabodhi tree, where Gautam Buddha attained enlightenment.

When planning your next vacation, consider a couple of these religious sites in your itinerary. Set off on a spiritual pilgrimage with your family and feel inspired. While you uplift spiritually, it is also vital to ensure your family's safety while travelling. Before making travel plans to these holy places, count on Magma HDI's general insurance policies and have a safety net for you and your loved ones.

Click HERE Browse general insurance policies

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Planning a reunion? Consider these five tourists spots you should go to

It's been a long and challenging time of social isolation, lockdowns, quarantines, and cancelled gatherings. But, finally, the series of missed opportunities have ended as more vaccines reach the arms, and the limitations imposed by the Covid-19 national lockdowns have progressively eased. Now, we have been allowed to socialise with our loved ones in ways we haven't been able to for a long time.

So, what better time to plan a reunion than now? It's time to take your travel bags out of your closet and put an end to these slumber times.

Below, we've talked about five great reunion spots for you and your loved ones to call home for a few days.

1. Goa, where vibes match your energy: If the most desired vacation in India had a name, it would most likely be Goa. Goa is as near a fantasy paradise as you can get and is a perfect blend of modern and traditional culture. You think of clean water beaches, enthralling water-sports activities, and crazy pubs and disco parties whenever you hear about Goa. But, wait, Goa is much more than that. The best Goan seafood, a historical Portuguese colony with a distinct charm and the Goan culture has no parallel. Since the proclamation of a nationwide lockdown in March, Goa has been one of the most eagerly awaited tourist destinations. It's the right time to plan a trip and make a vibe – Goa is ON!

2. Darjeeling, a paradise for tea lovers: Located in the Kanchenjunga range of the mighty Himalayas, Darjeeling is a picturesque hill station in the Northern region of West Bengal, which has earned itself the moniker of 'Queen of Hills.'

Rightly so, Darjeeling works wonders to cater to the magnificent Himalayan scenery, offering a blend of splendid tea plantations on steep mountain slopes, toy train trips through the beautiful city, and exquisite traditional Tibetan food. So if you want to cool off and spend time in the arms of mother nature, Darjeeling is the place to be.

3. Rishikesh, discover adventure with spirituality: Commonly known as the 'Yoga Capital of the World’, Rishikesh is part of India's beautiful state of Uttarakhand. Rishikesh is a place that truly epitomises the word serenity since there are several ghats and ashrams for you to rediscover yourself amid the world's craziness.

Go river rafting in the river Ganga or thrilling treks in the Himalayas; there's something for everyone. Rishikesh is catching the attention of travellers massively after the ease of lockdown restrictions. It will help you wake your spiritual side and enlighten your mood in peaceful surroundings.

4. Coorg, mountains calling: Coorg is part of the scenic state of Karnataka. Located halfway between Mysore and Mangalore, it appears to be a sliver of heaven that has strayed from God's realm. Coorg is a land of rolling hills, evergreen jungles, spices, and coffee farms. Fall in love with soothing sunrises, pristine air and heart-throbbing views of mighty elephants while sipping on a cup of famous Coorg coffee.

5. Munnar, surrender to serenity: Part of God's Own Country, Munnar is one of India's most famous hill stations. It is a destination with an abundance of natural beauty to see, experience, and enjoy. It is a land of virgin woods, beautiful hills, Savannahs, gorgeous valleys, countless streams, magnificent waterfalls, extensive tea plantations, and winding walks that are sufficient to calm your exhausted minds. Reside in the abode of greenery with your loved ones by visiting Munnar.

Have you decided on a destination for your reunions yet? If not, plan it soon, but remember that the pandemic has not ended yet, so you must abide by all Covid protocols. Also, don't skip the most crucial part of your trip: being safe and keeping others around you safe. Have reliable car insurance, and if you have one, check for your car insurance renewal before you pack your bags and set out for an adventure.

Click HERE to know about the best car insurance renewal deals that you can get.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Eight best tips to be a good pet parent

Having a fluffy and tiny pet with you is similar to raising a small kid. But, as their parents, you also have a responsibility to make sure they do not face any problems. Additionally, having a pet in your home brings a lot of challenges. You have to ensure that you take adequate care of your pet to get them a cosy and safe habitat.

We help you with some tips to become a good pet parent and shower your pet with some extra love and care.

1. Make your pet get a safe environment:

Since your pet will spend most of the time inside the house, ensure that you create a healthy environment. Perform all the primary duties such as ensuring that their water bowl is complete, having food whenever they are hungry, litter box, and bed to snuggle when they want to relax. Keep chemicals out of reach and make sure they are also away from areas that can put them at risk, such as electric wires, electric cords, and strings.

2. Take your pet to the vet regularly:

Like humans, pets also fall sick, and it often goes unrecognized. To ensure your pet is away from sickness, take them to the vet for a regular visit.

3. Keep them active and provide enough socialization:

Similar to how kids need to play outside, pets are equally active and playful. Take your pet to outings, for a walk, run, or take them out for fun activities. You could also take them to pet events where they have plenty of socialization with other pets.

4. Set a daily routine for your pets:

You can create timelines for bathroom breaks, mealtimes, playtime, and outings. This way, your pet sticks to a daily routine, making everything easier.

5. Groom them regularly:

Hygiene is crucial, whether it’s for humans or pets. To avoid infection and diseases, keeping your pets groomed is essential. Regular baths and cleaning will help in keeping them fresh. Additionally, trim their nails so you or other family members do not get injured while playing with them.

6. Invest in training your pet:

Training your pet is an essential aspect of being a good parent. While many pets change and adjust to new behaviours as they grow, training is necessary. You can start by training them from the initial stage, developing them into habits. However, you can also invest in professional pet trainers to save time.

7. Understand that your pet may suffer from separation anxiety:

Like humans, pets such as dogs and cats suffer from separation anxiety. Your pet will become anxious and follow aggressive behaviours as you leave home. An easy way to reduce separation anxiety is by leaving something with your scent on, such as a blanket or sheets, so they feel close to you even if you are not home.

8. Create a playful environment:

Your pets may become bored after a while. Although you cannot ensure that you will entertain them all the time, creating a playful environment by filling their area with toys and other products designed for pets will keep them joyful all the time.

Being a pet parent can be challenging and fun at the same time. Some people feel more connected to their pets than humans, and it’s no harm in that. However, as a pet parent, you must take proper measures to ensure your pet feels loved all the time.

Entrust your bond with your beloved pet with insurance benefits to avoid the worries of injuries and focus just on spending quality time with your animal buddies. Invest in a robust online general insurance plan and get the advantages of its features for your complete family.

Click HERE to know more about online general insurance plans.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

How rock climbing can help you boost your leadership skills?

There was a time when only those with unbelievable daring and high tolerance levels could enjoy rock climbing. But today, time is changing; with modern gears and professional instructors, anyone with passion and some training can exercise the sport of climbing.

Mountain climbing is the sport of climbing rocky surfaces with the aid of ropes and equipment. The goal is to reach an endpoint or a summit of a structure.

It is a physically demanding sport that combines fitness and agility with mental strength. It forces you to push your body's ability further to conquer an ascend or traverse. It may be difficult for some, but that is just another positive aspect of the adventure. The activity gives you a mental and physical boost with an immense sense of accomplishment.

One of the significant benefits is boosting your leadership qualities. As rock climbing is a preferred group activity, it becomes the ultimate classroom with lessons applicable to all aspects of life, including business, management, and leadership.

So, here are some of the important lessons you learn during your way up that eventually make a big difference in your leadership skills.

Trust – important of all! Trust and confidence within the team of climbers is a quintessential skill required during mountain climbing. You may enter situations where your life depends upon your teammate's abilities, and for this, their capability and competence must convince you. Trust cannot be earned or given in a moment. It requires several sub qualities like confidence, proficiency, transparency, and patience. You need to be familiar with each other's strengths and weaknesses and to be confident about relying on someone in the future.

Everyone has their fortes in climbing. For example, some are proficient in rock climbing, whereas others secure the rope while your partner climbs, so we must trust each other to lead when necessary. These are qualities of a good leader that he acts as a team player and not a commander.

Decision making – a remarkable ability! The adventure compels you to make many pivotal and critical decisions during your climb. Your one wrong decision can lead to a consequential mission termination, delay conquering the rock or even a mishap. It requires clarity of mind to work through solving problems. Being able to prioritise and understand the bigger picture is critical to navigating through obstacles.

A great way of decision-making in such environmental conditions is the OODA loop used by the US military. OODA stands for observe, orient, decide and act. OODA is a four-step loop approach that focuses on decision making by filtering available information, putting it in context, and making the most appropriate decision while understanding that alterations should be made (if necessary) when more data is gathered. It is helpful in scenarios where the ability to react to changing circumstances is vital.

Another leadership quality is 'care and concern'. No doubt on the hike, you look out for each other, but that is not enough. Ensure that everyone has a personal accident insurance policy, as it is a necessity that many may overlook.

Is a good leader enough for a successful trek trip? Absolutely not! Every individual requires a skill set for this sport. Skills of navigation, communications, survival, and climbing are all necessary. In addition, rock climbing requires courage and determination. The hard work of ascending is worth the peace at the top.

Click HERE to know more about our personal accident insurance policy.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here are the six best ways to combat work fatigue and get back your energy

We have all been in a situation where we've felt completely drained of energy but have no clue what to do to get it back. Work fatigue results in higher unproductivity and even leads to draining mental health. Therefore, to help you combat it, we have compiled a list of the best six ways you can regain your energy.

1. Stay hydrated:

When you don't drink enough water, your heart pumps at a lower rate than usual, resulting in a decrease in the supply of blood and oxygen to the organs. It is recommended to drink at least 3-4 litres of water per day. To get this amount of water, you can keep a bottle of water on your desk while working and take regular sips as you get your job done.

2. Have a clean diet:

It is necessary to ensure that your diet is balanced and contains the appropriate amount of nutrients required by your body. Your meals should include the right portion of protein, fibre, and, most importantly, green leafy vegetables. In addition, you must limit simple carbs and avoid sugar. Overeating can also be one reason why you feel lethargic all the time. Have a balanced diet that covers all your micro and macronutrients.

3. Use Pomodoro Technique:

Studies have proven that the human brain works more efficiently when given rest after any activity. If you work without taking breaks, you will feel low and unproductive. To avoid this, you must try the Pomodoro technique. Using this technique, you break your work into 25-minute chunks and take a 5-minute break every 25 minutes. This will help you manage your time efficiently and help you feel more productive and active.

4. Get yourself moving:

Studies have proven that individuals who work out daily have better cardiovascular activity and a better mood than those who do not. When you are physically active, your body releases endorphins in your bloodstream that give you a feeling of excitement and joy. Exercising for at least 20-25 minutes every day will help you be more active and physically fit.

5. Practice yoga and meditation:

To improve your focus and feel more energetic, you must try yoga and meditation. Many businesses and corporates have adopted meditation as a part of their culture. Practicing yoga and meditation every day may help improve your focus and achieve mental peace that will indirectly help you be more active throughout your day.

6. Consult your doctor:

This is your final resort if you have tried all of the aforementioned tips. There could be other causes why you feel tired and awful all the time. It is recommended to consult your doctor if you continue to feel fatigued even after a considerable amount of time. If you have health insurance, your insurance company can cover your medical expenses. Therefore, you will not have to worry about the cost of medical bills and pressure on your finances.

It can be extremely stressful to be unable to complete a given task even as the clock ticks closer to the deadline, especially when you are struggling with work fatigue. Fortunately, with the help of these tips, you will have a much easier time regaining your energy and feeling more productive!

Click HERE to understand the merits of health insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.