General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

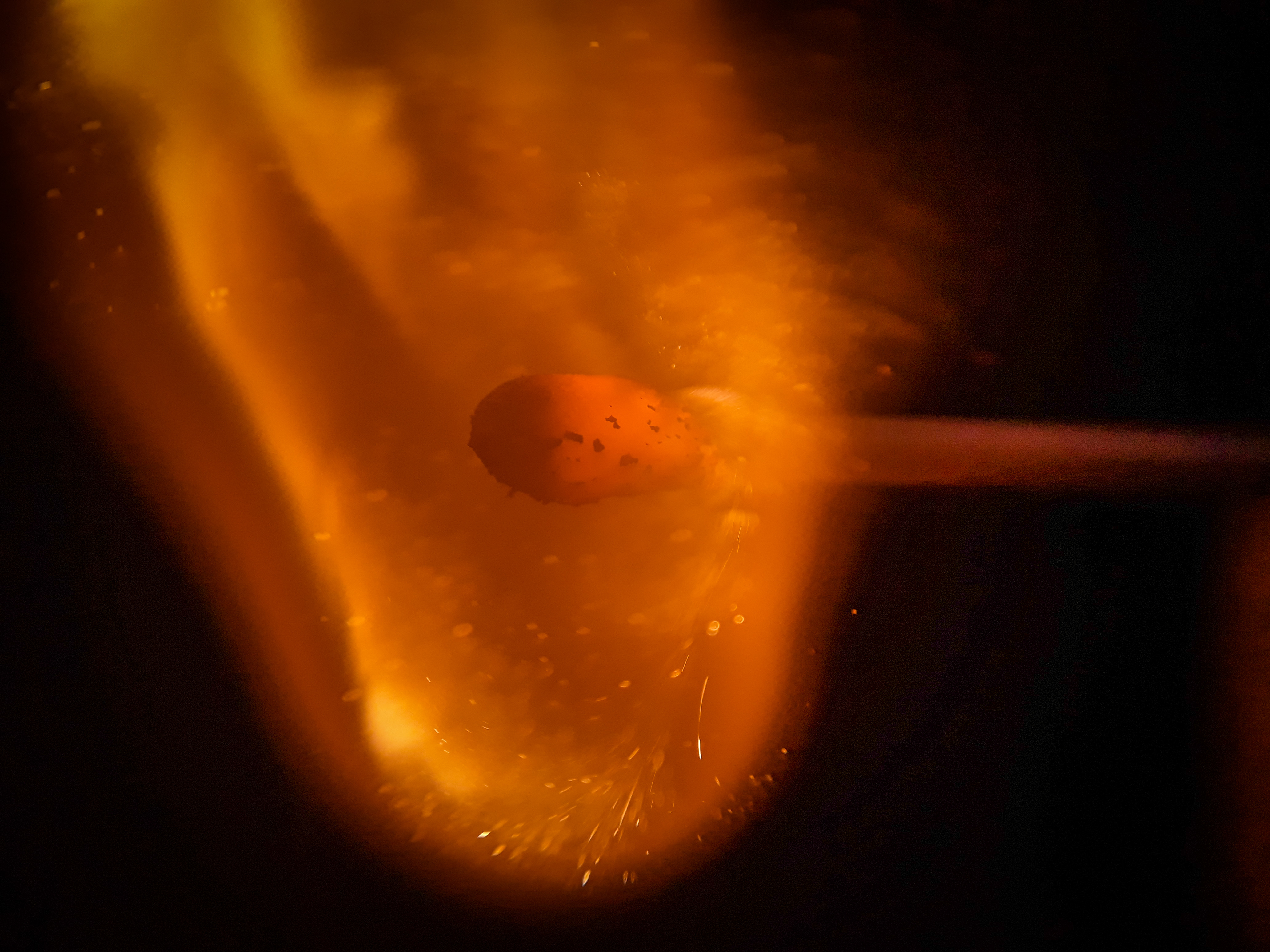

How innovation in e-scooters is making the headlines in India

Today, climate change is a severe concern. According to a survey published by IQAir, India now has 22 of the 30 most polluted cities globally, which is alarming! Nations around the globe are researching to find environmentally friendly alternatives for everything that feed on fossil fuels. India, too, has set a goal of reaching zero greenhouse emissions by the year 2050. For that, the country is exploring electric mobility solutions that will cut down severely on greenhouse emissions.

When we talk about the electric mobility of the country, its primary segment is the electric scooters. According to nationwide surveys, the market of e-scooters in India will grow by 25-30% by the year 2030. Reasons for these impressive figures are the constant hikes in fuel prices and also the rising pollution levels. Thus, E-scooters are the next big thing in India, making them flash in the headlines in India.

We've seen plenty of new businesses competing for professional status in the electric scooter sector in the recent past. Their advantages reflect their focus on newer technologies, cutting-edge designs, accessibility, and practicality. However, more encouraging is the arrival of international electric two-wheeler powerhouses in the Indian market.

The Indian government recognises the importance of environmental sustainability and renewable energy. It has launched programmes such as 'Switch Delhi' and 'Go electric' to encourage citizens to use electric vehicles. Below, in brief, we've discussed the pros of e-scooters and why you should think of getting one in future.

Environmentally friendly: Electric scooters are ecologically friendly since they reduce the emission of harmful greenhouse gases such as CO2. Every time you ride an electric bike, you're contributing towards a cleaner environment.

Pocket friendly: If you use an e-bike instead of a traditional motorbike, you will save huge money in the long term. Petrol and gasoline are expensive in most nations, and price increases can significantly affect your budget. With e-bikes, you can purchase low-cost batteries that can go 18-50 miles on a single charge.

*Quick math – an e-scooter consumes around 250 watts of power for 20 minutes of driving. Because the cost of electric power per unit (1000 watts running continuously for an hour) is Rs 5, it is evident that electric scooters are reasonably affordable.

Low maintenance cost: You no longer have to be concerned about the upkeep of your scooter. Because of the electric engine, you don't have to spend extra money on time-consuming activities like oil changes, filter cleaning, and gasoline, typically with standard two-wheelers.

Financial incentives: Indian Government provides tax benefits to owners of electric vehicles. Loans are also made accessible at cheaper interest rates, encouraging more people to buy e-scooter. In addition, the Department of Heavy Industries recently revised the 2019 Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) initiative to provide 50% more incentives for the electric scooters sector.

Easy to the Ears: In India, noise pollution has long exceeded permitted limits and has become a severe problem, particularly in metropolitan areas. Switching to an e-scooter can help with health issues, including anxiety, tension, and headaches, as they are almost silent due to the absence of disturbing noises of combustion engines.

Pat yourself on the back if you're planning to go for an electric vehicle or use one already. The future is certainly electric, and not only you're part of it, but you're also helping this world become greener. While you contribute to our mother earth's safety, protect your e-scooter by getting 2 wheeler insurance online for it. If you're planning to buy a scooter, then GO GREEN...GO ELECTRIC!

Click HERE to get the best 2 wheeler insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Wondering how to keep your car shining post-monsoon?

We love the monsoon for bringing down the temperatures and making us fall in love with books, coffee, and comforters. However, with the pleasant rain comes floods, water-logging, and much more. And all over again, the monsoon season never fails to surprise us with the amount of damage it does to our vehicles.

The lengthy bills from your car service centre for rusting, complete breakdown, and other damage to your vehicle remind you of your car insurance renewal.

Please remember your car needs some special attention post monsoon time. So here we bring some valuable tips to keep your vehicles safe and minimize the damage to your car.

1. Car Wash – a thorough cleaning: ‘Keep it clean!’ is probably the most ordinary and mundane advice anyone can give you for anything. But here, it is also the most effective. Nothing is better than a good clean-up of your car once the monsoon is over. Be sure to get rid of the leaves, mud, twigs, dirt, and other contaminants that could damage your vehicle. For example, if you have parked your car out in the open during the monsoon, you should get a proper car wash at a service centre to prevent the build-up of leaves and twigs that could potentially damage the paint on your vehicle.

2. Protect the Paint – keep it shining: The best way to keep your paint new as day one, even after these heavy downpours, is to use a protective paint layer, which separates the moisture and rain from the original colour on the surface of your car. For this, you can select from a wide range of quality protective products or opt for less expensive ceramic paint protective layer options. You can also go for a protective paint job at the workshop.

3. Electrical hazards – don’t get SHOCKED: Water and electricity can be dangerous together. So it is advisable to check all the wiring and electrical components of your car to avoid any short circuits. Get your car thoroughly checked for the wirings and any loose or open ends. Use electrical tape to fix them or call a mechanic.

4. Drive Slow – stay safe: Though this one is for all seasons, you need to be extra careful on the road after monsoons. There are potholes everywhere, and the quality of the road is even more aggravated. Drive cautiously, don’t attempt to be reckless as it may cost you badly.

5. Car insurance – safeguard your finances: Relying on your car insurance will help you recover and repair the significant damages to your car if it requires a visit to a workshop for the post-monsoon repair service. Car insurances are financial saviours, and it is your responsibility to avoid delays in your car insurance renewal.

Now you know these must-dos to keep your car clean and in good shape after the monsoon departs. It is always a good practice to get a post-monsoon servicing done to ensure that all the parts of your car are correctly functioning.

To know more about the car insurance add-ons that will be beneficial this monsoon, click HERE...

Say goodbye to indigestion with these seven effective home remedies

Some foods might delight your taste buds but can cause discomfort in your stomach. Overeating or eating something that does not agree with your stomach can cause indigestion.

Indigestion is a common health problem. Most people take medications because they do not believe in home remedies. While medications can provide quick relief, home remedies are suitable for your overall health in the long run.

Here we have a list of easy home remedies to calm your upset stomach with zero side effects and the best relief.

1. Peppermint tea:

Peppermint is not just a refreshing flavour for candies, chewing gum and mouth fresheners. It has antispasmodic qualities, making it an excellent ingredient for relieving stomach problems like nausea and indigestion. You could easily add peppermint to your diet by drinking peppermint tea after meals and sucking on peppermint candies when you experience symptoms.

2. Water:

Of course, you already drink water throughout the day. However, sometimes people can forget to drink the adequate amount required by the body. Water is essential for the digestion process and absorption of the nutrients in the food and beverages you consume. Being dehydrated can reduce the effects of digestion by facilitating the incomplete breakdown of complex food particles.

3. Baking soda:

Indigestion occurs when the acid level in your stomach increases. Baking soda has neutralizing properties, which relieve the effects of acid instantly. Baking soda is cheap and can be consumed by mixing with water or honey and lemon.

4. Chamomile tea:

A cup of chamomile tea can fix gut discomfort and indigestion by reducing the number of acids in the gastrointestinal tract. The herb also has anti-inflammatory properties that help ease the pain. Chamomile tea is also a popular choice for calming anxiety.

5. Avoid lying down:

Parents often tell us not to lie down immediately after eating, and now we understand why. Lying down after eating allows the food to travel back upwards, which causes heartburn. Avoid lying down for at least an hour after eating. If you must lie down, elevate your head, neck, and chest with pillows at a 30-degree angle.

6. Apple cider vinegar:

There are uncountable benefits of apple cider vinegar, ranging from skincare to weight loss and relieving indigestion is one of them. Insufficient amounts of acid can also trigger indigestion. The acidic properties of the ingredient increase your body's production of acids. Raw, organic, and unfiltered apple cider vinegar works best for indigestion.

7. Ginger:

Ginger has long been famous for its curative properties. It contains properties that can relieve the contractions in your stomach during indigestion by moving the responsible foods from the stomach much quicker. Ginger can be added to various savoury items as a spice and be used in desserts. For a quick ginger remedy, you could make ginger tea whenever you feel the symptoms.

By following the above remedies, you can manage your indigestion at home without heavy doses of medicines. These home remedies are scientifically proven to improve your condition. However, besides these, you may even count on insurance coverage to secure your health against other diseases. Choosing a good health insurance policy for family will act as a safety net for everyone at home. Purchase one today to enjoy the seamless benefits of the coverage.

Click HERE to know more about the health insurance policy for family that can be your financial saver.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Why do most millennials buy health insurance online in India

India is a global capital for housing millennials, as almost 34% of its population is GenY. Powered by advanced technology, data, to be more precise, millennials consume a large amount of data each day. No wonder they are recognised as the most data-driven generation.

Because they grew up online, the idea of getting things done from smartphones appeal to millennials' tech-savvy attitude. Rightly so, as it involves a lot less effort. The fact that millennials (and the great majority of customers) are accustomed to doing nearly all of their daily transactions online makes sense to purchase online health insurance.

In this space, we will talk about why this data-hungry generation prefers to go for online health insurance purchases and why you should too.

1. Lower cost: Millennials are identified as frugal shoppers as they believe in cost-effective purchases. They typically choose to follow their instincts and value the price over recommendations. Buying insurance offline involves a cost consisting of the paperwork, the commission of intermediaries, and the transportation cost to make the sale. These variables being absent for online health insurance reduce the premium cost immediately. There is even a chance of getting a lower premium that adds to the savings in some circumstances. And all this attracts millennials; after all, they love smart investments.

2. Ease in comparison: While purchasing health insurance online, you can compare several insurance plans from different company side by side, either by yourself or using dedicated comparison tools. It can help you look at the pros and cons of an insurance company and select the best for you. This ease in comparison is almost impossible while making an offline purchase. This speeds up the overall buying experience and matches this generation's demand for online convenience.

3. Customer reviews and testimonials: On purchasing online health insurance, users have an option to leave feedback on their experiences. These reviews are available on the insurance company's website, their social media pages and other third-party review websites. These reviews help to ascertain your decision for the best insurance plan for you. Millennials never overlook the reviews section; sometimes, that's the turning point in finalising or rejecting a purchase for them.

4. Time saving and DIY: Time is money, and millennials have a reputation for spending an average of two minutes looking for product information and making decisions. Moreover, they want to control their decision and follow their D.I.Y. style. Once convinced, they prefer to finish the entire procedure in a few minutes and get an instant digital copy of the insurance papers. They are more comfortable with online health insurance where neither the insurance company nor the intermediary agent is visited.

5. Online insurance calculators: Online premium calculators are available on the websites of majority of health insurance providers. It makes it simple for clients to assess a plan's premium based on their specific needs before purchasing. In addition, these calculators offer highly accurate estimates. Millennials believe in cost-saving even as much as they look for other features from their policy like add-ons and NCB (No Claim Bonus). Nothing beats a good policy with all the features and a low premium. These online calculators justify the needs of millennials to a great extent.

What does all this tell us about millennials' inclination towards online health insurance? As you can see, this generation is more likely to use the internet for their insurance-related purchases than average consumers. So whether you're a millennial, Gen Z, or a baby boomer, online health insurance is here to evolve and to provide convenient and attractive policy advantages. It's time for others to start exploring online health insurance options too.

Click HERE to buy the best online health insurance for you and your loved ones…

Two-wheeler insurance hidden costs you should know about

Buying a two-wheeler insurance requires investment of time as the long and complex policy document in small font might look tiresome and time-consuming to read. Most people overlook those crucial details and rely on their life insurance agent while purchasing a policy. You need to be aware of the hidden charges that ridiculously drive up your insurance bill, as your agent might not explain everything you should be knowing.

A few adjustments here and there in your two-wheeler insurance policy might not seem like a big deal to you, but trust us, those will help you save a considerable sum that stays with you over time.

So, here are a few two-wheeler insurances hidden costs you should always pay attention to.

1. Paperwork fees:If you are not opting for 2 wheeler insurance online and instead buying your insurance physically through cheque, you are certainly paying a higher premium. Your insurance company charges you a couple of hundred rupees for the paperwork. Also, the company will not bear the postage cost and handling of all that paperwork; they will undoubtedly pass those expenses on to you. In an online policy, your insurance providers will reward you by waving off extra charges for choosing to go paperless, setting up automatic payments, and paying your premiums online.

2. Avoid monthly payment: When it comes to your 2 wheeler insurance, the payment interval is equally important as the mode of payment. If you pay a monthly insurance premium, the company charges you for specific "processing fees" and "administrative costs" each time you pay. The "instalment fees" will cover all these expenses. Like most businesses, insurance companies also would like to collect their money first. So they encourage you to consider paying upfront, and for that, they offer you some rewards. Therefore, if you decide to pay quarterly (four times each year) or semi-annually (two times a year), you will notice that you have saved considerably on your premium. Of course, if you pay annually or pay-in-full, the offers are even better.

3. Cancellation fees: If you decide to withdraw your policy within 14 days of the cooling-off period, you will have to pay a small fee to the insurance company for the paperwork. What if you cancel your policy post completion of 14 days? Unfortunately, it'll cost you an even bigger fee for the days your insurance company has insured your 2 wheeler. These fees range from zero to thousands of rupees or even more. It takes administrative efforts to cancel your policy, so these efforts justify the cancellation fee.

Other fees include replacing paper documents or fines for providing inaccurate information to insurance companies when getting a quote. Yes, that's the fact that most of us are not aware of. Therefore, make sure that you provide the correct information while applying for a policy.

Did you also get promotional emails and phone calls for the cheapest 2 wheeler insurance online? Don't get fooled by these fabricated illusions of these promotional offers; instead, be a smart buyer to make intelligent purchases. You can often save a significant amount by moving online and paying annually.

Click HERE to get a quote for your 2 wheeler insurance now…

Two-wheeler insurance policy. Popular facts and myths

Have you got stuck in heavy traffic again? Guess who'll make the riding experience smooth and convenient by sliding through traffic? Your two-wheeler, of course!

For all the experiences you plan to rejoice in with your two-wheeler, there is a bit of practical advice – as a responsible owner, you should carry a valid insurance policy. But many people doubt that choosing an insurance policy is a daunting task and is expensive. So in this article, we'll tell you more about the myths and facts you should know about your 2 wheeler insurance policy.

Myths get a huge living space in India as false information and rumours always travel faster than light. So let's first have a look at some common myths about 2 wheeler insurance.

1. Choosing an insurance policy is a difficult task: Choosing an appropriate policy is confusing, full of hassles and a tedious task.

2. Insurance is expensive: Insurance is only going to cost money and would not be worth it. This is instead a very common thought every customer has when buying Insurance.

3. Third-party cover is sufficient for two-wheelers: Third-party cover will provide complete coverage for bikes. In case your bike is old, it does not need an insurance policy.

4. Insurance premium depends merely on credit score: The credit score of the owner is the only factor that determines the premium for your chosen policy.

5. An insurance policy covers all damages caused: The insurance policy is enough to cover all costs of damages despite the cause behind it. Your policy will pay you regardless of any terms and conditions.

Usually, facts get lost somewhere in the chaos of myths, but no worries, we'll present them before you.

1. Selecting an insurance policy is no fuss at all: With the assistance of professional insurance companies and their customer services, choosing and buying the right insurance is as easy as buying anything else. You can purchase the insurance right from your couch without even visiting the company.

2. Insurance is not expensive if chosen correctly: Nowadays, customers can choose from many options and plans offered by various insurance companies and even compare them to select the right one. Not only that, you are free to go through every little detail of the policy to avoid unnecessary charges.

3. A proper two-wheeler insurance policy is necessary for your bike: Just having a third-party cover is not enough to secure your bike. It will only provide cover for the losses against third-party and never for your bike. Hence, going for a comprehensive cover is a wise choice.

4. Online is safe: There is absolutely nothing to fear when opting for 2 wheeler insurance online. You can find the most attractive deals and discounts online and even compare policies with smart comparison tools. Moreover, sharing your personal information such as your name, age, address with reputed insurance firms is safe and trustworthy.

5. Every policy has specific terms and conditions: For all the insurance policies, there are limitations on claiming coverage. For example, the insurer will not cover any cost if the mishap includes the drink and drive case.

Having good information about both myths and facts should help you get a clearer idea about a two-wheeler insurance policy. So be a responsible citizen, don't fall prey to any myths and choose a policy for your two-wheeler now by clicking HERE.

Advantages of buying health insurance at an early age

There is a myth that young and healthy people do not need health insurance. An unhealthy lifestyle, irregular eating habits, and no time for exercising are the main reasons for premature illnesses even at a very young age. So, it has become necessary for everyone to have health insurance irrespective of age or income to cover themselves against lifestyle-related diseases. Getting health insurance at an early age brings many benefits and features. We explain a few of them here.

Low premiums:

The main benefit of getting health insurance at an early age is low premium costs since premiums are calculated based on risks. When a person is young, the risks involved regarding their health are lower; therefore, the premium will be low. It is advised to get health insurance as soon as a person turns 18. A child below the age of 18 can get coverage in the parent’s insurance policy.

Wide range of medical coverage options:

Another advantage of availing of health insurance at an early age is the comprehensive coverage options for diseases. Fortunately, treatments and medications are available for all diseases. Some of these diseases can cost a fortune if the expenses are not covered by health insurance. Health insurance policies provide a lot of financial support in case of any emergency. Also, there are lifetime renewal options if the policy is purchased in an early stage.

No-claim bonuses:

Every year, if a no-claim is made for the health insurance policy, the policyholder is rewarded with a bonus. Thus, for a policy purchased at a young age, it is very likely that you make no claim during the policy tenure and can get benefits of cumulative bonuses.

Income Tax advance:

Purchasing health insurance brings income tax benefits to you. Under 80D of the Income Tax Act, 1961, you can get a tax refund on the yearly premiums you pay for the insurance. It helps you in your financial planning from a very early age of earnings.

Low rejection rate:

Getting a health policy, adding the top-ups and other features is much easier for the young people than the elders. As mentioned earlier, getting the higher coverage or additional feature will cost you relatively less with a low rejection rate. You can enjoy more benefits of comprehensive and holistic coverage than the policies and coverage applied at a later age.

Avail more discount for online health insurance:

During pandemic times, visiting an insurance company and purchasing health insurance is not feasible. Most of the companies now offer discounts and other advantages if applying online. Online health insurance saves you money by recommending the best deals and well-suited policies depending on your requirements. Some websites even have the expertise to suggest plans that match your exact needs.

Like the other mandatory official documents such as driving license and PAN card, it should be your responsibility to purchase health insurance once you turn 18. Negligence in the matter of health is the worst mistake to make. Wisely choose the plan that can cover all your medical expenses for the long term.

TURNED 18 AND WANT TO BUY HEALTH INSURANCE THAT SUITS YOU BEST? CLICK HERE…

Top six camping destinations around Mumbai to spend a happening weekend

Surviving the heat of the hectic work schedules throughout the week and managing the balance between work and personal life is challenging. Mumbai’s fast-paced lifestyle can turn overwhelming as the weekend arrives. But there is a cure for this; Planning a weekend getaway to someplace away from the city chaos. This time think something different for the weekend besides the long drive trips to Lonavala and Mahabaleshwar or jetty rides to Alibaugh. We suggest a full-fledged camping experience to surrender in the arms of nature.

Don't miss out on the escape to the perfect experience of reviving your connection with nature. This article presents a cumulated list of camping sites in a radius of about 200 km from Mumbai.

1. Bhandardara, Ahmednagar:

Known for its patent Fireflies festival, Bhandardara is one of the top places for camping, especially for Mumbaikars. Located 165 kilometres from Mumbai, the destination allows you to have a comfortable long drive on NH3. This camping site also offers you amazing activities such as stargazing, constellation watching, and boating in the lake. Spend some peaceful time in serenity and flush out all the stress of the week during your stay at this beautiful campsite.

2. Malshej Ghat, Kalyan–Ahmednagar Road:

Tucked in the Western Ghats and home to a diverse range of biota is another lush spot for night camping named Malshej ghat. This could be your go-to place if you’re seeking a camping experience all by yourself. The mild air can soothe even the most restless hearts, and the mist and rain create the perfect environment for solitude.

3. Karnala, Mumbai-Goa highway:

Mumbaikars are no strangers to the name Karnala. The fort and sanctuary located here are famous all around the Raigad district. What makes it one of the most extraordinary monsoon retreats is its blanketed hillocks with verdant forests, grass, and foliage throughout the season.

4. Uttan, Mumbai:

Despite being located in Mumbai, this place is cuddled in a beautiful natural setting, far from the usual concrete jungle that we see. Situated at the city’s northern fringes, this is a laid-back fishers town. Visit it to live underneath the stars, eat fresh and delicious seafood, watch live music, and participate in thrilling adventure sports. What makes it even more exciting is that you don’t have to travel more than 50 km to reach the destination.

5. Kolad, Roha:

Residing on the banks of the river Kundalika, Kolad is one of the most serene camping spots around Mumbai. It is also known for being the favourite river rafting destination for Mumbaikars. It is left untouched by wannabe tourists, and hence the only thing that breaks the peaceful stillness is the chirps of birds and babbles of the river.

6. Pawna Lake, Pune:

This lake is an ideal weekend getaway for people who want to absorb the wonderful natural environs. As it rests in the woods, it provides the campers with a great deal of peace and contentment. This site has views that satisfy your exact image of lakeside camping.

Having tons to offer in connection with adventure, nature, relaxation, and breathtaking vistas, these camping sites will undoubtedly provide you with lifelong memories. However, the true essence of any trip can be experienced when it is crafted with security assured at all stages. You won’t like to carry the stress of the safety of your belongings and valuables when you’re out to enjoy your holidays. So, protect your travel with Magma HDI’s online general insurance plan that will ensure your assets’ security throughout your trip.

To look for online general insurance, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

These useful hacks can help you remove rust from your two-wheeler

There is no question that motorcyclists are crazy about their bikes and want to keep them glowing all the time. Most of the time, even seasonal changes won’t derail their desire to have a shining bike. Seasonal changes like wet and humid weather harm the two-wheelers most, mainly the rusting. Rust is an awful deal to handle when the bike has seen mud, water, ice, and road salt.

But there are DIY hacks that help you combat rust and preserve the life of your two-wheeled companion. In today’s article, we’ll discuss some clever, useful hacks that will help you handle rust efficiently.

1. Lemon Juice to remove rust:

The acidic nature of lemon helps eliminate rust in its early stages before it affects the inside metal. Here’s how to use it:

• Collect ample lemon juice in a cup.

• Apply the juice thoroughly onto a ball of steel wool with the help of a spoon, or simply dip the steel wool in the cup.

• Rub the rusted areas gently with steel wool.

• Wipe away the extra lemon juice and rust particles using tissue paper, done!

*keep the juice away from your eyes and any open wounds as it may cause burns due to its acidic nature. Wear gloves and glasses for precaution.

2. Get rid of rust using potatoes and salt:

When it comes to organic cleaning, this small technique is fantastic to have on hand. Here’s how you can use this duo to get rid of that adamant rust;

• Cut a potato in half.

• Rub the sliced portion of the potato on salt, thoroughly coating it.

• Rub the salted potato over the rusted parts vigorously. Slice the salted end of the potato off and dip it in extra salt as needed.

• Thoroughly rinse afterwards.

The oxalic acid present in potatoes naturally helps dissolve rust, while the salt works as an abrasive.

3. Sandpaper to scrape off the rust:

Use sandpaper to get rid of rust from parts such as engine and transmission, as these parts require precise attention. A slight deviation can throw everything off if not done correctly.

4. Baking soda to remove rust:

Make a thick mixture of water and baking soda and rub it all over the rusted surface. Let the paste settle on the bike's surface for about an hour. Rub the surface with steel wool. Rinse thoroughly with water & dry it using a paper towel.

5. Scrubbing – the good old way:

Simply scrubbing using a wire brush is also effective in getting rid of rust from larger bike parts. This technique, however, is not suggested for chrome parts of your bike since you may wind up scratching them.

Although these organic rust removing techniques are excellent, most of them are acid-based, and they have the potential to damage your bike, particularly in areas with mixed materials such as steel + rubber or steel + plastic.

It's best to hand over your motorcycle to experts for rust removals if it is heavily covered in rust. They make sure you get the best results while assuring the perseverance of your bike. A good 2 wheeler insurance provides the security covers with these aspects as well, including rust remover. So if you have 2 wheeler insurance, you can claim the rust repairs under it. Be a responsible owner and make investments that can yield you considerable profits. After all, your two-wheeler is a prized possession, and maintaining it in good shape should be your priority.

Click HERE to know more about 2 wheeler insurance.to know more about 2 wheeler insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Follow these simple steps to renew your expired driver's licence

Whether you are driving a motorbike or car, having a valid licence is mandatory. Most driving licences are issued for approximately 20 years or until the driver turns 50 years (whichever is earlier). Therefore, you need to renew your licence once it expires. Note that your driving experience and capabilities during your previous licence will not be considered for the renewal of it. Additionally, if you do not renew your licence until a year after the licence’s expiration, you will have to go through the entire process of getting a licence again.

Moreover, your driving licence is valid up to 30 days from expiration. Gone are the days when you had to stand in a long queue at the RTO’s office for the renewal of your licence. Due to covid’s second wave, the government issued a hassle-free way to apply for the renewal online in just a few simple steps.

No matter which state you reside in, you can easily apply for renewal from the comfort of your home. Continue reading the blog to discover all the vital steps you can take to get your licence renewed.

Steps to renew your driving licence online:

Step 1: Visit the official website of Parivahan Sewa Portal of MoRTH (Ministry of Road Transport and Highways) by clicking HERE

or head to HTTPS://SARATHI.PARIVAHAN.GOV.IN/.

Step 2: Next, enter your state’s name on your screen.

Step 3: You will now be redirected to the page with various options. Select “apply for DL renewal.”

Step 4: Now, a page with instructions will appear. Carefully read each instruction to avoid committing any mistake.

Step 5: Click on “continue” at the bottom of page and proceed further to the application form.

Step 6: Now, fill your application. Enter your previous driving licence’s number and date of birth and click on “continue.” Fill all the details and provide information as asked on your screen.

Step 7: Depending on your state, you may also require to upload your signature and photo.

Note: If you need to make changes to your medical certificates, you may have to book a time slot to undergo the RTO test.

Step 8: Now, the site will take you to the acknowledgement page, where you can see your application ID. Additionally, all the application details will be sent to you through SMS on your registered mobile number. Make sure you print out the acknowledgement for future reference.

Step 9: The final step is to make the payment and verify your payment status. You can pay through a debit or credit card. Usually, the fees may vary from one state to another.

Simply follow the above steps to renew your existing licence in a fast, convenient, and hassle-free way. Never drive a vehicle without a proper licence. If you are caught driving without a licence and valid insurance papers, you will be fined with penalties. Be a responsible driver; keep all your essential documents ready with you at all times, including your car’s insurance papers. If the insurance is due, make an online motor insurance renewal to ensure the benefits of your policy and protect you against any mishaps.

Click HERE to get the best quotes for online motor insurance renewal.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Is it possible to install CNG kits in two-wheelers?

Following year-long debate and discussions, the Indian government finally allowed CNG kits for two-wheelers as well. Interestingly, CNG kits can efficiently be installed even in mopeds with about 81.75 cc to 136.25 cc capacity. However, there are some restrictions on the installation of CNG kits in two-wheelers. ICAT and Automotive Research Association of India (ARAI) respectively approve only Euro-III-type automobiles to install these CNG kits.

CNG costs much cheaper than petrol or diesel and gives clean fuel to two-wheelers. This suggests that converting your two-wheeler into CNG will prove to be economically practical.

Advantages of installing CNG conversion kits:

• Natural gas is a cheaper alternative to petroleum as it costs almost one-third of petrol in some states of India. Natural gas is as cheap as 49.40 rupees per Gasoline Gallon Equivalent (GGE).

• CNG is less harmful to the environment than petrol. Compared to petrol and diesel, natural gas emits much less hazardous pollutants and hydrocarbons, thereby reducing the adverse effects of harmful emissions on the environment and human health.

• When compared to gasoline, CNG produces fewer toxic carbon deposits when burned. As a result, the engine is cleaner and more efficient. It removes the carbon deposits that taint the oil, reducing the need for oil changes.

• India has a well-developed pipeline network and abundant natural gas reserves. Switching to CNG fuel can help our nation to be less reliant on the import of oil.

• CNG can save your bike from getting green taxes. Vehicles that pass the automated fitness centres test are given a green tax at the time of registration. However, vehicles with CNG kits are exempted.

Disadvantages of installing CNG conversion kits:

• CNG tanks require more space. As a result, you may have to give up some room off your two-wheeler. In addition, a CNG cylinder can be a little heavier, which can be a difficulty in the handling of the two-wheeler.

• There are a limited number of CNG filling stations. Therefore, people who live in places with no easy access to CNG filling stations won't find CNG conversion the most efficient option.

• The cost of a CNG kit and the initial installation is high that refrains a decent population from installing these kits on their two-wheelers.

Experts believe air pollution will substantially decrease if more two-wheelers owners decide to switch to the CNG option. With global environmental issues bringing new challenges time and again, finding greener solutions and implementing them is a need of the hour.

Installing a CNG kit in your two-wheeler is not enough to improve the mileage and save additional expenses. Another thing to consider about CNG fitted two-wheelers is the expensive repair cost in case of an accident. Therefore, you require extra protection of a 2 wheeler insurance. Check out Magma HDI’s 2 wheeler insurance online and make your journeys stress-free and financially safe against adverse situations.

Environment-friendly and sustainable practices can be our first step towards a secure future. If you’re ready to compromise with the minor discomforts and consider pollution as a bigger threat, then switching to natural alternatives is the best choice that you can make!

Click HERE to get your 2 wheeler insurance online with us.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Planning a long road journey at night? Follow these nine safety practices

The city, highways, and the sky above look much more beautiful at night. And, driving alongside the stars and the pleasant winds is a memorable experience. But apart from the nicer part, night time driving is also dangerous. One of the main reasons is the decreased visibility during the night due to the low contrast and the glare of the headlights of vehicles coming from the front.

The probability of a fatal car accident increases three times during the night. When we are exhausted and sleepy, our reaction time is slow, and we cannot think or make any decisions correctly. As a result, our overall spatial and environmental awareness decreases.

Due to the condition and unpredictability of Indian roads and traffic, driving at night is a challenge. Still, if you are planning to take a long road journey at night, follow these 09 safety practices.

1. Driving at a slower speed:

37% of night time road accidents are due to speeding compared to only 21% in the daytime. We advise you to drive at a speed lower than you typically do on the same road in daylight.

2. Drive with someone:

It is always better to drive with someone at night as the two of you can take turns driving every two hours. This way, both will receive some rest, and neither will be too exhausted while driving.

3. Take a nap:

Whenever you start feeling drowsy, pull over and take a nap. Even an hour’s rest will keep you going for the next three to four hours. Ensure that the place you pull over is safe; a restaurant’s parking lot or petrol pump is better than a random spot on the highway. Remember to lock doors and check your surroundings properly.

4. Maintain a safe distance:

It is an essential practice for driving. This becomes even more important during nights because our reaction time and judgment abilities are always lower than in the daytime.

5. Dim the lights:

Avoid using high beams on busy roads as you will only be blinding the other drivers. But in case the lights on the highways are dim, switch to using high beams.

6. Drunk driving:

Drunk driving is illegal; still, many drivers don’t consider it serious. So, even if you do not drink, you are likely to meet many other drunk drivers on your way. Therefore, drive with caution as drunk drivers are likely not to follow signals properly and abruptly stop or switch lanes. Even if it's not your fault, you may have to pay the price. Here, good car insurance can assist you with covering the financial losses.

7. Clean your car:

Focus more on the windscreens and windows as this will increase the visibility. Keep the wipers in proper working condition. Fix any cracks or scratches in the glass as they are likely to scatter light.

8. Be well rested:

If you know that you will be driving at night, it is advisable to rest appropriately the day before. Also, take care of your eyes, wear anti-reflecting glasses to avoid high beams.

9. Eat a light meal:

Having heavy meals will make you feel sleepy and bloated, therefore stick to fruits and vegetables, and stay away from fast food.

Driving at night is not the safest choice but by being alert, sober, and following the practices mentioned above, we can make night journeys safe and convenient for you and other commuters. Also, driving at night does not mean you remain in the dark when it comes to your car insurance. Purchasing ideal car insurance and adhering to traffic laws and driving ethics can assure vehicle safety under all circumstances.

Looking for car insurance? Click HERE to get the best quotes.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Take a look at the seasonal maintenance checklist for your home

Buying a home is probably the most significant investment that someone makes in their life. But how often do we cherish and maintain it? The idea of climbing over roofs and crawling in small spaces to clean and check things does not excite anyone, but it certainly is necessary.

Few things need to be done more regularly than others, such as weekly cleaning your windows and wardrobes. Cleaning the drainage pipes, washrooms, and bathrooms can be done once or twice a month.

If thinking about home maintenance gives you a headache, do not worry. We have created the seasonal maintenance checklist for your home to make things easier for you.

But what are the main things you need to focus on?

• The exterior of your house

• Plumbing and drainage systems

• Electricals

• Security system

• Heating and cooling systems

1. Spring:

'Spring cleaning' is crucial as this is the humid transition period between winter's cold temperatures and upcoming summer heat.

• Check the overall condition of the roof.

• Pour water into floor drains; this will help prevent sewage odours and clean the gutters.

• Schedule your AC for service and replacement of its filter.

2. Summer:

Summer is all about spending time with your friends and family. So, this checklist suggests what you would require to do to prepare for a fun summer holiday.

• Remove dead grasses, lay flower beds, ensure everything looks fresh, and water your garden or house plants regularly.

• Check all the hoses for any wear and tear or leaking issues and fix them immediately if you find any.

• Deep clean the interiors and exteriors of your house, including the driveways and sideways.

• Pest Control during this season is crucial, mainly to prevent mites from damaging your furniture.

3. Monsoon:

Monsoons dominate India’s climate. Indeed, they bring the much-needed water for our crops, but they are also accompanied by strong winds, floods, and power cuts.

• Ensure no stagnant water accumulation as it is the breeding ground for mosquitoes and many other insects.

• Install an effective ventilator to prevent the musty odour from the damp walls and things.

• The constant dampness can cause bugs and fungus on your carpet and rugs so take measures to prevent that.

• A complete waterproofing of walls and ceiling is necessary.

4. Autumn:

The autumn season is the best time to run an overall maintenance check of your home as it is dry, and the temperature is often comfortable.

• Inspect your doors and windows for any cracks, and if there are, get them fixed.

• Check the paint, and if you are planning to paint your house, autumn is the best time.

• To remove the accumulated sediments, clean your water taps, showerheads and water heaters. This will prolong their life and their efficiency.

5. Winter:

Most of us love to be cosy and stay indoors during winters, so it makes sense to focus more on the indoors during this chilly time of the year. But, winter is a season of a few marquee festivals of India, so take this opportunity to keep your home shining. This will even keep you engaged during the cold season.

• A thorough inspection of plumbing is essential. The pipes will likely develop cracks and leaks when the water gets cold.

• Check the heating and air ventilation systems of all appliances.

If you follow this easily doable checklist, you will considerably save your time in maintaining your home in the long run. Not just the maintenance but also the security of your home is equally important. Include a point of home insurance in your checklist for additional protection from unexpected mishaps. Buy home insurance online to get the best deals on your plan. You may even stand a chance to get lower premiums if you have worked upon the security of your home by installing safety equipment and systems.

Click HERE to buy home insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Include these protective measures to keep your business safe from cyber attacks

As per recent statistics, India has got into the top 5 of most cyber-attacked nations globally by recording more than 1.1 million cyber security assaults in the previous year alone. With the corporate industry being a large sector of revenue generation and economy booster in India, assuring digital security becomes a primary concern.

Businesses are a primary target of cybercriminals as they can gain access to clients’ sensitive data and severely compromise it. Data is the new oil, and the industry is valued in trillions. No business can afford the risk of data leaks, living in the internet-driven world where we are surrounded by many mischievous minds known as hackers.

The practical ways that businesses can implement to ensure safety from cyber threats are mentioned below.

1. Set up Firewalls:

It is the initial line or rather a wall of defence against cyber-attacks. It blocks unauthorized access from outside of the organization and blocks people from within the organization from visiting or opening malicious links.

2. Keep your systems up to date:

System updates are crucial as they consist of security patches designed to protect from the latest security threats. Keeping your system up to date will also help in boosting the operational performance and deriving optimum results.

3. Anti-virus software:

Antiviruses identify, block, and respond to harmful software on your system. Even if you use your system carefully to prevent it from malicious software or files, antivirus software is an essential component of a comprehensive security plan.

Antiviruses scan every file on your system and compare it to known viruses and other forms of malware. If it detects a harmful file, it will block the program from executing and avoid the multiplication of viruses to corrupt the system.

4. Virtual Private Network:

Businesses can improve their online security by setting up a Virtual Private Network. A VPN will shield your business' internet traffic from hackers by channelling all of your data via a strongly encrypted tunnel. The initial milestone to hack systems starts with targeting an IP address. As a VPN hides your IP address, Attackers won't be able to take control of your system.

5. Insurance to the rescue:

A public liability insurance policy protects businesses from the impacts of cyberattacks. This includes security for lost revenue resulting from a cyberattack, payments made to hackers to retrieve data, third-party coverage for losses, lawsuit expenses, and fines.

Other Security measures to practice:

• Reduce the collection of personal and sensitive information from clients as much as possible.

• Educate employees about cyber security through assessments.

• Encrypt important data using the best encryptions procedures available in the market.

• Back up your valuable data at regular intervals.

• Don't forget to shield your cloud storage.

While businesses must digitalize to meet the demands of their consumers, at the same time, they must show their preparation for the adverse technologies and the hackers behind them. Despite having all efforts, if a security breach occurs, a public liability insurance policy can offer the cushion that allows the business to survive the crisis.

So, wisely invest in effective antivirus software technology to ensure a safer environment in the working ecosystem.

Click HERE to buy a public liability insurance policy for your business today.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Best tips to improve the mileage of a CNG car to cover more distances

Rising fuel prices have compelled car owners to find practical solutions to improve the mileage. There is a way out; substituting petrol and diesel-run cars with CNG options. With India putting more effort to reduce pollution and fossil fuel consumption, CNG is receiving more consideration as a more affordable and ecological fuel alternative.

But, do CNG cars have an excellent reputation now? It is because of the assumption that these cars do not require much maintenance, which is entirely wrong! Irrespective of the fuel type, all vehicles need proper care to give a better performance. Now the question arises; how exactly do we boost the mileage of our CNG cars?

Here are our best tips to improve the fuel efficiency of your car and cover more distances.

1. Servicing:

This might sound obvious, but many people still fail to do it. Servicing your car on time improves the mileage of the vehicle. If both the engine and the gas kit are appropriately maintained, the car performance goes up.

And just like the car, the fitted CNG kit also requires proper servicing. It does not matter whether your service station installed the CNG kit or the company had already fitted it; regular inspection and servicing are necessary.

2. Inspect for leakage:

When you get a CNG kit fitted locally, there are chances of damage to your vehicle. Also, when the CNG kit gets old or uses local parts, there can be a leakage in the pipe connecting to the cylinder. It may lead to the wastage of gas and a possible reduction in the car's mileage.

To get the best mileage from your car, you should regularly check your vehicle for any leakage issues. This will improve your car's performance and even reduce the chances of any mishaps.

3. Tyre pressure:

This alone can make a huge difference. Always keep your tyres inflated. If you have ever used a bicycle, you know how difficult it is to drag it with a flat tyre. The same concept applies to cars; cars will have to use more power to pull themselves if the tyres do not have sufficient pressure. Here is an extra tip; overinflate your car's tyres a bit, not to the point where they explode but a bit extra than the company specifications. Here is why; tyres will never be perfectly round in shape. They always squish a little at the bottom to create a flat contact patch with the ground, and more the air, less the area of the contact patch. This will make the car move quickly.

The mileage of a CNG car is approximately two times more than that of a petrol car, and by following the above tips, you can upgrade it to a better level. Don’t wait to refuel the gas until the indicator drops to the empty sign. Driving with less gas in the tank can affect the mileage.

Only improving the car's mileage is not enough to cover more miles. Another thing to consider about CNG cars is their maintenance and repair cost in case of an accident. Therefore, you require additional protection by purchasing insurance. Check out Magma HDI’s online car insurance and make your journeys stress-free and financially safe against adverse situations.

Buying a new car? Click HERE to get the online car insurance quotes.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Best ways to clean the foggy headlights for improved visibility

Have you experienced dull headlights of your vehicle during your journey in the night? Your vehicle headlights get faded over time, and they appear unappealing and significantly decrease the light output. The protective layer on the headlight wears off due to the Ultraviolet radiation from the sun, dust particles in the air, and even the heat generated by the headlight bulb.

You might consider purchasing a new pair of headlights in such a situation. This, however, would be a costly affair. There are solutions by which you can clean those hazy headlights without buying a whole new set or even replacing them. Here are some ways you can fix the foggy headlights issue.

1. Cleaning the vehicle's headlights with a toothpaste:

Here's how you can do it.

• Initially, moisten the headlamp with some water to allow the toothpaste to distribute evenly on the surface.

• Apply a layer of regular toothpaste on the headlight and rub it using a toothbrush or your finger. Gently rub it for a few minutes.

• Keep the toothpaste for around 10 minutes.

• Then, it's time to clean the toothpaste.

• Use a paper towel or a microfiber cloth to wipe. And you’re done.

• To wrap things up, apply a coating of vehicle wax to ensure that the headlights remain clean for an extended period.

2. Using Vinegar and Baking soda:

• Dust off the headlights.

• Dilute some vinegar with water and spray it on the headlights.

• Wipe off the solution using a microfiber cloth or paper towel.

• Mix vinegar with baking soda in the proportion of 2:1 (2 for vinegar and 1 for baking soda)

• Begin rubbing this solution onto your headlights. Wipe in circular movements with a clean cloth until you get the desired results.

• Once finished, clean the headlight using a wet sponge and apply vehicle wax.

3. Using carbonated soft drink:

Surprisingly, this hack works!

• Wipe the headlight using a wet cloth.

• Spray the carbonated drink onto the headlights.

• Let it rest for around 10 minutes.

• Wipe it off with a sponge and later rinse it with water.

• You may not get the desired results in one attempt. This process is time-taking and reflects its results late, so repeat the process until satisfied.

• Apply vehicle wax.

These were some quick DIYs for your foggy headlights. And, if done correctly, you’ll observe optimum results by saving a considerable amount of money.

But, there are specific detergents and products available for this purpose in the market to give you more detailed results. If you're not satisfied with these home remedies, choose an off-the-shelf product to clean your headlamps. You must maintain your headlights in good and shining condition because they ensure clear vision during the darker hours of the day and even signal an approaching vehicle while overtaking.

Despite all these DIYs, if the headlights’ situation appears severe, then visit the automobile mechanic to replace them altogether. Your motor insurance company in India mostly covers the cost of servicing and replacements. So, don't bother making payments out of your pocket. Instead, contact your insurer and inform them regarding the repairs, and you will indeed receive help.

Click HERE to browse through the motor insurance plans.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Best tips to prepare your cargo to be shipped safely

Correct packaging is the most crucial part to ensure your package arrives at its destination in the best condition. As of today, over 90% of global cargo shipping takes place via the waterways. Goods are damaged every day as a result of poor packaging and lack of shipping knowledge.

Cargo comes in various sizes and forms, and there is more careful packaging required for damage-free shipping. It might feel overwhelming, but we can help you choose the best packaging for your products. With this guide, you'll be able to secure your items as they go through the challenging shipping procedure.

1. Identify the nature of the cargo:

Foremost, separate the delicate and sturdy items from each other. Make sure you bubble wrap all the fragile items adequately before putting them into the package. If the shipment involves liquid items, keep them in a leak-proof and spill-proof container. Leave the sturdy items for the last; they require the least amount of cushioning among all.

2. Go for heavy-duty boxes:

Protect your cargo with as much coverage as possible by using robust, thick boxes that will not burst open during shipment. Thick boxes offer an additional degree of protection not present in standard shipment boxes. If you're not satisfied with one box, add another box to make it two times stronger by layering your package.

3. Choosing the proper cushioning:

A proper cushion will protect your cargo against shock, vibration, dents, or distortion. Cushioning comes in various forms such as paper filling, corrugated board pads, foam & bubble wrap, to name a few. Keep in mind these few pointers while selecting the cushioning material:

• Cargo sensitivity

• Transport-related stressors

• The cushioning material's stress range

*Pro-tip: After packing the box, give it a firm shake. If you hear articles are moving around inside the box, your package needs extra cushioning.

4. Tape the box well:

Cover your package with strong tapes that can hold all the folded ends of the box in place and prevent it from opening up during the shipping process.

5. Make your boxes water resistant:

Even if the shipping goes successful, unexpected wet conditions during loading and unloading at the docks could damage the cargo. Protect your boxes from such situations by shrink-wrapping them.

6. Label the boxes:

Proper labelling aids in the seamless operation of shipping. From sorting to timely delivery, label your package accurately. For example, if the box contains fragile items, mention it on the box with 'This side up' label to guide the carriers to keep the side of your box upwards.

7. Insure your cargo:

There is always the possibility that your package might get damaged during shipment. The carrier could be exempt from liability for cargo damage or loss under the law to worsen the situation. This is where marine insurance protects your package. If you insure the goods under marine insurance, it will protect them against all unavoidable losses during the shipping process.

As a shipper, you have various options for ensuring that your goods arrive at their destination in the best possible shape. Always select a reputable carrier, pack your cargo with the utmost care, offer detailed handling instructions and secure it with marine insurance so that your valuables get delivered unaltered.

Click HERE to know about the best marine insurance plans.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Everything you need to know before starting a retail business

The retail business in India has evolved amongst the most diverse and fast-paced businesses in the world. As per the FDI confidence index, India is the world's fifth-largest player in the retail sector. It is a highly competitive section that needs a lot of planning, because, with so much competition, one decision can easily make or break your business.

Starting your retail business is exciting but also challenging at the same time. From ensuring the correct products to giving good after-sales service, every bit counts. For this occasion, Seth Godin correctly said, "The only thing worse than starting something and failing is not starting something." So, to help you succeed in your venture, we've put down some key aspects to look after.

These key points help you establish your business and flourish in the long run.

1. Research has the most prominent role in the success:

You must research to understand better your target market and the type of customers you want to attract. Along with that, it is also crucial to determine whether the product you're trying to sell has any demand. It will also assist you in choosing the best possible location for your business based on demographics. Above all, good research and market analysis will give you an edge over all the competitors.

2. Manage your capital smartly:

Managing your capital will help you sustain your business plan. Setting up a current bank account is not enough. Your budgeting, finances, cash flow, payments, and invoicing are of utmost importance too. Consider having a good accounting software. It is fast, reliable, and more accessible than physically maintaining records.

3. Market your business correctly:

People love unique things and creative ideas. When you have an identity and design for your store, you stand out. Market your venture in a way that makes your brand feel appealing. Apart from traditional forms of marketing, use the digital marketing, social media and online campaigns to promote your store on internet. Set up a website, put email marketing in action, and watch your business flourish and your customers multiply.

*Pro-tip - Your in-store design, & layout play a significant role in attracting more customers.

4. Abide by the law:

There are numerous legal obligations you need to follow while setting up your business. Consulting a legal professional or a business counsel to determine which laws you must comply with, is always recommended.

5. Protect your business:

You need to be ready for unforeseen circumstances; there are various ways to protect your venture, one of the most crucial is insurance. Having the correct insurance can assist in safeguarding your company, consumers, and money. The type that businesses go for is public liability insurance. Magma HDI provides you with the best public liability insurance in India, so ensure that you make a wise decision and protect your new business with financial safety.

To wrap up, consider all aspects mentioned above to help you in your approach to a new start. Don't forget your objectives and goals, as it gives you a direction to figure out ways to operate your business successfully. So, keep the grind going on, and make your dream business bring you fortunes.

Click HERE to know more about public liability insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Facts about dry van shipping you need to know before starting a shipping business

Dry vans are the most preferred shipment method used for transportation. There are various advantages and benefits of dry van shipping, and you can use it to transport different products safely. Dry vans are preferred so much because they are completely enclosed on all sides, assuring safety to their contents.

If you are thinking of establishing a shipping business, dry vans are an excellent start for you. They are a popular choice in the shipping industry. Other than that, it is easier to buy online motor insurance for dry vans than loggers or tankers. Buying insurance not only protects you and your vehicle from damages but also covers legal liability for injuries caused to other drivers. Let's have a look at a few facts about dry van shipping.

1. They are versatile:

One of the best things about dry vans is their versatility. Dry vans are fully enclosed and come in various sizes. They are suitable for shipping anything to everything, such as non-perishable foods and beverages, household goods, clothing, textile items, plastic, and building products.

2. Favourites of freight transportation:

Dry vans are the most common, popular, and demanded freight transportation in the shipment industry. These vans look like boxes on wheels and have no temperature control. Therefore, goods that are temperature-insensitive can be quickly shipped using dry vans.

3. They offer protection to the goods:

Dry vans are entirely enclosed from all sides. This feature protects the goods from bad weather, such as rain, snow, or direct sunlight. In addition, the goods stay packed inside and safe from damage due to extreme climatic conditions or rough physical jerks. Dry vans are also theft-proof. This is why they are frequently used vehicles in the shipping business. Freight claims are also usually low in the case of dry vans.

4. They have hardwood flooring:

Dry vans today usually have a hardwood floor which is subject to damage. Wood is vulnerable to moisture that may come from freight or through open doors. This is a sensitive issue, but taking preventative measures and keeping up with the vehicle’s maintenance can help prevent damage to the floor.

5. High demand for dry vans:

These trailers are particularly widespread, but demand remains high, resulting in restrictions. In addition, due to the significant development of the retail sector, shippers have had much more products available, creating more demand for dry vans in recent years.

6. Dry vans are not suitable for perishable items:

If you want to ship food items or liquids that require refrigeration, you will essentially require this addition to your truck. Dry vans do not usually ship perishable or temperature-sensitive items, and you need to customize the carriers by installing refrigeration systems.

7. They have a maximum length limit:

You can find dry van trailers in various sizes. However, the maximum length allowed on the road is 53 feet. A dry van can carry up to 45,000 pounds of cargo at once.

Dry van shipping is worth all the hype it has created over the years as it is one of the world's most dependable, convenient, and cost-effective modes of transportation. If you choose dry van transportation, you can assure that your shipment will arrive at its destination safely and securely.

However, as a responsible business owner, you must opt for insurance to increase protection for your shipment business. Motor insurance is best suited for dry van trailers as they go off for shipping. With bare minimum effort, you can buy online motor insurance and get a cover for your dry van.

Purchase your online motor insurance HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Child nutrition: Are you feeding your toddler in the right way?

Toddler years are the most crucial milestones in your kid's life that emphasize utmost transformation, growth, and development. The child begins to consume table food and adopt new tastes and textures in 1-3 years. And once your baby imbibes these habits, the importance of a healthy diet comes into play.

A good diet provides them with the nutrients they require for overall health, energy to play, move about, and participate in the growth and development of their body. Feeding your newborn with just breast milk is acceptable for the first six months or a year, but now it is time for your kid to start absorbing what they need from a range of meals.

Here are a few pieces of advice to get you started with feeding your child the right way.

What should a toddler eat?

Offering your child a range of meals from each food category with diverse tastes, textures, and colours is the best idea to come up with. A regular meal and snacking schedule might benefit your child in developing good eating habits. Try to follow a pattern for feeding them around the same time each day. Give your youngster 3 modest meals, plus a couple of snacks, but a healthy one, within every two or three hours.

What is the recommended amount of food for a toddler?

Every kid is unique, and the quantity of food they require varies according to their age, activity level, pace of growth, and appetite. Your child's appetite may fluctuate daily. The mood, health, time of day, and food supplied to your child can all influence their diet. It is all based on averages in nutrition, so don't worry if you don't meet the target every day. Instead, focus on providing a broad range of nutrients in your child's diet every time. Begin by serving tiny portions of food at meals and snacks, and then allow them to crave for more.

What to avoid feeding toddlers?

Examine and avoid food items they have an allergic reaction. Also, be careful with the food items that can choke them. Always chop the food items into tiny pieces and keep an eye on them as they eat. Avoid greasy, complex, and sticky foods especially.

Whole grapes, vast portions of meat, chicken, and hot dogs, as well as candies and cough drops, are all slippery meals. Nuts, seeds, popcorn, chips, raw carrots, and raisins are small, hard foods. Peanut butter and marshmallows are sticky foods. You need to acquaint yourself with the proper knowledge of food categories and how those categories will benefit your toddler.

Being constantly concerned for your child is quite natural. Every parent ensures to provide their kid with the best things available. With some excellent guidance, it can ease a bit. Model some good eating habits and let your child see you and follow them. However, due to undetected disorders, a kid may not consume the proper diet. If you're still distressed that your child isn't consuming a balanced diet, consult a doctor.

Don’t forget to cover your toddler with the benefits of health insurance. You no longer have to wait 18 whole years to get health insurance cover for your children. All it requires is to look up online health insurance that covers the entire family and children, and you’ll be flashed with multiple Children Health Insurance Program (CHIP). Choose the policy that suits the best for your child’s requirements.

To look for online health insurance, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Celebrating the glorious 75 years of Independence – Azadi ka Amrit Mahotsav

The tales of our brave freedom fighters and their over-the-line selfless deeds are always an inspiration to the whole nation. One can never entirely express gratitude for their sacrifices for our nation’s independence from the British Raj. As we get farther from the year 1947, our gratefulness only grows more and more. This year on March 12th, in honour of our 75th Independence Day celebration, the Government of India started a national initiative to celebrate the glorious years of freedom – “Azadi Ka Amrit Mahotsav”.

This campaign is an attempt to cherish the relentless work of the citizens who contributed to India's evolutionary path to success and prosperity. This movement carries the ability to allow the vision of unleashing India 2.0, driven by the ethos of Atmanirbhar Bharat, a seed sown that is now a tree and bearing fruits. The campaign starts precisely 75 weeks before our 75th Independence Day that falls on 15 August 2023.

The main objective of this campaign is to hold a series of events to celebrate the success of Atmanirbhar Bharat in all sectors nationwide. India has marked its supremacy in Technology, Governance, Development, and Reformation through unmatched efforts empowering it to be a global superpower soon.

Several socio-cultural programs are conducted in conjunction with the Amrit Festival of Independence. These programs shall run on regional and state levels for educational and cultural aspects aiming to positively influence the lives of Indians and foster the development of India on a global scale. Various states and institutions have shown their enthusiastic participation in the campaign in multiple ways, including a 350 km run for defence staff members, an ITBP cycle rally, various exhibitions, and many more.

Another significant move towards the campaign was launching a mobile app this November. The Government of India unveiled the Azadi Ka Amrit Mahotsav app to provide a single source of all information pertaining to India's 75th-anniversary festivities. The app is accessible for all smartphone users and contains information on the AKAM-sponsored happenings. According to a statement released by the ministry of culture, the main page allows users to overview the app's unique and diverse content. This app is a digital library of wonderful experiences showcasing various sections, from highlighting the inspiring stories of our unsung heroes to embracing the noteworthy achievements made by our country.

The effort taken by the government to acknowledge the courage of our warriors will surely warm our hearts. This campaign displays a strong message to the world about the spirit of Indians and embarks on the splendorous journey of India from battling for independence to celebrating it. With such a strong nationwide initiative, the least we can do is play our part in it. So, let’s drench our hearts with patriotism and come together as one big family to contributing to the Mahotsav in any possible way. The entire nation is looking forward to unbinding the future of the new India- India 2.0! Jai Hind!

5 Best riding destination in Mumbai!

With the rain slowly subsiding and the roads getting clearer, Mumbaikars can finally get on their bike for a nice, pleasant ride. Now, you can finally say goodbye to the cloud-laden sky, dust off your bike, and hit the road for some hot cutting chai as you delve into the sceneries that your trip is going to offer. So without further ado, let’s look at the five best riding destinations in Mumbai. However, before you set out on your ride, make sure that you have access to the best two-wheeler insurance in India so that you can stay out of legal trouble.

1. Durshet

Durshet is located 64 kilometers from Mumbai and is known for its jungle safari and water sports. It’s hidden well in the laps of the Sahyadri mountain range and is covered in lush greenery. While you are here, you can take a dip into the shimmering cold water of the Amba river to refresh your senses. If you are someone who finds pleasure in visiting holy sites, then there are several temples around for a good morning walk that will fill you with a sense of devotion — the astounding nature only adds up to the serenity of this place.

2. Mulshi Dam

This dam is located 127 kilometers from Mumbai and is known for its several forts. It is a perfect place to get your camera out and click some amazing pictures that will decorate your gallery. The dam, which is constructed on the Mila river, works as a hydroelectric plant. The monsoon is particularly a good time to visit this place as you can see the river at its full flow while the mist fills the atmosphere, mesmerizing you with its beauty.

3. Malshej Ghat

Located serenely in the Sahyadri range, the Malshej Ghat is located at a distance of 154 kilometers from Mumbai. A bike ride here will offer you the naturally decorated view of lakes and valleys. It has some unique flowers that will make you take your camera, and perhaps never put it back. During the rainy season, you can even spot a few flamingoes perching, feeding themselves. It is a must-visit if you are into trekking, bird-watching, and hiking.

4. Vihigaon Waterfalls