General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

Why is wearing a seatbelt during a ride always a good habit

Road accidents in India are estimated at around 2 Lakhs per year, the highest in the world. This mainly happens as people fail to follow traffic rules, over-speeding their vehicles, and also the poor road conditions.

The government of India has set a few stringent rules and regulations for drivers. They are made to bring down the number of injuries and accidents. Wearing a seat belt is one of the essential practices of road safety that save lives in case of a crash. However, most people tend to ignore this simple yet crucial safety measure. They find it uncomfortable, unnecessary, and bothersome. This has caused many people to compromise their safety and surrender to a life-threatening event.

This article will briefly describe the various advantages of wearing a seat belt.

1. Holds you in one position:

You can undergo substantial damage if your car is moving at a great speed, and you suddenly crash. Without a seat belt, you can be thrown here and there. You can even jerk out of the car if the speed and collision impact is too high. It can result in severe injuries and even death. Hence, the seatbelt is extremely important.

If the car starts spinning or skidding, the seat belt will hold you firm in one place. If you do not buckle up, you are likely to get into a crash.

2. Restricts ejection:

As discussed earlier, if your car is moving at high speed, you are likely to be ejected out of the vehicle. It has happened a lot of times during car crashes or accidents. It happens mostly because the driver and passenger are not wearing seat belts. This causes them to lose control of their positions. Therefore, they are ejected out of the car.

With a seat belt, you will be firmly tied to your seat. This increases your chances of survival during an accident as the airbags will bear the impact, keeping you safe.

3. Matches the speed of the vehicle:

In general physics, our body tends to move with the speed of the vehicle. For instance, your body would do the same if the vehicle is at high speed and comes to a jolt. You are likely to hit the steering wheel or dashboard in this situation. If you're buckled up, this will not happen. It will keep you secured to your seat so that your body slows down with the vehicle. Seatbelts help you to adapt to varying speeds.

4. Force distribution:

With the seatbelt, the force of a crash is distributed to the stronger parts of your body. You will not be restricted to delicate areas like the head, abdomen, or chest. Your body will be prepared better to deal with a crash with a seatbelt. The chances of injury also decrease.

5. Protects your brain and spinal cord:

A car crash is most likely to cause brain and spinal cord injuries. This can affect you significantly and cause irreparable damage like temporary or permanent disabilities. They can even be fatal. A seatbelt protects you from these life-threatening car crashes.

Most road accidents take place with people not wearing their seat belts. Many lives could be saved if we agreed to follow all road safety rules. It is best practice to buckle up the seatbelt before starting your car. Avoid overspeeding and ensure that the seatbelt is accurately fitting and neither too loose nor too tight. Safety is paramount, and the next step to ensuring it is insurance. You should buy motor insurance online to protect your vehicle from any potential damages. Keep the stress of finances at bay and enjoy an array of benefits if you decide to equip your plan with various add-ons.

Click HERE to buy motor insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

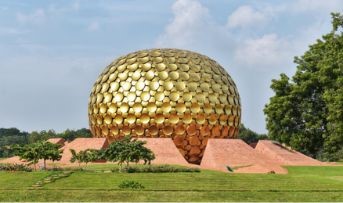

Auroville: An experiential township you must visit at least once!

India has many diverse places you can visit with friends and family to unwind and revitalise yourself after months of excessive work-life. These places always give you a fresh perspective and mesmerise you with renewed zeal.

One such prominent place is– Auroville in Pondicherry. It was founded in 1968 by Mirra Alfassa and continues to be one of Pondicherry's most popular places to visit. It is an experimental township where people of all nationalities, castes, races, creeds, and religions live together peacefully.

Auroville is spread over a wide area and was constructed by the famous architect Roger Anger. The structures present inside the premises of Auroville are rare, magnificent, and unique. Every nook and corner of this place elicits only peace and serenity. If you're looking for a place to find inner peace, consider spending a few days in Auroville.

Before you embark on your journey, you should opt for the best personal accident policy in India to ensure safety during your journey.

Here's a list of the best places to visit in Auroville.

1. Matrimandir

Matrimandir is one of the most renowned and beautiful places in Auroville. The temple consists of a golden dome that is made of petal-like structures. It is huge yet beautiful in every possible way. This temple is not dedicated to the preaching of just one religion. It is for anyone and everyone who is seeking moments of inner peace. You can visit the temple and see the chambers to meditate and find solace.

2. Quiet Healing Centre

If you love pampering yourself with relaxing massage and spa sessions, this is your go-to place in Auroville. This healing centre was inaugurated in 1997. It provides a stunning ocean backdrop and gives you ample ways to relax. You can indulge in Thai, Shiatsu, and deep tissue massage. The main aim of this place is to soothe your mind and body.

3. Botanical gardens

If you love plants, then this is your place to be. Different species of plants will surround you. A green blanket of bushes and trees will captivate your senses in this serene place. About 250 different species of plants can be found here. You can simply relax or stroll through them. There is also an educational centre nearby. You can explore it to get intriguing information.

4. Savitri Bhawan

Named after one of the most famous poems of Sri Aurobindo, the Savitri Bhawan features the teachings of Aurobindo. There are various ancient and modern paintings that you can witness here. The walls here are adorned with paintings that display the poetic lines of Sri Aurobindo. There is also a reading room with various books projecting his view on life. This place is a paradise for literature lovers.

5. Adishakti laboratory for theatre arts and research

If you are a theatre enthusiast, this place will appeal to you. You can catch some experienced actors performing here. Many workshops on theatre and acting are regularly held here. You can get some advice from the actors and enjoy valuable insights into acting.

There are many places to visit and explore in Auroville. This exceptional township is an embodiment of unity, integrity, and brotherhood. You need to visit it once in your life to witness this beauty for yourself. Whenever you plan to travel, ensure that you buy the best personal accident policy in India. Accidents come unannounced. Hence you need to be prepared. Invest in the best personal accident policy in India and prepare to enjoy your stress-free trip!

Click HERE to buy the best personal accident policy in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Why are preventive health check-ups offered by health insurance important

In the olden days, people unintentionally practised habits like following a set sleep schedule, eating locally sourced nutritious food, and engaging in physical activity, which are fundamental requirements for good health. Over time, we have grown to chase material wealth and forsaken our health in such pursuits. Hectic schedules, lack of time for personal interests, and excessive stress characterise modern lifestyles.

In such a background, it is almost impossible to follow healthy habits that lead to a disease-free life. This makes buying health insurance and following preventive measures essential to keep one’s health in the best condition possible. Additionally, periodic checks can help one recognise symptoms of an incoming illness and take corrective action at the earliest. This is facilitated by preventive health checkups, which are now included in health insurance plans. They provide several benefits to policyholders, which are discussed below.

Defining preventive health check-ups under health insurance.

Preventive health checkups are medical examinations run on to-be policyholders to assess their present state of health and identify their level of risk. It is an essential part of the insurance process as it makes the insurer aware of the existing illnesses suffered by the customer. The risk assessment directly impacts the annual premium paid for health insurance coverage.

Benefits of preventive health check-ups.

The above definition often puts potential health insurance buyers in a dilemma regarding their stance on the preventive health checkups offered. Detection of pre-existing medical conditions results in pricier premiums, but the checkup is highly beneficial to policyholders in multiple ways.

1. Substitutes individualistic effort:

Even when you are not sick, getting a health checkup is a prudent way to ensure that you are in the pink of health. Generally, a full-body annual health check is recommended for everyone. By purchasing health insurance, you no longer have to book an external appointment with a clinic. The insurance company takes care of the appointments and delivers the reports straight to your doorstep. Insurers even offer doorstep health checks, making the process incredibly convenient and hassle-free.

2. Early detection of diseases:

While the detection of disease increases the health insurance premium, on the bright side, it discovers an underlying problem that would otherwise have gone unnoticed and eventually led to more significant financial stress and physical discomfort. It is better to pay extra after early diagnosis and undergo treatment than bear the massive cost of a preventable illness that you neglected.

3. Tax deductions:

The Income Tax Act 1961 provides certain deductions that can be subtracted from your total gross income to arrive at the gross taxable income. One such deduction under Section 80D is preventive health check-ups.

Most insurance companies include free health checkups in their health insurance policy. However, in the case of non-inclusive health checkups, you can claim a deduction of INR 5,000 for medical checkups for yourself and your direct dependents, including your children, spouse, and parents. The Act also allows a deduction for health insurance premiums paid in the financial year of up to INR 25,000 for non-senior citizens and INR 50,00 for senior citizens.

4. Increases interest in self wellbeing:

Seeing the results of a health checkup is no short of a reality check. It can help you break poor habits, adopt a healthier lifestyle and work towards a more robust version of yourself. An additional incentive is a link between your health and premiums. Increasing premiums due to ill health is a great motivator to refocus your efforts towards building a healthy lifestyle and reducing the risk of diseases.

Preventive health checkups are a boon in the guise of a preliminary check that helps health insurance providers assess the risk of potential clients. These checks facilitate the early detection of potentially life-threatening ailments and provide appropriate facilities to take care of the problem at the earliest. While health insurance offers several benefits, including a safety net in medical emergencies, preventive health checkups are a perk you should take advantage of!

Click HERE to buy the best health insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here are a few myths you need to know about public liability insurance

Public liability insurance in India is a kind of insurance that aims to shield business owners from claims that lead to legal actions. It protects you if a customer or general public claims that your business activities caused them to suffer an injury or property damage. A policy will pay for these costs, which may include any compensation you are required to pay if a claim does end up going to court.

More about public liability insurance in India:

The public liability insurance policy covers the insured's legal obligation to pay third parties for unintentional death, physical injury, disease, and loss of or property damage. Subject to the limitations of indemnity and other terms, conditions, and exceptions of the policy, it covers the financial claims filed against the insured during the policy period, including legal fees and expenditures spent with the prior agreement of Insurers.

A few important points to remember:

● No culpability is acknowledged

● Claims filed more than five years after the incident won't be considered

Myths about public liability insurance:

1. Professional assistance and counsel are covered:

It's common to mix up professional indemnity insurance with public liability insurance. Public liability in India covers the costs related to unintentional damage and injuries. In contrast, professional indemnity protects against claims from professional negligence in business services and advice.

2. If you are sued, you can close the company:

If you own a small business, closing it won't make the case go away if you are proven legally responsible for someone getting hurt or something getting broken. The lone proprietor will be held personally liable indefinitely for any claims brought against a small business. Even while persons who run a limited company can close their company, they will still need to deal with any legal actions brought against them. Only a public liability insurance policy will be useful in these circumstances.

3. The purchase of public liability insurance is mandatory:

Businesses are not obligated by law to buy public liability coverage. However, it would be crucial to buy this coverage if you want to shield your company from having to pay out astronomical sums in claims. While performing their duties, your personnel may harm people or damage someone else's property. Businesses operating in public areas or on clients' property need this insurance policy. Get a public liability insurance quote if you need to figure out how much it will cost.

4. Loss is compensated through public liability insurance:

That's only partially accurate. Public liability insurance in India does not cover pure monetary loss. Therefore, a third party cannot demand reimbursement for the monetary damage they have sustained due to a service provider's acts.

5. Every time you sign a new contract, you'll need new insurance:

Most of the time, firms only have a single policy to cover all the contracts and projects they take on. However, for public liability insurance, when a new contract entails significant risk or is substantial, buying new insurance can be required rather than renewing an existing one. Almost every public liability insurance in India has flexible coverage options.

This simplifies adding new features when the company expands or takes on new jobs. This will be practical and guarantee that your business needs are addressed. Working with trustworthy and renowned insurance providers is essential when looking for insurance coverage to safeguard your small business. Your business can benefit from having the best public liability insurance in India.

Click HERE to learn more about public liability insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.