General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

The role of general insurance in disaster recovery and mitigation

Natural calamities are very uncertain and the worst nightmare for everyone. In recent years, natural disasters such as earthquakes, floods, cyclones, hurricanes, etc., have been rising globally and scarring the economy and the people. Seeing the destruction and trauma, everyone wants to insure themselves and their assets for financial assistance and mitigations after such an unforeseen and miserable disaster.

While life insurance protects your life and offers financial aid to your loved ones when you are no longer around, general insurance is crucial to reducing the risk of natural disasters and other emergencies. You can insure your assets with general insurance and get assistance to prevent negative economic hardship after a calamity. General insurance can also speed recovery by offering post-disaster liquidity and funding after the disaster.

What role does general insurance play in disaster recovery?

It is a common misunderstanding that natural disasters are rare and one does not need to insure their assets. In recent years, the frequency of earthquakes has been increasing and impacting the whole economy. Home insurance can save you from unpredictable future losses if you live in an earthquake-prone area. The financial losses after natural calamities continue to rise, generating significant financial risk. However, if you have general insurance, it can significantly reduce the financial burden, and you can get a considerable amount to rebuild or recover the property damage.

General insurance safeguards your property and can help you to get immediate assistance from the insurance company to overcome your financial need. The insurance company will reimburse the damages and losses incurred during the disaster and protect you from undesirable situations. Moreover, general insurance not only covers earthquakes but it covers all-natural calamities such as floods, hail, fire, storm, lightning, and hurricane, which cause extensive damage to your home. Thus, it is a worthwhile investment that keeps you financially and mentally sound.

Coverage of general insurance under disaster

General insurance covers the costs of hazards due to unfortunate events for the insured assets. Two types of general insurance covers allow protection against natural disasters: the home insurance policy and motor insurance. Both types of insurance policies are for the protection of assets.

A reliable insurance policy offers recovery for various damages such as damaged electric wires or lines, structure damage, water pipeline damage, broken doors, walls, and physical damage to the vehicle. These insurances cover:

● Exterior damage of the property costs

● Interior damage of the property expenses

● Coverage for physical injuries that may occur during the event while on the damaged property

● Damage or loss of personal assets or belonging from a property

● Cover losses to the vehicle involved in a collision

● Cost for the non-collision physical damage to the vehicle if damages in windshields break, storm, etc.

General insurance policies may vary according to the coverage they offer depending on certain factors and also the coverage you choose. The coverage may differ according to the size, type, location, value, cost of belongings, and age of the property.

Natural disasters are terrifying and cause heavy losses to the affected individuals and their assets. However, a general insurance policy is the right choice to protect your property against such losses. You can easily buy general insurance online in a few minutes without going outside at an affordable price and exciting offers. Browse through different policies, shortlist your options, and after the comparison, you can come to a final decision.

Click HERE to buy general insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Unsure of how to maintain your motorcycle helmet shield? Here’s all you need to know

A good helmet is an essential motorcycle accessory for your safety. It protects your head from severe injuries in an accident and can be a lifesaver. The helmet cushioning makes your ride comfortable, especially on a long drive. Moreover, you can also use it to add to your style statement.

A good motorcycle helmet shield is a must feature in a helmet. You should maintain your motorcycle helmet shield to extend the helmet's life and ensure clear vision. Let us discuss how to maintain a motorcycle helmet shield.

1. Cleaning:

The first step to maintaining our motorcycle helmet shield is regularly cleaning it. A dirty shield can obstruct your vision and invite an accident. In most cases, regular glass cleaners can do the job for you. Spray some glass cleaner on the shield, and use a soft and clean cloth to rub the shield's surface. It will remove the dirt from the surface and make your shield spotless.

2. Films and sprays:

Films for helmet shields are easily available at any motorcycle accessories shop. You can customise it according to the size of your helmet shield. It will create a barrier between rain and your shield and help to drip it off quickly. Moreover, you can put a film of any colour of your choice and make your helmet look cool and fancy.

Similarly, several sprays available in the market can be used for the same purpose. Anti-fog sprays are also available, which you can use from the inside of your helmet shield. They do not allow condensation to build up during the cold weather and help in clear vision. Films and sprays also protect your helmet shield from scratches and damage.

Ensure you do not keep your helmet shield up while riding through dusty passages, as it will ruin the effect of anti-fog spray and hamper your vision.

3. Wax:

Buy a good quality wax that can be applied on a helmet shield. Rub it on the surface, and use a soft, clean cloth to add shine to your motorcycle helmet shield. Wax can be effective in adding shine to your helmet shield while protecting it from scratches as well.

4. Keep distance:

Keep some distance from the vehicle in front of you while riding your motorcycle, especially at high speeds. This will ensure you are not bombarded with small stones and dust from their tyres. It will keep your helmet shield safe and secure. It will not crack, nor will scratches appear on its surface.

5. Keep your helmet safe:

Always ensure that your helmet does not fall from wherever you keep it. This applies to both home and outside. Also, avoid keeping it on the seat, mirrors, or handlebar, even if you are away for a few minutes. A fall can break your helmet shield or add scratches to it. Install a helmet hook on your bike and use it to hold your helmet while you are away.

A clean and shining helmet shield is a must while riding a motorcycle. A dirty helmet shield is a big no-no. It can hamper your vision and can cause serious accidents. Moreover, it will spoil your style and looks. When we talk about riding safety, two-wheeler insurance protects you and your motorcycle against damages and accidents, similar to a motorcycle helmet shield. Compare hundreds of options, and buy the two wheeler insurance online that fits your needs and budget. It will provide you with complete protection and financial assistance if your motorcycle is stolen or damaged.

Click HERE to buy two wheeler insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

The importance of hydration: How much water should you drink?

Staying hydrated is crucial to maintaining good health, but how much water should you drink daily? People often ask this question to ensure they are doing everything to stay healthy and avoid costly medical expenses.

Here, we will explore the importance of hydration and how much water you should drink daily.

How much water should you drink each day?

The amount of water you should drink daily depends on several factors, including age, gender, weight, activity level, and climate. The Institute of Medicine (IOM) recommends that men drink about 3.7 liters (125 ounces) of water per day and women drink about 2.7 liters (91 ounces) of water per day. However, this recommendation includes water from all sources, including food and beverages, not just pure water.

A general rule of thumb is to drink at least eight glasses of water daily, but more is needed for everyone. If you are physically active or live in a hot climate, you may need to drink more water to stay properly hydrated. You may also need to drink more water if you are pregnant or breastfeeding.

Tips for staying hydrated

Staying hydrated doesn't just mean drinking water. It also means consuming foods that contain water, such as fruits and vegetables. Here are some tips for staying hydrated:

● Carry a water bottle with you wherever you go, and sip on it throughout the day

● Drink water before, during, and after exercise to replace fluids lost through sweat

● Eat water-rich foods, such as watermelon, cucumber, and tomatoes

● Avoid sugary drinks, which can actually dehydrate you

● Pay attention to your body's thirst cues; if you're thirsty, drink water

● If you don't like plain water, try adding lemon or cucumber slices for flavour

Importance of hydration for health insurance in India Staying hydrated is essential for good health. Water helps regulate body temperature, lubricate joints, protect organs and tissues, and transport nutrients. It also helps to flush toxins out of the body, which is important for maintaining healthy skin and preventing illness.

For people concerned about health insurance in India, staying hydrated is particularly important. India has a high rate of water-borne diseases, and dehydration can increase the risk of infection. In addition, many health insurance policies do not cover the hospitalisation cost for preventable illnesses, such as those caused by dehydration.

Hydration and health conditions

Staying properly hydrated is important for everyone, but it can be especially crucial for individuals with certain health conditions. Here are a few examples:

1. Kidney disease: People with kidney disease may need to limit their fluid intake to avoid overloading their kidneys. However, it's still important to consume enough fluids to stay hydrated. Sometimes, healthcare providers may recommend a specific daily fluid intake for individuals with kidney disease.

2. Diabetes: People with diabetes may be at higher risk of dehydration due to increased urination caused by high blood sugar levels. Monitoring blood sugar levels and staying properly hydrated can help manage diabetes symptoms and reduce the risk of complications.

3. Heart disease: Certain medications used to treat heart disease can increase urine output and lead to dehydration. It's important to stay hydrated if you're taking these medications, but you should also talk to your healthcare provider about any specific hydration needs.

4. Cancer: Some cancer treatments, such as chemotherapy, can cause dehydration as a side effect. Staying hydrated during cancer treatment can help manage side effects and improve overall well-being.

If you have a health condition affecting your hydration needs, talking to your healthcare provider about staying hydrated is important. They may be able to provide specific recommendations for fluid intake based on your individual needs.

Additionally, certain medications can affect hydration levels, so it's important to talk to your healthcare provider about any medications you're taking and how they may affect your hydration needs. They may recommend adjusting your fluid intake or taking other steps to maintain proper hydration levels.

Staying hydrated is crucial for good health, and drinking enough water daily can be magical. Additionally, for people concerned about their health insurance in India, staying hydrated can help prevent costly hospitalisations caused by dehydration. Following these simple tips, you can stay healthy, hydrated, and happy.

Click HERE to buy robust health insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

The pros and cons of travel insurance: Is it worth the investment?

Wanderlust is an exciting feeling to cherish as it blooms the thought of mindful exploration of new places and experiences. Whether visiting with friends, family, or alone, safety matters most alongside enjoyment. And when we talk about safety while travelling, travel insurance is the first step you need to take. Travel insurance covers different areas and uncertainties to help protect you against any financial loss during the trip.

However, many people need to know this insurance and its pros & cons. This article presents you with a complete idea about the same.

What is travel insurance?

Travel insurance covers your belongings against theft or damage and any medical condition arising while travelling. Most travel insurance policies cover lost or stolen luggage, medical emergencies, and trip disruptions. The insurance also covers rental car damage and trip cancellation. When you opt to buy a travel insurance policy, there are different types that you can check. You can buy domestic travel insurance if you are travelling within the country.

Similarly, if you are travelling overseas, get international travel insurance. However, the policy amount varies as per the type of insurance you are purchasing.

Let’s look at some of the pros and cons of travel insurance.

Pros of buying travel insurance

1. It guarantees peace of mind

The main benefit of purchasing travel insurance is the sense of security it provides. Sometimes you worry about any circumstances during the journey and cancel the trip. Even in the worst-case scenario, having travel insurance guarantees peace of mind. With travel insurance, you can focus on making your trip memorable without worrying about the financial stress that might occur due to unavoidable circumstances arising during your trip.

2. Get compensation for lost luggage

In many cases, passengers travelling by air miss their luggage after landing at their destination. Moreover, travellers end up missing their important items during the trip. Missing and lost luggage can be chaotic and hamper your trip excitement. But, with the right travel insurance, you get coverage on phones, cameras, and other essential items. You need to mention all details while claiming the same.

3. Complete medical expense coverage

You cannot predict when you will fall ill or face health issues while travelling. However, because of the abrupt changes in climate, food, and time zone, there is a greater risk of contracting an illness when travelling. You should have a solid strategy to deal with medical issues when travelling overseas because healthcare can be expensive. Once again, travel insurance comes in handy for such a situation. It offers complete coverage for any medical costs incurred due to an illness or accident while travelling. However, it would help if you kept all the medical bills ready while claiming.

Cons of travel insurance

1. It is expensive

If you compare the price of travel insurance with other policies, you will find it relatively high. Also, many people avoid purchasing it since they never feel it is important and necessary.

2. High chance of getting rejected

Your travel insurance claim could be rejected for several reasons. Insurance companies try to bring down the compensation or deny the claim if they find that you don’t have valid or expected proofs and documents to produce. Even if you are claiming for minor injuries, it may get rejected. So, it is best to read all the policies carefully to avoid loss.

Having travel insurance by your side is a worthy investment if bought from the right insurer and by clearly understanding the policy features. If you are looking for travel insurance policies, carefully compare plans of different insurers and invest in the best one. Read the terms and conditions thoroughly and don’t hesitate to ask questions if you aren’t clear about any clause. For additional safety, investing in the best personal accident policy in India alongside a robust travel insurance will help you have a peaceful travelling experience. It’ll ensure you celebrate joyous moments with your loved ones and leave all the worries aside.

Click HERE to buy the best personal accident policy in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

What precautions should you take to keep your electronics safe from fire outbreaks at home?

Electronics have become essential to our daily lives, and keeping them safe from fire outbreaks is critical. Numerous things, including broken cords, malfunctioning appliances, and overloaded outlets, can result in electrical fires. Home insurance can provide financial security if a fire breaks out and damages your electronics or other belongings. You can customise your coverage options based on your needs and budget using home insurance online platforms that let you compare multiple policies from various insurance companies.

A fire outbreak might threaten your life and result in significant property damage. Therefore, taking safety precautions to protect your electronics is crucial.

1. Avoid flammable materials

Combustible substances like paper, cloth, and other flammable materials can quickly catch fire and spread. So it's crucial to keep these things away from electronics. Keep your electronics away from draperies, beds, and upholstered furniture. Place your gadgets in a different room and keep them away from combustible objects.

2. Use high-quality extension cords

Use high-quality extension cords that are appropriate for your electronic devices whenever you use them to supply external power. Ensure the cables are in good condition and have the correct voltage and power. Utilising extension cords that are the proper size for your equipment is crucial. Overheating and increased fire danger might result from using too-small cables.

3. Try not to overload electrical outlets

Overloaded electrical outlets are one of the primary causes of electrical fires. If too many devices are plugged in, one outlet or power strip might become overheated and catch fire. Use a surge protector to prevent the overloading of electrical outlets to avoid this. Surge protectors are made to cover any excess voltage and safeguard your equipment from power surges.

4. Inspect and maintain electronics regularly

Regularly check your equipment for signs of wear and tear, like frayed cords or damaged outlets. Replace any outlets or cables that are broken as soon as possible. Cleaning the dust and debris off of your equipment regularly will also help prevent overheating. Internal harm can result from overheating, raising the possibility of a fire.

5. Install smoke detectors

Smoke detectors are essential for quickly spotting fires so you have time to respond and get help. Place smoke detectors in each room of your house, especially the ones that house your electronic devices. To ensure your smoke detectors are operating correctly, examining them frequently is necessary.

6. Unplug electronics when not in use

Always remember to unplug your electronics from the outlets while not in use. Electronics should always be cleared to avoid overheating, which could start a fire. Certain electronics, such as space heaters and irons, if used carelessly, can catch fire quickly.

7. Fires should never be left unattended

Ensure you're constantly watching anything involving a flame or a lot of heat, such as cooking, microwave, etc. Keeping an eye on these electronics will enable you to promptly identify any issues or deviations from the norm. As a result, you might take care of the issue quickly to ensure your family's safety.

Protecting your electronics from fire outbreaks at home is essential to prevent potential damages. Numerous things, including overloaded outlets, damaged cords, etc., can result in electrical fires. A fire outbreak might endanger lives and seriously harm property. Take the above precautions to protect yourself and your home from the adversities of fire due to electronics.

Purchasing home insurance online is an easy and effective approach to safeguard your house and possessions against unforeseen losses or damages. Reviewing the terms and conditions of your home insurance policy is essential before purchasing.

Click HERE to buy home insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Electric Vehicle Insurance: Ensuring Safety and Coverage

As the world steers towards sustainable mobility solutions, electric vehicles (EVs) have emerged as a promising answer to the environmental concerns associated with traditional internal combustion engine vehicles. India, too, is making significant strides in the EV market, with the government's commitment to promote electric mobility.

India's ambition to electrify its transportation system is evident in its National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Electric Vehicles (FAME) schemes. These initiatives aim to encourage EV adoption by offering incentives, tax breaks, and promoting charging infrastructure development.

As more consumers switch to EVs, the focus on battery technology and its maintenance becomes pivotal after all the battery is at the heart of this technology revolution. And with the growth in this market, there arises a need for a tailored insurance solution as well.

However, many motor insurance companies still do not provide any specialized coverage for EV and HEV batteries, resulting in a void in this fast-developing sector. However, forward-thinking insurance companies are recognizing the opportunity and starting to offer specialized coverage for batteries.

In response to this demand, Magma HDI General Insurance has taken a proactive step by introducing a product: "Battery Secure Add On" This specialized insurance offering is designed to address the unique requirements of electric and hybrid vehicles.

What sets "Battery Secure Add On" apart is its comprehensive coverage of critical EV/HEV components, with a primary focus on the battery. This coverage extends to repair and replacement costs arising from various scenarios. For instance,

• If the battery is damaged as a result of an unexpected power surge while charging or Experiences consequential harm from a short circuit or water ingress, "Battery Secure Add-on” has it covered.

• Moreover, " Battery Secure Add On" goes beyond battery coverage alone. It recognizes that electric vehicles encompass a range of specialized components that differ from traditional combustion-engine vehicles.

• This insurance product also safeguards other electric-specific elements, such as the electric motor, ensuring holistic protection for the entire EV system.

Click HERE to learn more about the product.

Shedding light on Return to Invoice in motor insurance

Most people are familiar with motor insurance, its benefits, and its exclusions. It is an efficient financial instrument that supports us when our insured vehicle encounters an unfortunate incident. Motor insurance comes with many optional coverages that may be useful to you. Did you know about the Return to Invoice or RTI coverage? Choosing this coverage while you buy motor insurance online can be a great help. Let's learn more about RTI coverage, its benefits, and its functionality.

What is "Return to Invoice" in motor insurance?

Return to invoice is an optional coverage for your car insurance. It lets you get money equal to the car's original value, also called the invoice value. This coverage is not required by law, so you can buy motor insurance online and include RTI coverage as an add-on. It is an application you use when your car faces total loss, such as if someone steals it or it gets fully damaged by fire or a natural calamity.

How does it work?

In normal car insurance coverage without an RTI add-on, you can get the maximum claim amount as your car's "insured declared value" (IDV). IDV is always less than the invoice value of the car.

However, with car insurance having RTI coverage, you can get the maximum amount of claim on the invoice value of your car. In simple words, when you have RTI coverage in your car insurance, you can get the road value of your car when it is stolen.

How is it calculated?

You can easily determine the amount of insurance that comes with RTI by looking at the car's total price when you buy it. The return to invoice includes the total car price, such as road tax paid, ex-showroom price, and registration cost.

What is covered in Return to Invoice?

If your car gets stolen or damaged beyond repair, you can raise a claim against the RTI. Let's look at the different circumstances when this coverage can benefit you:

● When you don't have secured parking

● Living in an area where car thefts are common

● Living in an area prone to natural calamities such as floods, landslides, and more

What does not apply in the Return to Invoice?

Sometimes, the RTI cover may not work, and you can't claim the insured amount. Here are some situations when this cover is not applicable, including:

● Damage to your car when someone else is driving

● You can't avail RTI add-on if your car is older than 3 years from the buying time

● You can't avail of the RTI cover for minor dents and grazing on the car body

● You must submit a copy of the FIR to process the return-to-invoice claim

Benefits of Return to Invoice in motor insurance.

Some benefits of RTI in car insurance include:

● It increases the scope of your car insurance coverage

● It is beneficial when you live in an area where car thefts are common

● It is available for new cars. Hence, you can give your new car more care with this cover

● It is available with a comprehensive car insurance policy

Once you understand everything about the Return to Invoice, consider adding this optional cover. RTI can help you when your car is damaged beyond repair. If you live or park your car in a place where theft, natural calamity, or fire is common, you should add RTI to your policy when you buy motor insurance online.

Click HERE to buy motor insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Understanding how a cashless garage facility can be helpful

A cashless garage facility is one in which an insurance company has a tie-up with a garage. Whenever you meet with an accident or file an insurance claim for repairs, you will not have to settle the bill in cash at these garages. The insurance company will directly pay the bill. However, you have to bear some nominal charges for processing the claim. Also, some compulsory deductibles exist as per the insurance policy’s terms and conditions.

Not all garages will have a tie-up with your respective insurance company. The list of network garages is easily available with your insurance company. You need to verify it with your insurance provider and search for the nearest garage that will provide you with a cashless facility. Let us see how a cashless garage facility can be helpful to us.

1. Hassle-free claim settlement:

Insurance companies are directly connected to the network garages. Hence, you do not need to visit multiple garages to complete the repair work. You can directly go to the network garage after informing the insurance company, provide the required documents, and that’s it! The garage will take it over, and the insurance company will settle the bill. The entire claim settlement process becomes hassle-free.

2. Prompt service:

As mentioned above, not all garages are covered in the cashless network list of the insurance company. Hence, listed garages provide prompt and good quality repairs and renewal services to maintain harmonious relations with the insurance company. This can be helpful to you, and you’ll get quick service and timely delivery of your vehicle.

3. No cash payout:

This is one of the most important benefits of a cashless garage facility. In the non-listed garage, you have to settle the entire bill in cash at the time of delivery of the car. Accidents do not come informed. Hence, such sudden bills can put you under a financial burden. The repair costs of modern-day cars are hefty and can cost several thousands of rupees in one go.

A cashless garage facility will release this financial burden from you, and you’ll not have to pay any repair costs from your pocket. Minor documentation and deductibles charges can be easily met. This facility makes the claim settlement process swift, and you do not have to worry about footing the repair bill.

4. Transparent billing and quality service:

The insurance company and its surveyors are in constant touch with the network garage. They provide a big chunk of work to the garage regularly. Hence, the network garages abstain from committing any fraud, using sub-standard components and parts, or engaging in over-billing while repairing cars. Hence, we are assured of fair and transparent billing and top-notch service.

A cashless garage facility is a blessing for all vehicle owners. It makes the claim settlement process convenient, hassle-free, and fast. Also, it relieves us from paying sudden and heavy repairs and renewal charges when our car meets with an accident. We get quality work at reasonable prices.

But first, you need to have a valid and functional motor insurance policy for your vehicle to enjoy a cashless garage facility for it. Always renew your insurance policy on time and never let it expire because accidents do not announce before occurring. Opt for online motor insurance renewal, which makes the renewal process effortless. You can do it from the comfort of your office or home, at any time of day or night. Also, you are saved from the hassle of meeting with the insurance agent or going to the insurance office for renewal. Go the modern way; choose online motor insurance renewal.

Click HERE for hassle-free online motor insurance renewal.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Did you know about the knock-for-knock agreement in motor insurance

In India, awareness about motor insurance has grown significantly in the last few years. The number of insurance policyholders is slowly but steadily increasing. The increasing means of living and demand for luxury goods to improve convenience are anticipated to keep driving the market for motor insurance. Comprehensive motor insurance consisting of own damages and third-party covers is expected to grow more in the coming future.

Third-party liability insurance is mandatory to protect the driver against legal and accidental liability, financial loss or property damage, and medical expenses he may face after an accident. Despite its advantages, settling claims is a lengthy and costly procedure. The knock-for-knock agreement is a recently introduced aspect of motor insurance to simplify the process and increase the policyholder base and satisfaction.

This blog discusses all you need to know about the knock-for-knock agreement.

The issue before the knock-for-knock agreement:

When an accident happens, the persons involved can contact their insurance companies to compensate the other party for damages. However, this is a lengthy procedure that may sometimes take months to settle with unfavourable conditions. It is also still being determined whether or not the insurer will accept the claim.

In the background of such uncertainties, the affected party has no choice but to file a suit in court, which takes additional time and cost. The knock-for-knock agreement aims to eliminate this waiting period by providing an alternate solution to settle the claim among the parties without the court's involvement.

An alternative approach using a knock-for-knock agreement:

The knock-for-knock agreement is signed by two or more motor insurance companies insuring two or more parties involved in a motor accident. Since these companies are aware of the tedious claim settlement process, they use this alternative agreement and promise to bear the expenses for repairs or damages to their client instead of claiming the amount from the other party. Introduced in 2001 by the General Insurance Council, a motor insurance company doesn't need to sign such an agreement to make the claim process quick.

Advantages of knock-for-knock agreement:

While the concept is simple to understand, here is the summary of the benefits of signing a knock-for-knock agreement:

● Speedy settlement of claims

● Eliminates the need for the involvement of law

● Reduces the expenses required to be borne in case of proving the liability of the third party to derive a settlement from his insurer

Conditions for knock-for-knock agreement:

Three primary conditions are applicable for claims that are admissible under a knock-for-knock agreement.

1. Accidents must occur within geographical boundaries:

The insurance company decides such boundaries before the lodging of the claim. Generally, the limit is considered to be the defined geographical boundaries of India. It is implied that any accident outside the border cannot be admitted as a claim under a knock-for-knock agreement.

2. The claim must be filed as own damages:

Under the agreement, each motor insurance company agrees to compensate its client instead of demanding compensation from the other party. This claim can no longer be filed as third-party damages and is processed as "own damage". Therefore, you must purchase your "own damages" cover, without which you cannot complete this procedure.

3. Limit on the claim amount:

The admissible claim cannot exceed the insured declared value (IDV) previously mentioned in the policy.

The knock-for-knock agreement is a lesser-known aspect of motor insurance that makes claim settlements speedy and inexpensive. It saves the resources of a motor insurance company that agrees to such a contract. Explore this aspect to know more about its seamless benefits before buying motor insurance in India.

Click HERE to buy reliable motor insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Know more about the anti-locking braking system in detail

A critical safety element that is now standard in all modern vehicles is the anti-lock braking system, or ABS. The ABS is frequently marketed as an efficient breaking mechanism that significantly reduces accident risk by facilitating a good grip over the vehicle. We go over everything you need to know about ABS, including its advantages, how it works, and the several kinds you can find in modern vehicles.

What exactly is "anti-lock braking"?

The name of the technology suggests that when you apply the brakes, ABS keeps the wheels from locking. It shortens the distance you need to stop and lets you move or "steer" the car while the brakes are still on. This way, you can avoid collisions from sudden braking and crash into fellow vehicles or objects.

What is the purpose of ABS?

Irrespective of the car's speed, when you press the brake pedal (without ABS), the wheels lock up because the brake pads make tight contact with the wheel discs and stop the wheels from turning.

The car skids because of its momentum when the wheels stop rotating. As a result, the driver has no control over the wheels. Most frequently, this can result in severe accidents.

What are the main components of ABS?

Speed sensors, valves, a pump, and an ECU comprise most ABS parts.

Speed sensors:

These sensors are important to keep track of the wheels' speed.

Valves:

In the brake line, some valves regulate the pressure on the brakes.

Pumps:

When brakes are used, hydraulic fluid-filled pumps pressure the brake callipers or drums.

Electronic Control Unit (ECU):

In response to the signals from the speed sensors, the ECU acts as the command centre of all the processing.

How is ABS used?

When you use the brakes on a car with ABS, the speed sensors track how slowly the wheels turn. Brakes deliver a signal to the electric control unit when they are about to stop rotating. Using valves and pumps, the ECU removes some of the brake pads from the wheels, allowing them to continue spinning. When you apply heavy brakes, ABS enables the wheels to continue turning, giving you control over the car.

Without ABS, when you hit the brakes, the wheels would stop or lock up immediately, causing the car to slide. In this situation, the vehicle would skid and travel a fair distance. It would be challenging to turn your vehicle because the wheels were locked. ABS helps you slow down efficiently, deploy uniform braking, and quickly control your car and avoid it from spinning.

ABS benefits:

● Uneven tyre wear is avoided because the wheels don't lock up when the automobile is stopped.

● The Traction Control System (TCS) and ABS share specific fundamental architectures, which facilitate TCS installation on vehicles in manufacturing facilities.

● You may steer the automobile around obstacles when braking hard, which can reduce brake pad and brake disc wear.

● Minimises the risk of severe accidents due to sudden braking and enhances the car's stability post-braking.

When the brakes are applied hard at high speeds, ABS keeps the wheels from locking up, which makes it much less likely that a deadly accident will happen. The effectiveness of the anti-lock braking system has been demonstrated everywhere. Anti-lock brake systems are now so critical to safety that the Indian government has made them a requirement.

Safety is paramount, and braking is a crucial part of vehicle safety. It's also a good idea to get online motor insurance to upgrade the security of the vehicle and the owner. Motor insurance covers car owners' liabilities and protects them from damage to their cars and any legal obligations they may face. Browse through different options and opt for online motor insurance with the best premium and benefits that suit your needs.

Click HERE to buy online motor insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

These are a few common drainage problems harmful to your house

Most households should foresee drainage issues. We can only hope that the drains in our homes are in good condition because they are out of our sight. But several early indicators alert us to a drainage issue. If left unattended, these drainage concerns put people at risk and give rise to crises like safety, health, and financial problems when dealing with poor drainage conditions.

Seven typical drainage issues have been discovered to guarantee a flawless drainage system by sorting these issues:

1. Even with safety precautions, a clog in the drain system is unavoidable, and people flush many things down into the drain. Although it might begin as a slow-moving drain, it could eventually worsen and end up blocked. It is crucial to try an at-home fix for a blockage as soon as it gets noticed.

2. The installation, regular cleaning, and maintenance of gutters and downspouts are essential for the exteriors of dwellings. Numerous issues have arisen when several people take responsibility for their work independently. Both insufficient pipe installation and a lack of plumbing experience are the leading causes. If pipes aren't put in the right way, they can cause plumbing issues, broken tubes, and other property damage, along with the improper passage of sewage.

3. Drain pipes are subjected to a lot of wear and tear, resulting in fractures or cracks that cause the pipes to have open joints. Water leaks from these cracks could result in serious issues in the neighbourhood and even structural damage. Another indication of leaks and an excess of moisture is the development of mould. Pest infestations that enter through pipeline cracks are another issue about pipe breaking and leakage. Fortunately, one can easily fix these problems with prompt diagnosis.

4. With the right slope, water will flow away from the house. It has a big effect on the slope of the land so that the drainage moves away from buildings, especially in places that need to be paved, like parking lots and driveways. Sometimes, the builder might get this wrong and let water seep in or get stuck in the structure, damaging the walls.

5. The growth of plants can be dangerous to plumbing. In the trenches built around pipes and drains, tree roots can obstruct or destroy pipework as they develop and spread. They can enter the drainage system through openings, mainly already-damaged joints. They usually leave a mess of odours and have significant health risks.

6. Heavy rain or storms and the debris they leave behind can cause clogs, floods, or overflows in the drainage system if not appropriately covered.

7. Flooding can put pressure on pipes and can damage the ground. An inadequate drainage system or pipes is another sign of outdoor flooding.

8. Assume your house is next door to your neighbour's. Even if you take all the proper steps, there is still a chance that water from your neighbours' properties will cause damage to your property. It can occur because of a flood on their land or simply because your property is lower than theirs. To prevent water runoff from the neighbours, you must take the appropriate actions and ask for effective waterproofing of the floor.

These problems show how important it is to keep up with drainage system maintenance to avoid extreme issues. Even though most drainage problems aren't evident at first glance, the above points will help you figure out what's wrong and how to fix it.

Conduct periodic inspections of your house's drainage system and look for damages in the pipes, sinks, or ducts. Immediately call the experts to fix it before the issue becomes severe. Ensure regular cleaning of the drains to avoid clogging and unwanted growth of plants. To deal with other problems related to the well-being of your home, like protection from damages to belongings due to natural calamities and other issues like riots, invest in a reliable home insurance India policy. This will provide you with optimum coverage for your home financial support by compensating for the damages caused.

Click HERE to buy home insurance India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here are a few effective winter travel tips for enjoying a memorable trip

Who does not love to travel in the winter season? The chilly weather with snow-clad mountains or the cool climate on the beaches and plains can be delightful and welcoming. Taking advantage of the pleasant climate and an ideal season to travel, numerous tourists plan family holidays and group tours to explore the best winter destinations in India. But the idea of winter travel reminds us of the arduous task of carrying thick, heavy, woollen clothing.

Are you planning a family trip or a solo adventure this winter? Here are a few effective winter travel tips for enjoying a memorable trip.

1. Plan in advance:

Winter travel in December and January coincides with Christmas and New Year vacations in schools and holidays in offices. Hence, there is usually a lot of crowd at popular vacation spots and heavy bookings on flights, trains, and hotels.

Hence, you should always plan your winter trip well in advance. Book your travel tickets and accommodations as early as possible so that you don’t have to cancel your trip at the last moment due to the unavailability of travel tickets or rooms in good hotels.

Even if you can get flight tickets and good accommodation at the last moment, you will have to pay exorbitant rates. So why not plan in advance, save money and make your trip memorable?

2. Check your flight and train departure:

Always check the timings of your flight or train departure in the winter season before leaving home. They are usually delayed and are sometimes even cancelled due to heavy fog and low visibility. Keep an alternate route or service in mind in case of any cancellations. This will ensure that your travel plan gets successful.

3. Travel light:

You will wonder how we can travel light with bulky woollen clothes, especially if we are visiting some cold place or a hill station. It is possible by following some simple tips. Wear your most bulky jacket, sweater, shrug, or scarf on the day you have to travel. This will mean you will not have to pack them inside your bags. Also, wear your heavy boots and pack your lighter shoes or slip-on in your bag.

Do not pack multiple t-shirts, tops, or jeans with you. Repeat them. What you wear on the top is only visible in winter. Keep changing your jacket, shrug, or coat, and no one will know you are repeating your dresses! Also, buy woollen clothes of superior quality so that you don’t need multiple layers of clothing to keep you warm. Carry thermal innerwear of good quality as they are light and warm.

4. Rent travel gear:

You don’t need to carry your travel gear everywhere you travel in winter. For example, if you want to ski in the snow, you can rent all the essential gear, including snow boots and overcoats, from the resort you are staying in.

5. Medication:

The cold season brings many ailments, such as flu or fever, nasal congestion, cough, etc. Always carry appropriate medication, especially when travelling with kids and the elderly. Also, use small cases for carrying your cold cream and moisturiser so they only take up a little space.

Make your winter trip special and memorable by following the above travel ideas. Another important tip is to go for your true companion that will never leave your side, i.e., travel insurance. Travel insurance will protect you against trip cancellations, lost baggage, damage to your luggage, etc. You can take an annual plan to cover all your trips or insure only a particular trip.

Insurance will also offer coverage in case of any medical emergency and assistance arising during your trip. Make your life secure and tension-free by choosing a wide variety of general insurance policies. Moreover, buy online general insurance from the ease of your home with a few clicks, additional benefits, and the best premium rates. We wish you a happy winter!

Click HERE to buy online general insurance before planning your winter travel trip.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Smart tips for washing home glass windows with sparkling shine

Have you ever tried running your hand over your house's glass window panes? The amount of dust you will come across is worrisome. We all are familiar with the saying "cleanliness is next to godliness," but at this point, it is not just about keeping your house clean. It is also about your and your family's health. The dust that settles on furniture, doors, and windows surfaces enters your body when you inhale while just being around your house and going about your everyday chores.

Many times, we rush to the doctor with a common cold or some health issue which is related to the hygiene problems arising from the dust and dirt which have made their way into our home, costing us several trips to the emergency room, medicine dosages, or having a troubled sleep at night.

But how can you combat this problem? Don't worry. This blog will discuss smart tips for washing home glass windows with sparkling shine, which would help you eliminate the tiniest speck of dust, leaving the glass panels squeaky clean!

1. Notice the frame:

If you closely examine a window, you will be shocked by the amount of dust, spider webs, etc., settled on the frame of the glass. The first step to cleaning your windows would be to clean the frame so that the dust particles do not float in the air and find their way to any other surface. You can use a microfibre towel to clean the dust and a sparkling shine solution to wipe off the frame after dusting.

2. How about a mop:

The windows can be large and high, which might not be accessible to clean using a small microfibre towel. A mop with a stretchable handle is the best idea in this scenario. You can dip the mop in a solution, wring it and then wipe the glass windows by stretching the handle to the required length. Ensure that the mop reaches all the corners of the windows, thus giving them the sparkling shine!

3. A small wiper is an intelligent option:

Doubling up on cleaning supplies has never gone to waste. Apart from using a microfibre towel and a mop, you can also use a small wiper which would help you wipe off the cleaning liquid so that it doesn't leave a stain on the window. Keeping a wiper will help you clean the window's exterior glass panel, thus eliminating pollen or bird waste, etc.

4. Rain can be difficult for the windows:

It is advised to clean the windows from the inside and the outside three to four times a year. The most favourable time to clean your windows is during spring and autumn. Cleaning your windows during these seasons helps eliminate any complicated to-clean mineral deposits that might have been set due to the rains.

5. Cleaning directions are a huge bonus:

Spraying some cleaning liquid and using a microfibre towel to wipe the windows can have magnified effects if you clean the window in a circular motion and jazz it up by swiping horizontally and vertically to avoid setting off any liquid stains or dirt.

Other tips include using tongs when cleaning window panes and blinds, using a lint roller on the window screens to remove the lint that might have found its way, cleaning/vacuuming the curtains, etc.

These were a few smart tips for washing home glass windows with sparkling shine. Keeping your house clean and hygienic is very important. Home is not just a place to live; it is an emotion. It houses millions of memories and fosters relationships, so you must get home insurance to protect this sacred space against any unforeseeable mishaps and situations. You can look for the benefits of the various home insurance options which are available in the market and purchase the one which suits your needs.

Click HERE to learn more about buying home insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

List of ancient temples in India that you must visit once in your lifetime

Out of 195 countries, setting oneself apart from others is difficult. Most countries are either known for their rich resource endowment or their progress and economic significance. Over the years, India has continuously made optimal use of its resources to cultivate its financial position amongst other leading developing and developed countries. However, one thing that makes India genuinely unique is its rich cultural identity.

India is a land of deep-rooted culture and traditions. Ancient temples and practices are proof of the long legacy of the old civilizations that formed the fundamentals of society. There are over two million temples in India, proving the significance of heritage and spiritualism in the country. Of this enormous number, many temples have existed since the rule of the ancient kingdoms and are proof of the vibrant traditions and beliefs of Indians.

The easiest way to experience the diverse culture of the expansive land is by immersing in the historical archives engraved on the temple walls and sculptures. Before you plan your trip to explore these temples, we recommend contacting a general insurance company to purchase a comprehensive cover to compensate for any damages during travel. After checking that off, here is a list of ancient temples you must visit!

1. Mundeshwari Devi Temple:

Located in Bihar, it is said to be one of the oldest temples in the country, open to the public. The Archaeological Survey of India dates the temple back to 108 AD after consideration of its design and architecture. The temple is a shrine for Lord Shiva and Goddess Durga and is popularly known for its distinct octagonal design.

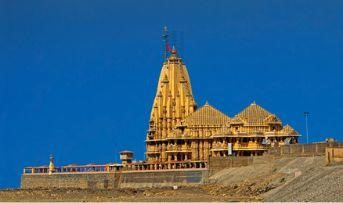

2. Somnath Temple:

Located in Gujarat, the Somnath Temple worships Lord Shiva. It is one among the 12 Jyotirlingas and holds great significance to the devotees of Shiva. The legend behind the temple also involves the Moon God. The temple initially held massive troves of treasures, which Mahmud of Ghazni raided during his attacks. Despite being destroyed, the temple has been restored and provides a peaceful environment to bask in its cultural significance.

3. Sree Padmanabhaswamy temple:

The gold-plated temple in Kerala is dedicated to Lord Padmanabha. Also known as the richest temple in India, the temple is thought to have existed for over 5000 years. The temple's wealth is estimated to be around 1 Lakh Crore Rupees, excluding a closed vault that cannot be opened until the chanting of the Garuda Mantra, an unknown chant.

4. Konark Temple:

The temple, built in the 13th century, is a UNESCO World Heritage site in Orissa. Dedicated to the Sun God, its architecture sets it apart from other temples. It is designed based on geometric ideals, making it truly unique. The main temple had a suspended sun idol built using granite and magnets.

5. Dilwara Temple:

Dilwara Temple is an important Jain pilgrimage in Mount Abu built between the 11th and 13th centuries with intricate engravings. The exterior does not give insight into the grandeur of the exquisite marble carvings inside. The hilly terrain outside makes one appreciate the entire process of building the temple in an age without the convenience of transport vehicles.

6. Amarnath Cave Temple:

Situated in Jammu and Kashmir at a height of 3900 metres, visiting this shrine is an experience like no other. It is a naturally formed cave with a lingam of ice resembling Shiva's idol. Reaching the temple is challenging and requires significant effort and dedication.

While it is recommended to visit such divine places to uncover and understand the traditions and Indian heritage, it is also essential to pay heed to one's safety during the travel. A general insurance company provides excellent travel protection that one must consider before planning a trip.

Click HERE to buy travel insurance from the best general insurance company.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here are the best blue water beaches in India which should be on your wishlist

Who does not enjoy travelling? Being able to visit and explore new places, try local cuisine, click pictures, and enjoy the native culture of a place is the dream of every traveller. Travelling fills the heart and mind with a sense of euphoria. It boosts your happy hormones and uplifts your spirits. Hence, everyone must take at least one vacation every year.

What if you're a beach person looking for your next blue water beach holiday in India? This article is just for you. We recommend 05 top beach holidays where you can enjoy quality time in blue waters and golden sands.

However, no matter where you travel to, you should always have general insurance to back you up. You can check the general insurance online quote in advance and purchase insurance that provides comprehensive coverage for your luggage and ensures a safe trip.

Here's a list of the best blue water beaches in India.

1. Marari Beach, Kerala:

If you're a fan of Kerala, you should visit this beach. Located near Kochi, this beach is close to the Mararikulam village of Kerala. The waters are apparent here. It is also peaceful and full of lush green vegetation around the village. It is also rated among the top five hammock beaches in India. You can spend some quality time here with your loved ones.

2. Butterfly Beach, Goa:

Present in South Goa, you can reach this beach easily by taking a ferry ride from Agonda beach. It is one of Goa's hidden gems, unexplored by most travellers. Not many people are aware of the magnificence of this beach. It is picturesque and beautiful in every possible way. It is a haven for nature lovers. Many butterflies hover over the beach, making it all the more enticing.

3. Radhanagar Beach, Andaman and Nicobar Islands:

It is one of the most picturesque beaches on Andaman and Nicobar’s Havelock Island. It has clear blue waters and white sands to its credit. A line of coconut trees surrounds the coastline, making it all the more aesthetic. The sunsets here are a sight to behold. You also have the chance to participate in various water sports when you are here at the beach.

4. Varkala Beach, Kerala:

Also known as Papanasam Beach, Varkala beach is one of the most breathtaking beaches in Kerala. You will catch a stunning view of the Arabian Sea from the cliffs present at the beach. You can either sunbathe on the golden sands or stroll by the coast. This beach is serene yet beautiful. You can also go swimming in the waters and rejuvenate yourself.

5. Bangaram Beach, Lakshadweep:

With its jaw-dropping blue waters and white sands, this beach is a cheerful retreat to enjoy with close ones. It is secluded from the hustle and bustle of city life. The beach has brown rocks on all sides. It makes the beach all the more attractive. The beach also has unique bioluminescence at night. The blue waters glow and look starry.

Make these top beaches a part of your travel bucket list and plan a dreamy holiday to savour these destinations' mystic charm. Regardless of the places you want to travel to, always have general insurance to keep your travel covered. An ideal insurance policy will cover your expenses if you incur any damages while travelling or if your luggage is damaged or stolen. You should also check the general insurance online quote before you apply for any policy. Research the best options and invest in a plan that best suits your needs. Better be safe than sorry!

Click HERE to get a general insurance online quote.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Enlisting the simple yet effective soundproofing solution for your room

We all want to live and work in a peaceful environment that motivates us to always give our best. Silence boosts productivity and makes the surroundings blissful. Silence is required for various activities throughout the day. Whether studying, working, or even sleeping, loud noise can disrupt your peace and well-being. High levels of sound have many ill effects on an individual's physical and mental health.

Significant decibels of sound not only lead to noise pollution but also contribute to an unbalanced lifestyle. It can increase blood pressure and heartbeat. It is also highly harmful to kids and older adults. Increased exposure to noise can damage the eardrums in the long run. It also increases anxiety, frustration, and irritation and can even trigger migraines and anxiety attacks.

The simple way to tackle this problem lies in soundproofing. It is a great boon to humanity and helps in preventing unnecessary sounds. Everything can be blocked by using soundproofing at home, from construction noises to vehicle horns.

Before making any changes to your house, purchasing the best house insurance India is recommended to safeguard your home in emergencies.

Without further ado, let's have a look at the best tips and tricks for soundproofing quickly at home.

1. Make use of soft materials or fabrics:

It is a known fact that sound travels via waves. This means that hard materials like metals amplify the sound. The more iron, tin, or copper you have around, the more complex sound will travel through them. On the other hand, soft materials like linens, cotton, and silk absorb sounds. The more soft fabric you have in a room, the better. Your curtains, carpets, blankets, and rugs can contribute a great deal to absorbing sound. You can also invest in soundproof curtains.

2. Use acoustic frames:

It is one of the latest things available for absorbing sounds. They are wooden frames with foam intact in them. They are highly efficient in absorbing sounds. They can be hung on the walls for soundproofing. This also prevents the noise of adjacent rooms from entering the desired room. It is excellent for people who live in apartments or condos. Acoustic frames are available in various shapes and sizes as well.

3. Consider adding layers:

If your building is still in development or if you have access to renovations, consider adding a layer of drywall. This wall will separate your room from the outside world. It will also cut off all external noises and prevent them from reaching your room. The stronger the wall, the better. It is advisable to get it done with the help of professionals while building a new room.

4. Notice the doors:

The doors play an integral role in determining the amount of sound that enters the room. For starters, keep it closed at all times. You can consider adding weather stripping around the door knob or handle. This will prevent any unnecessary noise from entering or leaving the room. You can also make use of a soundproof blanket. It can be put at the back of your door and removed when not needed.

5. Pay attention to the floors:

Floors can also help in soundproofing. You can put carpets on the floor to absorb the noise from outside. If you want a more effective solution, you should use foam flooring. It can be easily added over the flooring present and does not require much effort for installation.

These are some great ways to prevent noise from entering your house. Implement these and reward yourself with a peaceful and soundproof environment. In addition, protect your home with the best house insurance India, as it helps you deal with financial expenses in case of mishaps.

Click HERE to buy the best house insurance India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Tech may not be the best solution to expand the Indian policyholder base

Even though the Indian insurance market has been expanding quickly in recent years, just about 3% of Indians currently have life insurance. Increasing the base of policyholders is essential to ensure that more people are sheltered from financial shocks. Although technology has been suggested as the answer to this issue, it may not be the most effective strategy to increase the number of Indian policyholders. This blog will discuss how tech may not be the best solution to expand the Indian policyholder base. So, without any further delay, let's get started.

1. Accessibility is still an issue:

As it is frequently out of range for significant portions of the population, technology may not be the most incredible way to increase the number of Indian policyholders. Despite India's tremendous internet expansion, many residents of rural areas still need access to smartphones and the internet.

The most successful way to communicate with these people is still through conventional media like newspapers, radio, and television. There is a substantial digital divide between tech adepts and those who are not. For instance, older individuals may need help navigating online insurance platforms, and individuals who do not speak English well may need help understanding the language used in many online insurance policies.

2. Price is one of the primary reasons:

Technology can be expensive to develop and maintain, which is another reason why there might be better ways to increase the number of policyholders. For smaller insurance companies, it might be too expensive to spend on technology, software development, and cybersecurity to build and manage online insurance platforms.

Insurance companies might also need to engage specialised personnel to operate the platforms, raising expenses even more. When costs like these are eventually passed on to customers through higher premiums, insurance becomes less affordable and less available to those who need it.

3. Lack of trust and belief in the insurance providers:

Additionally, there may be better uses of technology than fostering public confidence in insurance. Many individuals in India continue to be cautious of insurance companies and doubt their motives. This distrust is frequently based on prior instances where insurance companies have allegedly broken their commitments or failed to live up to their pledges. Personal interactions, open communication, and moral conduct are necessary for fostering trust and confidence in the insurance industry. Technology can undoubtedly make some of these encounters easier, but it cannot replace the value of human interaction, especially when fostering trust.

4. Absence of proper awareness and information:

Since technology tends to overlook the significance of insurance education, there might be better answers. Educating the public about the advantages and importance of life insurance is essential to increase the number of policyholders. Understanding the many insurance policy types, the coverage they provide, and how to pick the one that best suits their needs can all be achieved with insurance education.

The value of in-person interactions with trained insurance agents who can answer questions, offer guidance and help people choose the best policy cannot be replaced by technology, even though it can help deliver this education through online tutorials, webinars, and other digital resources.

What could be some probable solutions to this issue?

Policymakers may concentrate on enhancing life insurance education and awareness initiatives, particularly in rural areas. Offering financial incentives to those who buy insurance policies, including tax savings, may encourage people to enrol in insurance. Insurance companies may also consider partnering with banks, post offices, or non-governmental groups to reach a larger audience as an additional distribution channel.

We hope this blog provides insights into this issue and how insurance companies can grow their consumer base. While we are on the topic, it only seems like a brilliant idea to talk about how you need to get insurance from the best general insurance company which caters to its customers' needs optimally and is available 24*7 to assist them with their queries, therefore, helping them arrive at a decision.

Click HERE to learn more about how you can choose the best general insurance company for your needs.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Taking insurance on your education loan may help you financially secure yourself

Higher education costs increase yearly, and many students turn to education loans to fund their studies. While a student loan can be a great option to finance your education, it can also be a significant financial burden after graduation. That is why it is crucial to consider taking out insurance on your education loan.

General insurance plans can offer you financial security in case of unexpected events that may cause you to default on the repayment of your education loan. Let's examine the benefits of taking out insurance on your education loan.

1. Financial protection for unforeseen events with education loan insurance:

Firstly, it provides financial protection to you and your family in case of an unexpected event such as job loss or a medical emergency. Suppose you cannot repay your education loan due to unforeseen circumstances. In that case, the burden of repayment falls upon the co-applicants. If you purchase insurance coverage, your insurer will ensure that your loan payments are taken care of, providing much-needed relief to you and your family during difficult times.

2. Improving credit scores with education loan insurance:

Insurance on your education loan may also improve your credit score. If you default on your education loan, it can adversely impact your credit score, making it more difficult for you to obtain credit in the future. By taking out insurance, you can avoid defaulting on your loan. This will help you maintain a good credit score and ensure that you are in a better position to obtain credit in the future.

3. Reduced burden of repayment:

Thirdly, insurance on your education loan can provide peace of mind. It can be stressful to think about the financial burden of repaying your education loan, especially if you are doubtful about your future income prospects. With insurance coverage, you can rest assured that your loan payments are taken care of. This will help you focus on your studies and career prospects without worrying about loan repayments.

4. Inbuilt insurance in education loans:

Insurance on your education loan may only sometimes be necessary. You can manage your loan repayments without insurance if you have a stable income and a good credit score. Additionally, some education loan providers may include insurance coverage as part of their loan package, so check with your loan provider before taking out a separate insurance policy.

Another critical factor to consider when buying insurance on your education loan is the type of insurance policy you choose. Various insurance policies are available, such as disability, unemployment insurance, etc.

5. Unemployment insurance for education loans:

Unemployment insurance can provide temporary financial assistance if you lose your job and cannot repay loans. It guarantees repayment of the loan amount without letting it reflect as a default. It also allows you to focus on finding stability and a consistent source of income rather than worry over the possibility of defaulting payments.

In conclusion, general insurance plans on your education loan can provide valuable financial protection and peace of mind. Similar to purchasing other general insurance plans, assessing your individual needs and circumstances is essential when choosing an insurance policy for your education loan. Carefully review the terms and conditions of the policy, and compare policies to ensure that you are getting the best value for your money.

Purchasing general insurance plans for your student loan is not necessary and only mandatory when applying for institutions abroad. It can be a valuable tool for all those who want to protect themselves and their families from unexpected events that may affect their ability to repay their education loans.

Click HERE to buy different general insurance plans online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

These tips will save you from stressing on your daily long-distance commute

As the pandemic's effects subside and we return to offices, the stress associated with commuting has returned. Every weekday, most office workers face a huge challenge in the morning of whether travelling upwards of an hour one-way is worth their compensation.

Whether you choose private or public modes of transport, here are some tips and tricks to relieve stress from your daily commute.

1. Prepare the night before and leave earlier:

Hectic mornings increase stress levels during the commute, which results in irritation and reduced productivity. Worrying about being late every day can be very stress-inducing. To combat this, start preparing for your day ahead at night. Keep your work clothes and meals ready, and finish all your work. This will lead to a less stressful morning, resulting in you leaving 10 minutes earlier and not worrying about delays in reaching.

2. Try to commute actively:

Commuting via personal transport, such as a car or bike, can cause health issues. The best way to go about this is to walk or cycle as part of your commute if your work location is not far. This is known as an active commute, and it will drastically change the way you travel. Exercising on your way to work releases endorphins and improves mental and physical health. If walking or biking is not possible, try to take public transport. It increases your activity and reduces stress levels significantly.

3. Detach from the digital world:

In the age of social media, it is increasingly challenging to focus on oneself rather than what people on the internet are doing. It is essential to go off the grid for your mental health.

Your daily commute could be your time to read a new book, watch the view outside, or focus on yourself with meditation. Meditation has been a proven method of giving the brain the rest it deserves, and whether it be guided meditation or simply focusing inward, it will surely benefit you.

4. Try getting flexible hours:

It makes absolutely no sense sometimes that everyone has the same office hours. This causes the "rush hour," which is impossible to tolerate five days a week. If this is an option, ask your office for flexible hours, so you can come in before the rush hour and leave earlier too.

If this is not an option in your company, find some activities around your workplace before leaving for the day, like working out or reading a book in a nearby park. This way, you'll be able to avoid rush hour.

5. Try to buddy up for a long commute:

If you find driving incredibly dull and tedious, one way to improve it is to find neighbours who go to the same area for work and carpool with them. This way, the pressure of driving does not fall on you every single day, and you can chat with people along the journey. Ensure that you purchase new motor insurance or avail of online motor insurance renewal facilities to protect yourself and your car against the financial burden of accidents.

6. Stretch it out:

Keep stretching those aching muscles! Even when you're the one driving, always keep adjusting your neck and back, so they don't cramp up and give you further pain.

In conclusion, since long-distance commutes are an inescapable necessity in the urban lifestyle, effective management techniques are becoming essential to prevent strain on your mood and physical well-being. We recommend alternative commute methods to private transport for the best impact on your health. However, in case of no option but to travel by vehicle, ensure that you protect yourself against accidents. Check for your insurance status and get online motor insurance renewal before the due date.

Click HERE to know more about online motor insurance renewal.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

These tips can change the outcome of your DIY house painting project

Buying a house can be an expensive but gratifying event. It is an extensive process involving multiple options and intense decision-making to create your dream house. After spending massive amounts of money, effort, and resources on your home, investing in house insurance India is prudent to protect your home, belongings, and more from uncertainties.

After spending massive amounts on purchasing your home, consider these DIY for your home's interiors to save on additional expenses. Equipped with the right tools, creativity, and zeal, you can take on any home DIY project! A painting project is the ideal task to test your skills and is manageable. Before you start painting, here are some tips to enhance the outcome of your DIY house painting project.

1. Purchase premium paint:

Make sure to pay attention to the quality of the paint. Every room in your house deserves a different type of paint, so keep that in mind. Choose paints with minimal volatile organic compounds and odour to keep your family safe. For your favourite walls in your house, choose a standout colour to create an accent wall.

2. Remove the hardware:

Remove light fittings, doorknobs, electrical cover plates, window locks, and window lifts. Store the components in a bucket. Tape the screws to each piece of hardware, and identify each one with its location to simplify future reinstallations.

3. Identify the type of paint on existing walls:

Test a patch to determine what colour was used there. Apply alcohol-soaked cotton to a small section of the wall. The paint is latex if there is paint residue on the cotton ball. If not, the colour is oil-based.

4. Inspect and prepare the area: