General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

All you need to know about the impact of rising medical inflation on health insurance premiums

You must have seen people around you discussing the rise in medicines, procedures, consultation fees, and expenses. The skyrocketing prices are justified due to the increasing costs of medicinal equipment and treatments. The costs of living have been escalating every year. And while living by yourself looks economically intimidating, creating a family and raising children drives up the cost, which could be scary for a single source of income in these times.

In this blog, we will discuss all you need to know about the impact of rising medical inflation on health insurance premiums. This information will answer all your questions about how the fluctuation in the price of health insurance affects your finances. So, without any further delay, let’s get started.

1. Let’s look deeper at the term “Medical Inflation”.

Medical inflation indicates the rise in average and per unit prices of healthcare assistance. There can be various factors that can influence the increase in the cost of medical services like technological progress, increase or decrease in the number of professionals in the healthcare industry, rising demand, price of materials, transportation costs for medical equipment, and increase in the cost of usage of healthcare services per person.

2. What do you mean by “medical healthcare demand”?

With the fast-food culture gripping the roots of our lifestyles and the hectic work life, people have become addicted to stagnancy, which has caused more harm to our health than ever. Humans have become vulnerable to severe health risks like diabetes, blood pressure issues, hypertension, anxiety, depression, etc., drastically affecting our lifestyle. Therefore, the demand for medical assistance is causing medical inflation in our country.

3. What is the current medical inflation scenario in India?

The inflation in India has been on a consistent ‘single-digit’ rise. However, medical inflation is inching toward double digits, which is a matter of concern. The affordability of health treatments and services would become heavy on the pockets of people and will potentially cause a significant dent in their savings.

Hospital beds, medical staff, conveyance, etc., reported inflation of 9.4% back in 2018-2019, while the cost of medications saw inflation of 7.2% during the same period. And in 2021, there was an unimaginable increase in the inflation rate by 14%.

4. What is the expected impact of the rising medical inflation?

As discussed in the previous point about the rising medical inflation rate, there is a direct influence on health insurance premiums. In some cases, the health premiums increased up to 30%, as reported in the financial year of 2022. The demand for healthcare assistance saw a rise of almost 25%, which indicates the necessity of these services in our country. Many health insurance policyholders have increased their insurance coverage to accommodate the rising medical inflation.

It is suggested that while you purchase your insurance to cover significant procedures and surgeries, you also include minor treatments and diagnostics. As a policyholder, you must watch out for the medical inflation rates to adjust your policy and avail the provisions to expand your coverage accordingly. It would be best to always account for inflation before finalising your health insurance policy.

We hope that the insights proved helpful. To ensure that any medical emergencies in your family can be handled stress-free in the monetary aspect, you need to purchase the best health insurance policy that would cater to your needs in an optimum way and allow you to focus on the recovery of the patient and have no worries about the expenses.

Click HERE to learn more about health insurance and its benefits.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here's why you need to look for a turbo engine when purchasing a new car

An internal combustion engine, known as a turbo engine, employs a turbocharger to increase the air flowing into the machine. This increases the engine's power output. Utilising typically wasted exhaust gases to power the turbocharger is the fundamental idea behind an engine with turbocharging. These engines are standard in high-performance vehicles because they significantly boost power without increasing the engine's size or weight.

Remember that turbocharged cars are regarded as high-performance vehicles, which may increase insurance prices when buying online car insurance. Here are some reasons to consider a turbo engine when buying a new car.

1. Increased fuel efficiency

A turbo engine can boost performance while also enhancing fuel efficiency. It can create more power with the same amount of fuel. As a result, drivers can benefit from a more potent engine without compromising fuel efficiency.

2. Enhanced power

A turbocharger improves the air's density by compressing it before entering the engine. This makes it possible for more gasoline to be consumed and increases the power generated.

3. Smaller engine size

A turbo engine can be lighter and smaller while offering the same performance level as a typical engine. This implies that turbocharged vehicles may be smaller and more manoeuvrable, making them enjoyable to drive.

4. Superior torque

A turbo engine also has the benefit of having more torque than a normally aspirated engine. The twisting force that the engine produces is what propels the car forward. A turbo engine may accelerate instantly because it can produce more torque at lower RPMs.

5. Easily tunable

Turbo engines are more straightforward to tune than standard ones. Furthermore, performance upgrades may be easier to implement since a turbo engine is built to handle more power.

6. Improved driving experience

Driving can be more thrilling because of the engine's improved power and torque, particularly during acceleration from a stop or passing on the highway. Additionally, a turbo engine may emit a fine whine when the turbocharger is spinning up, adding to the engine's sound appeal.

7. High altitude capability

Turbo engines are particularly well-suited for high-altitude terrains. Natural aspiration engines may have difficulty generating the same amount of power as they would at sea level due to the less dense air at high elevations. In contrast, a turbo engine compresses the air to compensate for the reduced air density, enabling it to generate the same amount of power at high altitudes as it would at sea level.

8. Future-proofing

As emissions standards become more stringent, many automakers are using turbo engines to lower the size of their machines while maintaining the same level of performance. Turbocharged vehicles may be better suited to meet upcoming emissions regulations. Furthermore, if turbo engines become more popular, they may have more aftermarket support in the future, making it easier to locate components and accessories.

Car makers and enthusiasts choose turbocharged engines because of the numerous benefits they offer for automobiles. They are more powerful and torquey while consuming less fuel than conventional engines. Their enhanced acceleration allows motorists to reach high speeds conveniently. The advanced turbocharging technology has resulted in lowering emissions and making turbocharged engines a more environmentally responsible choice.

You may also research more about turbo engines to understand their working better before making any decision. Also, thoroughly study and provide precise details about your vehicle and driving history to obtain an accurate quote when applying for online car insurance for your turbocharged vehicle.

Click HERE to buy online car insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Your guide to buying the best second-hand car in Mumbai

Pre-owned cars, often known as used cars, are very economical, available in good condition and have a lower depreciation rate. These benefits make buying used cars a good idea and fulfil the dream of every person to own a car.

Banks and NBFCs even provide used car loans with affordable interest rates and quick processing times to make owning a used car simple. In a city like Mumbai, you'll find multiple options for second-hand or pre-owned cars in various regions. There are numerous certified dealers with a wide range of cars to choose from.

Here is how to find the ideal used car at the most competitive price if you want to purchase it in Mumbai.

1. Check with family and close friends:

First, ask people you know for recommendations while searching for a used car. There may be someone you know who wants to sell their vehicle. Because of the added trust factor, you can be confident that you are getting the best value for your money. Even better, you may ask them to let you borrow the car for a few days. This way, you can test drive it and decide whether you will be interested in buying it.

2. Purchase and sale on social media pages:

Social media groups are another way to connect directly with sellers and avoid the fees that middlemen charge. For buying used cars in Mumbai, there are specific social media groups. Until you find a vehicle you want, you can search for ads offering used cars for sale. The good thing about these groups is that you can talk to the seller directly, negotiate the best price, and set up a time to look at the car before you buy it. You can also view actual images of the cars for sale.

3. Used-car gateways:

You might also check out online marketplaces that specialise in selling pre-owned automobiles. Retailers selling directly to consumers conduct the necessary audits before establishing their car prices.

4. Nearby used-car dealerships and garages:

You can also rely on a trusted mechanic in a nearby garage. These experts also know individuals who are planning to sell their cars. A technician can provide you with valuable information on any pre-owned cars currently on the market and point you in the right direction.

Another option is to go to a used car dealer. Always bring along a car fanatic or a mechanic who knows a lot about cars and can help you choose a perfect car.

5. Resellers with permission:

With a good reputation, carmakers have approved resellers who purchase and resell their brand's products. You can go directly to a reseller if you are searching for a specific make and model or have faith in a certain brand. Mumbai is home to many resellers who can provide safe and excellent cars.

You can apply for a loan once you have selected a used car to purchase. Here, a pre-owned car loan calculator comes in handy to estimate the EMI you would be required to pay. Follow these steps to locate the best buying spots in Mumbai and get great deals on different categories of pre-owned cars.

Get coverage for accidental damages by comparing and selecting the best car insurance company in India from leading four-wheeler insurers. If a policyholder's car is damaged or stolen because of something out of their control, the car insurance will pay for it. So, once you buy your pre-owned car, ensure that you also invest in your car's safety along with the transfer of registration and other essential documents.

Click HERE to buy insurance from the best car insurance company in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Understanding your skin as an indicator of your overall health

Skin is the largest organ and serves as a protective barrier against external factors. It is responsible for our physical appearance and can also be a vital indicator of our overall health. Our skin often reflects the state of our internal health, and changes in appearance, texture, and colour may indicate underlying health issues. In this blog, we will dig deeper to understand skin and what it can tell about your overall health.

The first step in caring for our skin is understanding its anatomy and physiology. Our skin comprises three layers: the epidermis, dermis, and subcutaneous tissue. The epidermis is the outermost layer that protects against external destructive factors such as UV radiation, pollution, and microbes. The dermis contains connective tissue, blood vessels, and nerves, while the subcutaneous tissue provides insulation and energy storage. Understanding the functions of these layers can help us identify potential skin issues and take appropriate measures.

1. Skin as a reflection of gut health

The gut and skin are closely related, and changes in gut health can affect our skin's appearance. For example, acne and eczema are often linked to an imbalance in gut bacteria, leading to inflammation and other skin issues. Therefore, a healthy gut means healthy skin. Eating a healthy diet rich in fiber, probiotics, and prebiotics can improve your gut and, in turn, enhance skin health.

2. Skin as an indicator of nutritional deficiencies The appearance of our skin can also indicate nutritional deficiencies. For instance, dry and flaky skin may indicate a lack of vitamin A, whereas pale skin may indicate iron deficiency. Proper nutrition is necessary for healthy skin. A balanced diet with various fruits, vegetables, whole grains, protein, and carbohydrates can provide the nutrients for healthy skin.

3. Skin as a sign of chronic diseases

Skin changes can also indicate underlying chronic diseases such as diabetes, liver issues, and kidney disease. For example, yellowing of the skin may indicate liver problems and skin tags may indicate insulin resistance. Regular check-ups and a healthy lifestyle can prevent and manage these conditions. Additionally, online health insurance can provide financial support and ease the burden of medical expenses.

4. Skin as an indicator of hormonal imbalances

Hormonal imbalances can also affect the skin's appearance, leading to acne, hirsutism, and other skin conditions. Women may notice changes in the skin during their menstrual cycle, pregnancy, and menopause. Hormonal imbalances can be managed with proper medical care.

5. Skin as an indicator of stress and anxiety

Stress and anxiety can affect our skin's health, leading to acne, wrinkles, and dullness. Managing stress through meditation, exercise, and therapy can improve our skin's appearance and overall health.

6. Skin as a sign of aging

Our skin undergoes various changes, including wrinkles, fine lines, and age spots. However, premature aging can be prevented by avoiding excessive sun exposure, maintaining a healthy diet, and avoiding smoking and alcohol consumption.

7. Skin as an indicator of autoimmune diseases

Autoimmune disorders occur when your immune system attacks and destroys healthy cells. These disorders can also affect the skin's appearance, causing rashes, ulcers, and discolouration. These conditions require proper medical diagnosis and treatment to manage symptoms and prevent further complications.

8. Skin as an indicator of environmental exposure

The skin can also indicate environmental exposure to toxins, pollutants, and other harmful substances. Prolonged exposure to UV radiation from the sun can cause sunburn, skin cancer, and premature aging. Chemical exposure, such as pesticides and industrial chemicals, can cause skin irritation and allergic reactions. Proper protective measures, such as wearing sunscreen and protective clothing, can prevent these harmful effects.

Understanding our skin's role in overall health is essential for keeping it glowing and preventing underlying adversities. Taking care of our skin involves a nutritious diet, regular exercise, stress management, and seeking medical attention when necessary. Taking online health insurance can further provide financial support and ease the burden of medical expenses during emergencies. Therefore, caring for our skin is about our physical appearance and overall well-being. Let us prioritise our skin health and take steps towards a healthy lifestyle.

Click HERE to learn more about the benefits of purchasing online health insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Why is wearing a seatbelt during a ride always a good habit

Road accidents in India are estimated at around 2 Lakhs per year, the highest in the world. This mainly happens as people fail to follow traffic rules, over-speeding their vehicles, and also the poor road conditions.

The government of India has set a few stringent rules and regulations for drivers. They are made to bring down the number of injuries and accidents. Wearing a seat belt is one of the essential practices of road safety that save lives in case of a crash. However, most people tend to ignore this simple yet crucial safety measure. They find it uncomfortable, unnecessary, and bothersome. This has caused many people to compromise their safety and surrender to a life-threatening event.

This article will briefly describe the various advantages of wearing a seat belt.

1. Holds you in one position:

You can undergo substantial damage if your car is moving at a great speed, and you suddenly crash. Without a seat belt, you can be thrown here and there. You can even jerk out of the car if the speed and collision impact is too high. It can result in severe injuries and even death. Hence, the seatbelt is extremely important.

If the car starts spinning or skidding, the seat belt will hold you firm in one place. If you do not buckle up, you are likely to get into a crash.

2. Restricts ejection:

As discussed earlier, if your car is moving at high speed, you are likely to be ejected out of the vehicle. It has happened a lot of times during car crashes or accidents. It happens mostly because the driver and passenger are not wearing seat belts. This causes them to lose control of their positions. Therefore, they are ejected out of the car.

With a seat belt, you will be firmly tied to your seat. This increases your chances of survival during an accident as the airbags will bear the impact, keeping you safe.

3. Matches the speed of the vehicle:

In general physics, our body tends to move with the speed of the vehicle. For instance, your body would do the same if the vehicle is at high speed and comes to a jolt. You are likely to hit the steering wheel or dashboard in this situation. If you're buckled up, this will not happen. It will keep you secured to your seat so that your body slows down with the vehicle. Seatbelts help you to adapt to varying speeds.

4. Force distribution:

With the seatbelt, the force of a crash is distributed to the stronger parts of your body. You will not be restricted to delicate areas like the head, abdomen, or chest. Your body will be prepared better to deal with a crash with a seatbelt. The chances of injury also decrease.

5. Protects your brain and spinal cord:

A car crash is most likely to cause brain and spinal cord injuries. This can affect you significantly and cause irreparable damage like temporary or permanent disabilities. They can even be fatal. A seatbelt protects you from these life-threatening car crashes.

Most road accidents take place with people not wearing their seat belts. Many lives could be saved if we agreed to follow all road safety rules. It is best practice to buckle up the seatbelt before starting your car. Avoid overspeeding and ensure that the seatbelt is accurately fitting and neither too loose nor too tight. Safety is paramount, and the next step to ensuring it is insurance. You should buy motor insurance online to protect your vehicle from any potential damages. Keep the stress of finances at bay and enjoy an array of benefits if you decide to equip your plan with various add-ons.

Click HERE to buy motor insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Auroville: An experiential township you must visit at least once!

India has many diverse places you can visit with friends and family to unwind and revitalise yourself after months of excessive work-life. These places always give you a fresh perspective and mesmerise you with renewed zeal.

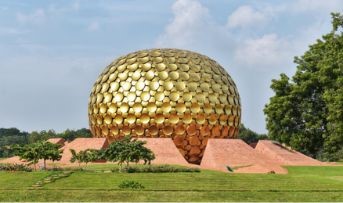

One such prominent place is– Auroville in Pondicherry. It was founded in 1968 by Mirra Alfassa and continues to be one of Pondicherry's most popular places to visit. It is an experimental township where people of all nationalities, castes, races, creeds, and religions live together peacefully.

Auroville is spread over a wide area and was constructed by the famous architect Roger Anger. The structures present inside the premises of Auroville are rare, magnificent, and unique. Every nook and corner of this place elicits only peace and serenity. If you're looking for a place to find inner peace, consider spending a few days in Auroville.

Before you embark on your journey, you should opt for the best personal accident policy in India to ensure safety during your journey.

Here's a list of the best places to visit in Auroville.

1. Matrimandir

Matrimandir is one of the most renowned and beautiful places in Auroville. The temple consists of a golden dome that is made of petal-like structures. It is huge yet beautiful in every possible way. This temple is not dedicated to the preaching of just one religion. It is for anyone and everyone who is seeking moments of inner peace. You can visit the temple and see the chambers to meditate and find solace.

2. Quiet Healing Centre

If you love pampering yourself with relaxing massage and spa sessions, this is your go-to place in Auroville. This healing centre was inaugurated in 1997. It provides a stunning ocean backdrop and gives you ample ways to relax. You can indulge in Thai, Shiatsu, and deep tissue massage. The main aim of this place is to soothe your mind and body.

3. Botanical gardens

If you love plants, then this is your place to be. Different species of plants will surround you. A green blanket of bushes and trees will captivate your senses in this serene place. About 250 different species of plants can be found here. You can simply relax or stroll through them. There is also an educational centre nearby. You can explore it to get intriguing information.

4. Savitri Bhawan

Named after one of the most famous poems of Sri Aurobindo, the Savitri Bhawan features the teachings of Aurobindo. There are various ancient and modern paintings that you can witness here. The walls here are adorned with paintings that display the poetic lines of Sri Aurobindo. There is also a reading room with various books projecting his view on life. This place is a paradise for literature lovers.

5. Adishakti laboratory for theatre arts and research

If you are a theatre enthusiast, this place will appeal to you. You can catch some experienced actors performing here. Many workshops on theatre and acting are regularly held here. You can get some advice from the actors and enjoy valuable insights into acting.

There are many places to visit and explore in Auroville. This exceptional township is an embodiment of unity, integrity, and brotherhood. You need to visit it once in your life to witness this beauty for yourself. Whenever you plan to travel, ensure that you buy the best personal accident policy in India. Accidents come unannounced. Hence you need to be prepared. Invest in the best personal accident policy in India and prepare to enjoy your stress-free trip!

Click HERE to buy the best personal accident policy in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Why are preventive health check-ups offered by health insurance important

In the olden days, people unintentionally practised habits like following a set sleep schedule, eating locally sourced nutritious food, and engaging in physical activity, which are fundamental requirements for good health. Over time, we have grown to chase material wealth and forsaken our health in such pursuits. Hectic schedules, lack of time for personal interests, and excessive stress characterise modern lifestyles.

In such a background, it is almost impossible to follow healthy habits that lead to a disease-free life. This makes buying health insurance and following preventive measures essential to keep one’s health in the best condition possible. Additionally, periodic checks can help one recognise symptoms of an incoming illness and take corrective action at the earliest. This is facilitated by preventive health checkups, which are now included in health insurance plans. They provide several benefits to policyholders, which are discussed below.

Defining preventive health check-ups under health insurance.

Preventive health checkups are medical examinations run on to-be policyholders to assess their present state of health and identify their level of risk. It is an essential part of the insurance process as it makes the insurer aware of the existing illnesses suffered by the customer. The risk assessment directly impacts the annual premium paid for health insurance coverage.

Benefits of preventive health check-ups.

The above definition often puts potential health insurance buyers in a dilemma regarding their stance on the preventive health checkups offered. Detection of pre-existing medical conditions results in pricier premiums, but the checkup is highly beneficial to policyholders in multiple ways.

1. Substitutes individualistic effort:

Even when you are not sick, getting a health checkup is a prudent way to ensure that you are in the pink of health. Generally, a full-body annual health check is recommended for everyone. By purchasing health insurance, you no longer have to book an external appointment with a clinic. The insurance company takes care of the appointments and delivers the reports straight to your doorstep. Insurers even offer doorstep health checks, making the process incredibly convenient and hassle-free.

2. Early detection of diseases:

While the detection of disease increases the health insurance premium, on the bright side, it discovers an underlying problem that would otherwise have gone unnoticed and eventually led to more significant financial stress and physical discomfort. It is better to pay extra after early diagnosis and undergo treatment than bear the massive cost of a preventable illness that you neglected.

3. Tax deductions:

The Income Tax Act 1961 provides certain deductions that can be subtracted from your total gross income to arrive at the gross taxable income. One such deduction under Section 80D is preventive health check-ups.

Most insurance companies include free health checkups in their health insurance policy. However, in the case of non-inclusive health checkups, you can claim a deduction of INR 5,000 for medical checkups for yourself and your direct dependents, including your children, spouse, and parents. The Act also allows a deduction for health insurance premiums paid in the financial year of up to INR 25,000 for non-senior citizens and INR 50,00 for senior citizens.

4. Increases interest in self wellbeing:

Seeing the results of a health checkup is no short of a reality check. It can help you break poor habits, adopt a healthier lifestyle and work towards a more robust version of yourself. An additional incentive is a link between your health and premiums. Increasing premiums due to ill health is a great motivator to refocus your efforts towards building a healthy lifestyle and reducing the risk of diseases.

Preventive health checkups are a boon in the guise of a preliminary check that helps health insurance providers assess the risk of potential clients. These checks facilitate the early detection of potentially life-threatening ailments and provide appropriate facilities to take care of the problem at the earliest. While health insurance offers several benefits, including a safety net in medical emergencies, preventive health checkups are a perk you should take advantage of!

Click HERE to buy the best health insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here are a few myths you need to know about public liability insurance

Public liability insurance in India is a kind of insurance that aims to shield business owners from claims that lead to legal actions. It protects you if a customer or general public claims that your business activities caused them to suffer an injury or property damage. A policy will pay for these costs, which may include any compensation you are required to pay if a claim does end up going to court.

More about public liability insurance in India:

The public liability insurance policy covers the insured's legal obligation to pay third parties for unintentional death, physical injury, disease, and loss of or property damage. Subject to the limitations of indemnity and other terms, conditions, and exceptions of the policy, it covers the financial claims filed against the insured during the policy period, including legal fees and expenditures spent with the prior agreement of Insurers.

A few important points to remember:

● No culpability is acknowledged

● Claims filed more than five years after the incident won't be considered

Myths about public liability insurance:

1. Professional assistance and counsel are covered:

It's common to mix up professional indemnity insurance with public liability insurance. Public liability in India covers the costs related to unintentional damage and injuries. In contrast, professional indemnity protects against claims from professional negligence in business services and advice.

2. If you are sued, you can close the company:

If you own a small business, closing it won't make the case go away if you are proven legally responsible for someone getting hurt or something getting broken. The lone proprietor will be held personally liable indefinitely for any claims brought against a small business. Even while persons who run a limited company can close their company, they will still need to deal with any legal actions brought against them. Only a public liability insurance policy will be useful in these circumstances.

3. The purchase of public liability insurance is mandatory:

Businesses are not obligated by law to buy public liability coverage. However, it would be crucial to buy this coverage if you want to shield your company from having to pay out astronomical sums in claims. While performing their duties, your personnel may harm people or damage someone else's property. Businesses operating in public areas or on clients' property need this insurance policy. Get a public liability insurance quote if you need to figure out how much it will cost.

4. Loss is compensated through public liability insurance:

That's only partially accurate. Public liability insurance in India does not cover pure monetary loss. Therefore, a third party cannot demand reimbursement for the monetary damage they have sustained due to a service provider's acts.

5. Every time you sign a new contract, you'll need new insurance:

Most of the time, firms only have a single policy to cover all the contracts and projects they take on. However, for public liability insurance, when a new contract entails significant risk or is substantial, buying new insurance can be required rather than renewing an existing one. Almost every public liability insurance in India has flexible coverage options.

This simplifies adding new features when the company expands or takes on new jobs. This will be practical and guarantee that your business needs are addressed. Working with trustworthy and renowned insurance providers is essential when looking for insurance coverage to safeguard your small business. Your business can benefit from having the best public liability insurance in India.

Click HERE to learn more about public liability insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.