General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

Learn about these efficient ways to ensure health and safety in your office post-Covid

The pandemic was emotionally challenging for everyone globally. The sudden shutdown of the world was something that no one ever saw coming or would have imagined. The office-goers had to undergo an acute struggle of adapting themselves to this drastic transition.

But, now, with successful vaccination drives and improved safety standards, the workplaces are opening again, and people have started resuming their work. However, life before the pandemic and after the pandemic are two very different situations. So, while returning to your work again, it is crucial to understand that you have to be extra careful of your office premises with robust preventive measures to avoid exposure to the virus.

This post covers all the essential health and safety measures an employee and employer needs to follow. Continue reading to get the best Covid tips for your safety in the office!

For Employers:

• Before the office re-opens, ensure that it is properly disinfected and sanitized. Consider that every office space, such as equipment, tables, chairs, stationary, and other utilities.

• Create a Covid safety plan and guidelines for all the employees to ensure they do not catch an infection.

• Ensure regular temperature screening and measurement of oxygen levels before the employees enter the office. It will help to catch early symptoms and make sure other employees are not affected.

• Make masks mandatory even indoors. It is to prevent getting in contact with the virus.

• Make both COVID vaccination mandatory for the employees. If certain employees have not taken their vaccines yet, encourage them to take the vaccine or help them in getting the required vaccination. Sometimes, in-office vaccination camps can also help employees get vaccinated in the office premises.

• During meetings, ensure that the chairs are placed at a safe distance. It is advisable not to have too many employees in one room. Similarly, cafeteria or canteen area should be sanitized and have a strict code of conduct. Avoid any large social gatherings inside the office premises.

• If an employee demands sick leave, do not encourage them to come to the office and work. Instead, make sure you plan out paid sick leaves to protect other employees’ health.

• Use technology for the best and safety measures. With all the advanced options available, try to make things as contactless as possible, including the attendance machines.

• Limit all your business travel. Businesses must follow all the deadlines and guidelines issued by the government.

• Lastly, keep all the health essentials nearby and available. These include sanitizer, tissues, masks, napkins, soap, and doctor-on-call.

For Employees:

• As an employee, you need to take care of your hygiene and avoid contact with any person.

• Use sanitizer often, even for your keys, wallets, and other personal belongings, whenever you enter the office.

• In case you feel sick, ask for sick leave. Do not be in the mindset of, "I need to go; I will miss my salary." While your salary is crucial, you could spread the virus in your office.

• After returning from work, make sure you take a bath or sanitize yourself. It helps you protect your family.

• Keep your medical insurance intact. The pandemic has pushed most of the businesses operating online with a noticeable increase in online purchases. Similarly, buying online health insurance helps you avoid visiting the insurer's office and with lower insurance premiums for your policy.

• Avoid gatherings in the office as much as possible, and make sure you use masks whenever needed. The same should be followed even if you are vaccinated.

Collective efforts can make the return to the pre-pandemic life more conveniently. With positive intent, work enthusiasm, and by adhering to strict safety and hygiene standards, businesses and employees can ensure a safe physical return to the workplace. So, get your office bags and formal ready. The good old 9 to 5 days are coming back soon.

Click HERE to secure your health with the best health insurance plan.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Nine habits that are killing our metabolism

Metabolism constitutes the chemical activities that repeatedly occur inside your body that keep your organs regularly operating, such as breathing, cell repair, and food digestion. Your metabolic rate regulates the number of calories you burn while also maintaining bodily balance by monitoring blood sugar, cholesterol, and blood pressure levels.

However, the metabolic rate tends to slow down as you age. And some unhealthy habits accelerate the process. This invites health problems and makes our body vulnerable to infections. Maintaining a proper metabolism keeps the body in good shape and powers the organs to perform to their best capacities. But, we practice a few habits that negatively impact our metabolism at an alarming rate. Let’s look below at the mentioned factors that could be killing your metabolism.

1. Eliminating breakfast:

Needless to say, breakfast is the kick-starter of the day. It is the most important meal that no one should skip. Since our metabolism slows down during sleeping hours, eating in the morning is a way to provide ample calories for the entire day.

2. Excessive sitting:

Sitting for hours causes your body to go into energy-saving mode. This impedes your metabolism and impairs the body's capacity to control blood sugar, blood pressure and break down body fat.

3. Insufficient consumption of protein:

Protein fuels your muscles, and muscles are significant for metabolism. Also, protein improves satiety and is essential for maintaining a healthy weight.

4. Ignoring the importance of strength training:

The more active muscular tissue you have, the greater is your metabolic rate. Therefore, strength training is a vital component of metabolism since it directly connects to muscle mass.

5. Inadequate hydration:

A recent study proves that consuming half a litre of water improves metabolic rate by 30% that lasts for about an hour. So, by staying hydrated throughout the day, you'll have the benefit of a faster metabolism.

6. Poor sleep schedule:

You'll have a slower metabolism and hormone abnormalities if you don't get enough sleep for several nights in a row or have difficulty sleeping due to any medical condition. An average sleep time should be at least 07 hours a day.

7. Eating fast food regularly:

Junk food already adds a lot of calories, but it also slows down your metabolism as high-fat food takes longer to digest.

8. Feeling tense frequently:

Cortisol, a hormone produced by the body whenever stress intensifies. Cortisol significantly increases hunger, comfort food cravings, reduced desire to exercise, and poor sleep quality, all of which negatively influence metabolism. So, keep stress away for both mental and physical well-being.

9. Having a warm room to sleep in:

Our body responds indifferently to the surrounding temperature. Sleeping in a chilly environment can boost levels of brown fat, which burns calories to produce heat. The optimal nightly temperature is 19ºC.

We are sure you practice more than five of these bad habits unknowingly that affect your metabolic rate, making you unhealthy and inviting disorders. One can never elucidate the importance of taking care of the body at every age. Apart from these habits, we usually have another habit of not prioritizing and securing our finances against undesired health conditions. We simply recommend you stay in your best possible shape and back yourself up with insurance. If you haven’t protected yourself with a health insurance cover, rather than opting for conventional methods to purchase health insurance, buy online health insurance and get yourself a chance to bag great deals on your purchase.

To browse online health insurance, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

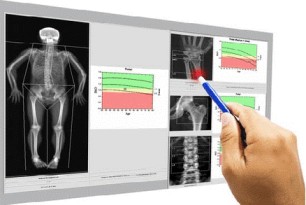

Seven useful exercises that can improve your bone density to make you feel strong

Bone density lessens when they lose calcium faster than the body can restore. This condition is known as osteoporosis in the medical field. Both women and men can develop osteoporosis, although females are more vulnerable since their bones are comparatively smaller. There is an increased loss of bone density during menopause because of estrogen decline. For males, any disease that causes a drop in testosterone might raise the risk.

Osteoporosis is one of the most severe health conditions faced in India. Approximately 50 million people in the country suffer from low bone density conditions, which demand prompt attention.

Exercising fueled with good nutrition will help you keep these problems at bay if you start early. You can avoid this condition with two things, a good workout and healthy eating habits. However, if you have the condition already, it’s best to consult your doctor and proceed further.

In this blog, we’ll tell you the top 07 exercises that can help you increase your bone density and make you stronger.

Exercise 1: Foot Stomps

• Stomp your foot on the ground. Just like crushing a cold drink can.

• You have to stomp 4 times on each foot.

• Exercise 3-5 sets.

Exercise 2: Standing on a single leg

• Grab onto something which will help you maintain balance when you stand on a single leg.

• Lift any of your legs and place your raised foot on the inner thigh of the other leg.

• Hold the same position for about a minute.

• Now, repeat similarly for the other leg.

Exercise 3: Squats

• Stand with your feet hip-width apart. Your hips, toes, and knees should be pointing forward.

• Bend your knees and stretch the buttocks backwards. Make sure your knees don’t go beyond the toes, and your heels are bearing all your weight.

• Rise and repeat the movement 10-12 times. Do not overstretch yourself.

Exercise 4: Ball sit

• Sit on an exercising ball & keep your feet flat on the ground.

• Try keeping the back straight and maintaining your balance on the ball while doing it.

• Keep your arms out at your sides, palms facing front. Once done, hold that position for a minute.

• After each set, stand and rest. Apply the same for a new set!

Exercise 5: Hip leg lifts

• Stand with your feet at hip-width apart.

• Put your weight to your right foot.

• Swing your left foot and raise it to the side. Make sure you keep the leg straight when you perform this exercise. Also, do not go beyond the 6 inches mark off the ground.

• Lower the leg.

• Perform 10 to 12 repetitions and return to your standing position.

• Repeat the same exercise with another foot.

Exercise 6: Bicep curls

• Stand straight with a barbell / dumbbell in each hand, resting your elbows at your sides. Extend your forearms in front of you. Bend your knees slightly for an ideal posture.

• Bend your elbows and bring the barbell/dumbbells up to your shoulders. Hold for a second at the peak and try to squeeze the bicep muscle.

• Come back to the starting position.

• Do 10-12 repetitions and perform a couple of sets.

Exercise 7: Shoulder lifts

• Stand with your feet shoulder-width apart, chest high, shoulders squeezed, head straight, and abs tight. Hold the dumbbells/weights on either side.

• Raise the dumbbells just above shoulder level using only your shoulders and arms.

• Return to the initial position.

• Do 10-12 repetitions for the first set. Go for another set, only if possible.

When you perform these workouts, make sure to supplement the growth with proper nutrition. Consume food that has a good concentration of calcium content. Try to naturally increase calcium intake rather than depending on medicines or supplements.

Osteoporosis may make your knees weak, but health insurance will help you lift yourself up when the going gets tough. Don't let your finances go weak. Get health insurance that will cover your journey towards being strong again.

Click HERE to know about the health insurance plan that will secure all your medical needs.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Six things that you must be aware of while buying a superbike

Are you like one of those superbike enthusiasts who would stop talking to their friends only to watch a superbike pass by? Do you also have a dream of owning a superbike at least once in your lifetime? If yes, well, then you have come to the right place!

When we say a superbike, it does not include the small capacity sports bike. We are talking about the ones with a liquid-cooled, four-stroke, in-line engine that produces a sweet humming sound. The options for superbikes in India have amplified a lot recently, but only knowing about the model names is not sufficient and would not help you out in any way.

So here are six things you must be aware of if buying a superbike.

1. Cost:

The engine contributes massively to determining the price of superbikes. A good superbike has an engine between 800 ccs to 1200 cc that derives power usually used in four-wheeled vehicles. A good superbike in India will cost you somewhere between Rs 5 lakh to Rs 40 lakh, for which you can also consider applying for a bike loan. But apart from the initial cost of buying, maintaining a superbike can at times be expensive because of the high-quality fuel requirement, repairs, and servicing. Plus, the bike insurance premiums also add up to the overall maintenance cost.

A cheaper option can also be a used superbike; this can be financially beneficial. But there are always a whole lot of things to consider before deciding to buy a used superbike.

2. Fuel:

You just can't compromise on the fuel quality for your superbike as it can do significant damage to your engines. The superbike manufacturers recommend fuel quality for each model based on the octane. In simple words, the higher the octane, the better the fuel grade. But this can be a problem at many fuel stations in India. For example, most superbikes require 95 RON; this is a fuel rating not available in India. So, before buying a superbike, check whether such high-quality fuels are accessible to you. Along with fuel, other liquids like engine oil and coolant also need to meet the standards.

3. Servicing:

Servicing for superbikes is expensive as most parts are not readily available. Also, you can't be sure that you would find good, adequately trained, and knowledgeable mechanics in your vicinity. Due to the condition of Indian roads, we also recommend quicker service schedules.

4. Insurance:

Basic bike insurance is a necessity for every motorcycle. However, for your superbikes, go for comprehensive bike insurance with multiple add-ons because the superbike parts are costly, and good insurance will be beneficial.

5. Skills:

Riding a superbike requires a lot of patience, practice, and caution. Multiple driving schools teach you how to ride a superbike. You often don't realize the amount of power a superbike has, that a small mistake can cause serious injuries. You must be capable enough to handle the strong machine with ease.

6. Safety gear:

A regular helmet is not enough when riding a superbike. You will have to invest in a good-quality helmet, riding suits, gloves, and boots.

Superbikes are for those who dream for bigger and faster things, but the greed for speed creates a need for safety. Such engineering marvels are full of power and require riders with a sense of responsibility and safety. Think about the usability of a superbike in your life, understand the cost and other requirements, and purchase one to feel that adrenaline rush through your blood.

Click HERE to buy insurance that will ensure the safety of your bikes.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Ten best budget backpacking tips for solo travellers

We all have one bucket list to travel the world and witness every corner and culture of the globe. Ranging from road trips, hiking, camping, trekking, the excitement is never-ending for a traveller, and if this is a solo trip, the experience is unparalleled. Travelling solo is one of the most liberating and adventurous experiences in life.

You might doubt that travelling solo is not that easy, especially if this is your first. Below is the guide to give you the ten best tips to plan your backpacking for a solo trip.

1. Be a wanderer:

Don't stick to one place. Instead, explore as much as you can by walking around in the cities & countryside. Be like a free spirit, save your transportation cost within the destination.

2. Split up your spending:

Organize your budget smartly and choose public transport to travel. If you need a flight, then try grabbing some reasonable offers. For example, choose a safe hostel stay or travel by night train to cut your hotel costs.

3. Do your research:

More than the excitement for the travel, you need the proper planning. Once you have finalised the destination, do some homework about the culture, the best hotspots, local monuments, popular joints and the best travel route to reach there. You won’t feel alien and will be able to explore places freely and with a better perspective.

4. Don't bind yourself:

Decide a budget before leaving and adhere to it. The motive is to travel and discover maximum with minimum cost. So, research about free public attractions days, bus passes and discounted tickets that cost less than the usual fare. Prior planning will save your time and money for these discoveries.

5. Pack up mindfully:

Going light is still the thumb rule for every solo traveller. Remember to make an essential items list that helps you carry your luggage like a backpack and save time and money searching luggage cloakrooms.

6. Stick to your itinerary:

Before your actual trip, you must imagine yourself visiting the attractions mentally or virtually through your itinerary. Therefore, it is vital to design an ideal itinerary to have an organized trip. If you sincerely follow the itinerary, you are less likely to waste extra money and time.

7. Safety & essentials:

Don't forget that safety is a primary concern while you travel solo. Take a local SIM card to stay in touch with your family and friends if travelling overseas. Note down and save the emergency numbers, helpline numbers of the destination. Carry all the essential items you might require, such as a small first-aid kit, pair of masks, hand sanitizer for additional safety.

8. Organization is the key:

Keep a separate bag or folder and organize your important documents and papers like passport, hotel bookings, tickets, identity card, health insurance agency details etc. Keep a spare copy separately.

9. Communicate and socialize:

You can find other solo backpack travellers and can team up with them. Networking is the gift you will bring back with you, so open up and enjoy the excursions together. And interactions with fellow travellers might get you some ideas and advice that might help you navigate easily.

10. Enjoy low-cost thrills:

Not all good things are expensive. Enjoy local cuisines, weekly markets for shopping with less spending and more memories. Budget trips teach you several worthy life lessons. Through travel and planning, you get an opportunity to uncover your hidden abilities to be the best version of yourself.

You don't always need a company to travel. Managing everything yourself on a solo trip will help you reflect upon your true self. Lastly, as you are travelling alone most of the time, buckle up your health with the laces of health insurance to cover all your needs for the perfect solo trip ever. As it is rightly quoted, "You have to get out of the box and travel to identify who you are!"

Are you looking to buy health insurance? Click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Ten best tips to glide through traffic with safety

No one likes to be caught in traffic for hours. But let’s face it, it isn't easy to find our way without any traffic jams on the route. We can't blame the number of vehicles plying on the road solely, but our driving habits as well cause the heavy traffic jams. Almost every driver wants to get through traffic as quickly as possible, which is not always accurate and time saver.

It’s all too easy to give in to the temptation of switching to a lane that appears free from traffic. But if you think of it, will changing lanes constantly get you any closer to your destination? Or is it all just psychological to be thinking that the lane is always faster on the other side?

Following are the top ten tips to get through traffic keeping in mind the safety and rules.

1. Plan beforehand:

Plan your trip keeping in mind weather conditions, road construction, seasons and festivals, and the peak hours.

2. Keep your cool:

Getting frustrated while driving can lead to aggressive and reckless behaviour. This can hinder your mental state and make you lose your focus while driving, thereby endangering everyone on the road.

3. Reduce your speed:

Now naturally, in the middle of the traffic, you would not get a chance to drive speedily. Yet, some drivers habitually try to speed up to make up for a lost time, resulting in a crash.

4. Do not swerve through lanes or attempt to get ahead of traffic:

Other drivers may change lanes as you approach as they can’t foresee what you’re up to and vice versa. So, staying in one lane and abiding by the lane discipline is essential and the safest option.

5. Use indicators:

While weaving in and out of lanes is not advisable, it is occasionally required. Doing so with indicators will let people know what you’re doing, keep you safe, and make it easier for you if a vehicle enables you to pass them.

6. Remove all sources of distraction:

Always keep your eyes on the road. This is especially critical while travelling in congested areas. It doesn’t make driving less dangerous because you’re moving slower.

6. Remove all sources of distraction:

Always keep your eyes on the road. This is especially critical while travelling in congested areas. It doesn’t make driving less dangerous because you’re moving slower.

7. Practice driving proactively:

Just because you’re driving safely doesn’t guarantee everyone else is as well. So, stay alert and make judgments of fellow drivers on the road.

8. Take a break whenever needed:

Pull over to the side of the road and extend your legs while trying to relax.

9. Maintain a safe distance between you and the vehicle ahead of yours:

The ideal gap is said to be 3 seconds. Maintaining a safe buffer distance from vehicles ahead of you is crucial to eliminate the chances of collisions due to sudden braking.

10. Don’t stop and stare:

Turning your head to look at a crowd or a collision that isn’t involving you is a bad idea. Instead, keep an eye on the road ahead of you.

Always keep in mind that arriving at your destination safely is the first goal for all drivers on the road. Unfortunately, a traffic jam may take up most of your time, and delays are unavoidable in many situations. It is nearly impossible to eliminate traffic jams from our lives. But you can surely reduce the impact it might have on you.

Take the road safety measures, follow the above tips and ensure that you have online car insurance are some of the ways to make your driving smoother and stress-free. Remember that choosing trustworthy online car insurance supplements a layer of protection for you and your vehicle on the road against any eventuality.

To look for online car insurance, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

These five indoor plants can significantly improve your health

The past two years have indeed taught us the importance of staying at home and keeping our house and surroundings healthy. Spending most of our time indoors, we naturally miss going out in the fresh air. But, a basic hack to welcome nature to your home and make it feel fresher is to adopt domestic plants.

Many of us prioritize the maintenance and size of a plant while purchasing them for our home but never really look for the benefits they provide. Of course, having ‘trendy’ plants around is a good idea. Still, a beautiful plant that silently works its magic on your health while you go along with your daily routine is even better. Here are the top indoor plants that can help you recover some common health issues;

1. Peace lily:

As beautiful as the name is, the essence of its nature remains unparalleled. These lilies demand no high maintenance and effortlessly add elegance to the room. Apart from its lovely appearance, this plant is known for eliminating hazardous chemicals from the air, such as ammonia, formaldehyde, benzene, and trichloroethylene. They even contribute to keeping the environment fresh and relatively humid.

2. Aloe vera:

Nothing makes a kitchen windowsill come alive like this warmth-loving succulent. Being one of the most low-maintenance plants; Aloe vera can do much more than make your skin glow. All you have to do is give it plenty of sunlight and watch out for brown spots on its leaves. The spots are an indication of abundant chemicals present in the air.

3. Philodendrons:

This big-leafed plant has made its mark all over Instagram for its attractive leaves. However, that is not all it offers; Philodendrons are renowned for removing hazardous substances from the air, including xylene and formaldehyde. It doesn’t ask for much attention except for being placed in a low-light and cool spot.

4. Herbs:

Shelter some herbs like Lavender, Peppermint, Rosemary, Thyme for multiple benefits. For example, lavender is well known for its aromatherapy to provide relief from stress. Traditionally, Rosemary has been considered to help people concentrate and sleep better. Whereas, Peppermint can help get rid of bacteria and bugs.

5. Transvaal Daisy:

Commonly known as Gerbera, it has pretty flowers and the capacity to remove benzene from indoor environments. A surprising fact about this plant is that it produces oxygen in tremendous amounts at night, making it the perfect decor for people suffering from lung problems, sleep apnea, and insomnia. Also, NASA recently acknowledged it as the best antioxidant plant.

Just the sense of being around nature can solve more than half of your health disorders, and it is a scientifically proven fact. Having indoor plants not only make your space more beautiful but also offer you many health benefits. Nevertheless, you cannot only rely on your houseplants to keep your health secured. Remember that choosing trustworthy health insurance supplements a layer of protection for your health. So, the next time when you water your indoor plants, consider what they’re giving you in return!

Click HERE to know more about the health insurance plans for you and your family.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Tips to boost your body's performance during winters

Winter is just around the corner, and we all are excited to welcome it with a smile. There is something magnificent about the chilly breeze, beanies, heaters, and crisp evenings. The sweater weather inspires us in numerous ways. Although, a large percentage of people despise this season due to varied reasons apart from the discomfort it brings along.

Our body can have a tough time adapting to the change in winters. Moving becomes a task, and we tend to get lethargic. Being curled up in a blanket doesn't allow us to leave, and all morning alarms go snoozed. We start late, and our daily schedules get hampered. Physical activities slow down drastically, and we love being idle rather than active.

But not anymore because we have compiled the best tips to keep yourself productive and increase your body's activeness. Have a quick look at it:

• Increase hydration and the intake of tea. Staying hydrated and warm throughout the day will keep you from being lethargic.

• The addition of supplements like vitamin D, C, E, and Zinc is a must in your diet as they can assist in remaining healthy throughout the winter. It will also make up for your body not getting enough sun.

• Exercising is an essential factor when it comes to staying active. Regular exercise has several advantages that assist in preventing our bodies from a variety of health disorders.

• Keep a natural diet plan. Take advantage of the season's whole fruits and vegetables and add them to your everyday meals for a nutritious diet.

• A good sleep helps your body regains its composure and energy. As a result, getting a proper amount of sleep is critical to cope with the tiredness and strains.

• A regular eating schedule can help to increase your metabolism and keep your glycogen stores maintained throughout winter.

• Practice conscious eating. Use moderation and substitution techniques in your diet. For example, soups are great options to add fibre-filled vegetables into your diet.

• Maintain personal hygiene. There is a significant risk of becoming a victim of viral infections if you do not possess a proper sanitary environment.

• Find ways to avoid winter blues. Find an activity to perform each day to keep yourself entertained and engaged which won't make you feel lazy. Listen to your favourite upbeat music, take short walks, treat yourself to some hot chocolate or green tea and hot showers, go out in the sun, and play outdoor sports with your friends.

• Start skincare. How your skin would react to cold is unpredictable. Hence, keep it moisturized all the time.

Make the most of the above tips to help you feel warmer and cozier during the winter season. Add them to your ways of dealing with winter blues and flu(s) and see how it works for you. Winter can be harsh, but we can keep our bodies healthy with suitable precautions and care. Sometimes despite being cautious, you may end up as a victim of viral diseases. So, as you layer yourself with warm clothes for protection, add another layer of health insurance to have the perfect winters.

Winters can be a little overwhelming, but it still brings the best; the berries, snow, Christmas, and new year. A little effort from your side can make the season your favourite!

To view the best health insurance policies, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Why do some people prefer cab service over owning a car

Owning a car is an investment that some individuals cannot afford, while others do not enjoy driving in overcrowded cities with heavy traffic. A new study shows that around 57% of people in India prefer cab services over owning a car. The figures of similar studies carried out in several other countries will surprise you too. Comparatively, in China and the United States, where people utilize ride-sharing services instead of their automobiles are 53% and 31%, respectively.

So, why in India are people preferring cab service over owning a car so much? In this post below, we'll try and answer it.

Here are the key advantages that people acknowledge to make this choice.

1. Service that is available round the clock:

Cabs are now accessible 24 hours a day, seven days a week. No matter if you're in your home town or out of the station. All you have to do is to book a cab through a mobile app. In no time, the cab will be at your doorsteps.

2. Convenience in this fast-paced life:

Got a presentation to prepare but you have to drive to the office too? Just book a taxi and continue working while your driver takes you to your destination. Not just that, as you don't have to drive yourself, you can utilize the time doing other important and meaningful tasks which you would rather have missed.

3. Variety of vehicles to choose from:

Cab services provide you with the luxury to book from a range of vehicle options. Cars ranging from sharing vehicles to high-end sedans are available. You can select a car based on your requirements and budget.

4. Professional drivers to ride with:

Cab services use well-trained professionals and experienced drivers to offer you comfortable transportation. The drivers are familiar with the city roads and traffic patterns. The driver will also assist you in reaching your destination quicker while keeping your safety in mind. A cab ride is even more favourable for you while commuting in an unknown city.

5. Other perks of being a passenger:

When you ride with a cab service, finding the proper spots for parking, paying tolls, and other things is not your headache.

6. Light on the pockets:

Studies have statistically proven that going for a rental is easier on your pockets in the long term for many cases. Feel free to check the study papers online, and calculate the expenses of both the possibilities.

Sounds good, right? However, the narrative about road safety and the accidents with cabs is anecdotal, proving that not all taxi rides end on a good note. In such a situation, the need for a personal accident policy arises even more. Individual personal accident insurance provides financial assistance to you in the event of an accident.

Choosing a cab service indeed has many advantages. These are just a few of the main reasons some individuals choose cab services over having a car. You may also consider savings like EMIs, petrol/diesel prices, and maintenance costs before making any purchase. On a conclusive note, now, we leave the decision to you, what between the two matches your requirements.

Click HERE to know more about personal accident insurance to make your trips safe!

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Seven best methods to ensure fire safety for buildings

In the wake of the catastrophic fires in India these days, building owners have become more concerned about fire safety for their residential and commercial buildings. Once a fire starts spreading, it is hard to control it. Even though we have efficient modern firefighting methods, it is always better to be cautious about things that can cause destruction.

Ensuring fire safety for buildings is essential, as even a minor fire outbreak in a building can ignite the most extensive fires, sufficient to destroy the whole structure. No one can predict fire mishaps; therefore, improving our fire safety methods is necessary.

This article will look at the best methods to ensure fire safety for buildings that you can implement right away.

1. Educate people on fire safety:

Prevention is better than cure, and the saying cannot have a better real-life example. Unfortunately, most casualties and deaths occur during fire incidents because of insufficient knowledge on fire safety. Therefore, everyone in the building should be made aware of the fire protocols and guidelines.

2. Emergency escape route:

If a building catches fire, there is a possibility of a power breakdown, and the lift too will stop working immediately. Constructing emergency escapes or fire exits is a necessity in almost all high-rise buildings. It is important to ensure that nothing blocks the fire exit route.

3. Create designated smoking areas:

Always ensure the proper disposal of used cigarettes to avoid the possibility of sparks turning into flames. It is also mandatory to monitor smoking zones as several fires initiate from there. Nowadays, most of the premises maintain a smoke-free zones with the designated smoking areas in the building. Smoking anywhere other than the designated areas should be strictly prohibited.

4. Have a sound fire detecting system:

The first step that the maintenance department should take is to instal a fire detecting system in the building. There have been regular technology upgrades in fire sensors, and you must stay up-to-date with their handling to use them during an emergency. These sensors often send an alert to the local fire department, informing them of your location.

5. Display fire safety signs:

Signs are one of the most effective methods of cautioning people of danger. Fire safety warning signs, fire fighting equipment signs, and the labelling of piping that holds toxic compounds are examples of illuminated signs that communicate safety information.

6. Install a fire extinguishing system:

You do not always require the local fire department to put out the small fires. Modern buildings contain sprinklers and fire extinguishers to control minor fire outbreaks. We advise you to use fire sprinklers rather than fire extinguishers because people might not handle extinguishers because of a lack of training. On the other hand, sprinklers will equally spray water everywhere in the building, thus putting out any fire.

7. Inspect your fire doors:

Fire doors have helped save many lives and have considerably reduced the damage by slowing down the fire. Therefore, regularly check your fire doors and replace them immediately if they have undergone even a small fire.

Fires are not in our control, but the least we can do is prepare ourselves for them. Regular monitoring of fire safety equipment, maintaining them, following fire safety norms for the building, and mock fire drills are essentials for the buildings. Remember that, apart from following the above tips, you also need to choose fire insurance for the building. Fire insurance can immensely help you financially against any fire mishaps. During a fire, even a single second can make a massive difference. Always act immediately and sensibly during these incidents. Don’t hesitate to leave all your belongings and evacuate the place in case of a massive fire outbreak. You need to understand that you can get a new home, but what about your life?

Click HERE to know about the different fire insurance policies you can buy today!

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Are electric scooters a reliable commuting option

With each passing day, people are extra concerned about the environment and the reality of climate change. As a result, more and more people are opting for environment-friendly and sustainable options, like e-scooters as a greener alternative.

The face of personal transportation has immensely changed since the introduction of electric vehicles in the Indian market. Electric scooters are an excellent alternative to traditional combustion engines. They have become the new face of convenience and an affordable mode of transport in India, with over 150,000 e-bikes and e-scooters sold in 2020 alone.

Yet, we know relatively little about its reliability. And to better understand it clearly, we will answer a few questions and tell you about its limitations and advantages.

What is an electric scooter?

Electric bikes or scooters are plug-in electric vehicles that use electric motors to get locomotion.

What is the mileage of an electric scooter?

On average, an electric scooter can go up to 70 km in a single charge, that is 70 km in 10 rupees making it cost-effective and an efficient commutation option.

What batteries are used in an electric scooter?

Usually, electric scooters operate on lithium-ion batteries and adhere to a 12v starter battery or a 24v electrical system.

Do you need a driving license and insurance?

Yes, in India, you would need a driving license and 2 wheeler insurance to drive any vehicle which has a capacity of more than 250 kilowatts and can attain a speed higher than 25km per hour.

What is the expected life of an electric scooter?

Electric scooters might not have the same life span as petrol bikes because engines work longer than motors, but motors are easily replaceable.

Are electric scooters reliable?

When buying a vehicle, the main factor is its reliability—whether it is safe to use, performance, durability, flexibility, etc. To know it, let's understand the pros and cons of buying an electric scooter so that you can make a choice.

PROS:

1. Easy maintenance

There's no need to maintain a battery, clutch, or oil change, and there are no valves to tune, throttle bodies to sync, or air filters to replace. You'll only need to change tires and brake pads every once in a while.

2. Limited noise pollution

Of course, it is a myth that electric motorcycles are entirely silent, but still, the noises are comparatively minimal. This means that you get to enjoy a peaceful experience. Also, no neighbours will be disturbed late at night!

3. Environment-friendly

The best advantage that electric scooters bring with them is the green revolution. These sustainable vehicles are shaping the future of the world towards a cleaner and more environmentally safe era.

4. Insurance benefits

Reports suggested that the Indian EV market will grow at 36% in the coming years and emerge as a key segment in the insurance business. Thus, in most cases, you will notice that the 2 wheeler insurance premiums are comparatively low for electric vehicles.

CONS:

1. Charging

One of the main problems is finding a charging unit for your electric vehicles. Let's say you do find one, but certainly, charging will take more time than filling a tank with fuel. Therefore, a fuel-based vehicle is more practical due to the easy access to a gas station.

2. Resale value

Electric scooters have a low resale value. And if the battery needs replacement, there is almost no market value of the vehicle. Also, it is hard to find a buyer interested in a used e-bike.

3. Storage space

E-bikes generally do not have much storage space below the seat, but new design technology is finding solutions to address this requirement of ample storage in vehicles.

These checkpoints related to the reliability of an electric scooter come in handy for you to compare the advantages and understand your requirements correctly. Planning an e-scooter certainly brings your meaningful contribution towards zero air pollution.

Planning to buy a new electric bike? Click HERE to cover it with a reliable two-wheeler insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

These seven healthy breakfast recipes will charge your day

A nutritious and filling breakfast fuels you up for the day and provides you with the energy you need after fasting for 8 to 12 hours. And not having one will leave you feeling irked and restless for the rest of the day. Therefore, it is essential to have an energy-rich breakfast in the morning.

But, what should be your ideal breakfast diet? Nutritionists suggest that your breakfast should have approximately 50 percent fruits or vegetables, 25 percent proteins, and 25 percent carbohydrates.

This article has rounded up seven healthy and tasty breakfast recipes that will charge your day.

1. Smoothies – a protein delight:

If you do not like a heavy breakfast, a smoothie is a perfect fit for you. It is a complete meal with all the essential minerals and vitamins. Then, just whip up a few fruits and veggies, and you are good to go! Adding a couple of ice cubes, dry fruits, or sleek pieces of fruits will elevate the taste of your smoothie.

2. Poha – the delicacy of the west:

Next on our list is everyone’s experimental and go-to breakfast. It is a famous dish of the western part of India but loved by the entire nation. It is tasty, light, and easy to make. It has a lot of variety to fit every taste - Kanda Poha, Aloo Poha, Tarri Poha, Curd Poha, Coconut-jaggery poha. The key ingredient here is rice flakes. You can add vegetables and spices the way you like.

3. Upma – cook it quickly:

Students living away from home prefer it because it is prepared in under 5 minutes without much hassle or even ingredients! It is slow to digest; therefore, it keeps you full for longer. Prepare this breakfast food using semolina or sooji and rice flour.

4. Salad – the authentic taste of fitness:

Some may think that a salad is not enough for breakfast, but there is nothing better than salad if you use the right ingredients. It is a perfect delight for diet-conscious people. It will boost your mood and productivity instantly, help maintain weight, enhance your digestive system, and be an excellent light breakfast option.

5. Idli – the trademark of the south:

Whenever South Indian breakfast is considered, idli always stays at the top. It is a steamed cake made of rice and black lentils. You can have an Idli with coconut chutney or vegetable stew. It is a healthy option as it requires no oil and is rich in carbohydrates, enzymes, and fibres.

6. Paratha – stuffed with love:

Many people consider it an unhealthy and heavy breakfast option as it is stuffed with excessive fats and consumes amounts of oil or butter. But, if you swap a few ingredients, it can be nutritious and delicious at the same time. Use whole wheat flour or multi-grain flour and knead the paratha dough with curd of whey water. Make your innovations as per your dietary requirements and enjoy parathas with curd, ketchup, or a chutney.

7. Muesli – the powerhouse of taste:

Muesli is a cold oatmeal dish full of fibre and proteins. To start your day on a sweet note, you may add chocolate, honey, and almond milk to your muesli. This breakfast recipe can give an energetic start to your day.

“One should not attend even the end of the world without a good breakfast.”- Robert Heinlein expressed this years ago, but it sounds right even today. Indeed, breakfast is crucial for the day. But on-the-go breakfast like bread and cheese or a packet of cookies is not sufficient. So, even if you are time-bound, it is still necessary to have an elaborate and disciplined breakfast daily.

To reinvent your breakfast routine, try bringing variations into your recipes. Search for exciting recipes online, watch videos, and bring newness to your morning meals. Along with these tips, invest in healthy habits like buying online health insurance to add the flavours of good health and financial safety to your life!

Click HERE to know more about the online health insurance you can buy.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Why should businesses start thinking about cyber security?

In this digital age, our professional and personal lives have all begun to gravitate toward the internet. Unfortunately, due to this widespread phenomenon, we are now more exposed than ever before to invasions of privacy and fraud. Businesses are at a higher risk of cyber attacks than individuals.

Hackers are making the best use of their mischievous minds to discover and exploit vulnerabilities in the working infrastructure of several small and large businesses. As a result, tons of sensitive digital data of users, customers and organizations, including government agencies, are subjected to threat from cybercriminals.

It's more urgent to get a solid cyber security policy in place to safeguard your business from cyber-attacks. In this article, we'll go through some pointers that will help you understand the criticality of this issue and help you take the necessary actions to get it secured right away.

Let's take a look at some common cyber-attacks first.

1. Phishing:

Phishing is when a fraudster appears as somebody else to trick individuals into supplying personal information such as credit card details. Financial institutions, Banking, E-commerce sectors are at high risk from phishing.

2. Ransomware:

This type of malware attack affects a computer or server; it encrypts files and locks them down. The attacker then demands payment to restore the files to their original state. Both private and government sectors can be affected severely by ransomware.

3. Spyware:

This is when a cybercriminal installs malware on a victim's computer; it collects their internet history, credentials, bank account information, and other sensitive data.

4. Denial of Service Attack:

Also known as a DoS attack, a hacker attempts to take down a network by flooding it with traffic to avoid other people from utilizing the service.

Why should you think about getting cyber security?

• Ample resources are required to recover from a cyberattack, with the typical breach taking 55 days to resolve. This will hinder and divert time, money, and personnel resources away from the other operations of your company.

• If your company stores a lot of personal information about your consumers, you must maintain its security so that no data of even a single user gets compromised. Customers can lose trust in your company when their valuable information is at risk in a data breach, and you can face unfavourable lawsuits as a result. 41% of customers believe they will stop doing business with a firm if their data is compromised.

Statistical overview:

• Every 39 seconds, a cyber-attack occurs around the globe.

• Cybercrime will cost the globe $6 trillion by the end of 2021.

• 24,000 malicious applications are eliminated across the web every day.

• By the end of 2021, the average ransomware request will be more than $1000.

• Only 25% of businesses worldwide have their cyber security department.

The threat of cybercrime is gradually rising. Millions of records are affected each year by data breaches, and reports of violations are increasing at an alarming rate.

It's not only about data privacy or net neutrality that needs attention; a complete change in emphasis to internet security is concerning. In the long term, taking an extra step in cyber and email protection can help businesses increase their overall productivity. You can take an extra step today by getting public liability insurance in India. This will help you cover both first and third-party liabilities caused due to online attacks.

See the best public liability insurance in India HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

What are happy hormones? Best ways to activate them and your lifestyle

The current pandemic situation has undoubtedly left us feeling depressed and lethargic. Unlike before, being stuck at home, we do not have much to look forward to, which has affected our hormonal balance. Everyone is dealing with this situation in their own way, and some of us have a hard time adapting to this change. Especially people with an active lifestyle find this switch extremely challenging.

Before it starts to take a toll on your mental state, we must find ways to cope with it. One of the ways is to boost your happy hormones to keep yourself healthy.

What are happy hormones?

These neurotransmitters have a role in mood control, pleasure, bonding, and even pain reduction. These enzymes are essential for your health in areas such as growth and development, metabolism, and reproduction. Happy hormones mainly include Dopamine, Serotonin, Oxytocin, and Endorphin.

How to boost these hormones?

1. Dopamine – the “Reward Chemical”

Linked with pleasurable experiences and a motor system function, Dopamine is an essential element of your brain’s reward system. It is nicknamed the “feel-good” hormone.

To boost it: Get plenty of rest, eat nuts, try to achieve realistic goals and spend time practicing healthy hobbies or getting soaked in the sun. Musical therapy and meditation can also increase dopamine levels surprisingly.

2. Serotonin – the “Mood Stabilizer”

This hormone assists in the regulation of your mood, appetite, digestion, learning capacity, and memory. Low levels of serotonin can land you into depression.

To boost it: Work out, or participate in a sport, consume carbs, drink milk at night, and focus on incorporating omega-3-rich foods into your diet. Mood enhancement can also boost serotonin levels. Cheer yourself up by recalling all the beautiful memories of the past. You may open an old photo album or do an activity that excites you the most.

3. Oxytocin – the “Love Hormone”

The feeling of love, affection, and being valued boost the oxytocin level; hence it is nick-named as the “love hormone.” It also helps develop trust, empathy, and bonding in relationships through deeper connections and physical intimacy.

To boost it: Get a massage once a week, take up a new hobby, spend quality time with loved ones, help someone, have a pet, or practice yoga.

4. Endorphins – the “Pain Killer”

Your endorphin levels tend to rise when you engage in reward-producing activities like eating, working out, or having a fun time celebrating even small moments. It is also a natural pain reliever produced by your body in reaction to stress or suffering. Endorphins redefine our social attachments by promoting pleasure.

To boost it: Go out for a run, eat a protein-rich meal, plan out a romantic evening, take a hot shower.

Your body remains active and energetic if your mind is refreshed and active. Therefore, boosting your happy hormones is crucial for a healthy lifestyle. Besides the suggested ways to improve productivity, you can figure out your methods to develop and boost these hormones. Find what makes you genuinely happy and pursue it often to lead a healthy lifestyle. While you are at it, do not forget to back up your physical health with insurance. Browse through our online health insurance plans to seek the best one that makes your dopamine level go high, to feel good and safe!

To find online health insurance plans, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Unable to decide between petrol and diesel car? We got the answer

Unlike old times, almost all car manufacturing companies are now producing new vehicles with both petrol and diesel variants. With it, the common misbelief of a petrol car being superior is also burning to the ground. The way diesel engines have advanced significantly poses a severe threat to their petrol rivals by being more efficient and economical.

But the debate remains as to whether to go for a petrol or diesel model. Allow us to clear it out for you quickly. Here are the 5 major aspects to compare both the options, and let’s view the results.

1. Performance:

If you are a power enthusiast looking deeply into car performance other than anything, remember that a car’s performance is mainly affected by the amount of weight it carries. However, both petrol and diesel cars offer specific power. For example, if you like instant pick up, a petrol car will impress you better. On the other hand, a diesel car will amaze you with the sudden thrust despite the slow start. So, out of the two variants, decide what suits you better.

2. Prices:

Diesel models are generally more expensive than their petrol rivals, and so is their maintenance cost. Do not let the fuel prices confuse you with the car prices. Although diesel as a fuel is cheaper than petrol in our country, the cars sell at a higher price. It's on you to decide whether to pay more for your car one time or more for your fuel every time.

3. Maintenance expenses:

Do diesel models require a higher maintenance cost? That no longer stands true for every case. Although maintaining a diesel vehicle is still more expensive than a petrol vehicle, it has become comparatively affordable than earlier. It even varies between the different classes of the car and the brand.

4. Fuel-efficiency:

This is something to consider later in all the aspects mentioned earlier. Mileage for diesel vehicles is one of the sole reasons for people to choose them over petrol vehicles. A diesel car will run more kilometres in the same litres of fuel than a petrol car. So, in terms of fuel efficiency, diesel cars are clearly the prize winner.

5. Fuel costs:

India has always had diesel at a reduced price than petrol owing to the subsidies. Although the price gap has reduced continuously in almost all states, this is still a fact. Hence, diesel is cheaper than petrol, with diesel vehicles having a better mileage than the latter. Therefore, despite the initial higher charges, it is proved that a diesel car is affordable after all.

Owning a car is a luxury in itself; hence ensure to get the one most suited to your expectations. Regardless of what type of car you buy, decide it after assessing the running cost, the duration you want to retain it and resell value it brings to you. And when you finally make a purchase, do not forget to buy new car insurance as made mandatory by the laws. Apart from choosing the best vehicle variant, you also need to buy new car insurance for a financial safety net if the unexpected occurs.

To buy new car insurance for your car, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Things to do after your car gets totaled post an accident

No one likes to think about the possibility of their vehicle being in an accident, but knowing what to do when it happens, helps you a lot. According to a survey, almost 77% of drivers have been in at least one accident during their lifetime. Thus, as per the facts, your chances of getting into a car accident during a 1,000-mile trip are 1 in 366.

After a car crash, your immediate response is to ensure everyone's safety and get medical attention even if the injuries seem minor to you. The immediate aftermath of an accident is quite stressful, and not knowing what should be your next step only adds to the stress.

Therefore, it is time you learn what to do when your car gets totaled post an accident.

After the accident, when you inform your insurance company about the incident to claim your insurance, the company may deem your car to be 'totaled'.

But, first, what exactly does 'a totaled car' mean?

• If the value of repairing the vehicle is more than the value of the car, pre-accident.

• If it can be dangerous to use the car again after the repair work.

Some companies cover the cost of towing the car. Few look after your rental car bills only for three days, whereas some might cover for an extended period. Different companies have different policies for the drivers. Therefore, it is better to be familiar with your private car insurance policy.

Now follow the given steps to claim your insurance settlement.

Step 1

Give your insurance company a call. Many companies have mobile applications where you can click images of the damage and post them, and an inspector will survey the specifics. But, when you think your car is totaled, it will take much more than a basic inspection to verify the damage.

Sometimes, there is not much visible damage, but some damaged parts of the car can cost much more than you anticipate. For this, you will have to trust your inspector to do a thorough inspection of your vehicle.

Step 2

Submit your application, policy details, and police report. Now, all companies have different documentation processes, and you must be sure to understand what papers you will need to submit precisely. Your settlement request would not proceed further unless the company has received all that it needs.

Step 3

Whether you own the vehicle or are leasing it, the insurance company will write a check to you, your lender, or the lease company. The amount of your total loss settlement will be the AVC, average cash value of your car, which depends on the following

• the current market value of your vehicle

• the condition of your car pre-accident as well as its mileage

• other features of the car such as leather seats, power windows etc.

Sometimes fortune turns harsh on us, and it becomes tough to accept the reality. Accidents can happen anytime, and it is rightly quoted that 'Accidents hurt, but not safety.' The recovery post a severe accident is never a peaceful process. Seeing your beloved car turn into crushed pieces of metal is an awful feeling. Don't wait for the worst to happen. Be prepared by buying private car insurance that assures you the complete assistance and compensation you expect during the tough times.

Need private car insurance? Click HERE to get the best insurance quotes.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Ten features that your car might have but you've overlooked them

You may be spending every day driving around in your car but not well aware of its every feature. We can guarantee you that you have missed out on more than one feature of your car. But you have got nothing to worry about as we have you covered.

Failing to notice each of your car’s features is quite common and happens to all of us. The reason could be because it is not in your direct vision or sometimes, we are just too caught up to notice it. People are not familiar with these high-tech vehicles yet, and it is understandable.

Allow us to introduce you to these amusing features that you probably overlooked.

1. A trunk that doesn’t require you to use your hands: Some new cars have these sensors that automatically unlock and open the trunk when you wave your palm in front of a sensor or detect your smart key in your pocket.

2. Extra storage space: Few cars come with hidden storage under the passenger seats or beneath the foot space.

3. Rearview mirror that dips: The rearview mirror has adjustable settings to keep you from blinding by headlight glare? To switch between “day” and “night” settings, you only have to utilize the tab below the mirror.

4. Sensors for lane centering: Another feature of self-driving technology works based on a camera installed behind the windshield to scan lane lines and alarm you if you go out of the lane.

5. Hooks for hanging things: Also called the takeaway hooks, these are commonly located near the headrests and above the rear doors. You will also find spaces to hang your shopping bags if you look closely.

6. Fuel-efficient body frames: Some cars feature aluminium frames instead of steel bodies to reduce their weight. It makes the car more fuel-efficient as it increases the speed and eventually improves the mileage.

7. Magic seats: This seat system allows you to fold the passenger seat entirely to increase your boot space.

8. Colour-coded cables: Many modern-day cars come with different colour cables in the hood so the driver can quickly know what to look for between maintenance. The oil cap, coolant, brake fluid, and washer fluid cables are all colour-coded for convenience.

9. Amplified soundproofing: Accelerometers fitted on the vehicle detect the motions and vibrations that generate noise. Then the Bose RNC technology sends a cancellation signal directly to the car’s sound system.

10. ESD: It stands for Electronic Stability Control. This feature automatically applies the car’s brakes to regulate a turn in tight corners or bad weather.

These are the top ten overlooked yet valuable features of newly produced cars that we accumulated for you. So, acquaint yourself with all the fantastic features of your vehicle and make your driving more comfortable and hassle-free than ever.

As much as it is fun to discover your car’s crazy features, it is crucial to look after its protection. Overlooking your car’s functions may not be a big deal, but ignoring your car insurance renewal is. Do not forget to keep your car insurance renewal on time to avoid interruption in receiving the policy’s benefits in terms of safety during the time of mishaps.

To buy or renew car insurance online, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Planning to make modifications to your bike? Understand how it may impact your insurance

The craze of upgrading the look and feel of bikes has been a massive attraction, especially for the youth. These modifications are mainly made on the aesthetics or performance of the bike. However, people spend hefty amounts to get these modifications without considering their influence on the vehicle's insurance premium.

Also, know that not every modification is for looks and performance; some are for ensuring security. So, the question remains, how do all these modifications affect the insurance premium?

Below, we've explained all the types of modifications and their effect on your vehicle insurance premiums.

1. Modifications aimed at performance enhancement:

All bikers seek greater performance from their motorcycles. Whether it's a small or large modification, most of them enjoy altering things that they feel would considerably improve the performance of their bikes. Changes are done for faster acceleration, better handling, and effective braking.

Typically, insurance companies view such bike modifications as 'risky,' as more incredible speed increases the likelihood of an accident. As a result, they charge a higher premium for bike insurance.

2. Modifications aimed at aesthetics improvement:

Aesthetic changes improve your bike's visual appeal and give it a distinct appearance. For example, you may customize your bike by changing its colour, altering the seat cover, adding fibre components to bulk up the bike, or adjusting the headlights to make it look sporty. These upgrades come with an increased danger of your bike being stolen. As a result, the cost of your insurance premium may shoot up.

3. Modifications aimed at security:

Not all bike upgrades raise the value of the bike. Security upgrades might help you save money on your bike insurance premiums. Such changes are to reduce the likelihood of bike theft. Increasing the security of your bike with sensors, locks, and other such equipment can help you save money on your bike insurance.

Insurance companies provide discounts for installing anti-theft systems because they perceive it as a deterrent to theft. As a result, it is a win-win situation for both the insurer and the insured. To get benefits on your bike insurance rate, make sure you only install gadgets that have been certified by the Automotive Research Association of India.

4. Modifications aimed for specially abled persons:

If a rider is differently abled, his bike will be modified to accommodate his impairment, thereby allowing him to ride more comfortably and conveniently. There are no additional fees for such modifications. Instead, the insurance provider offers a discount to make these modifications.

Several factors influence the premium amount whenever you modify your bike. As a result, you must notify your insurer of any changes while purchasing bike insurance online or physically.

We all want to make our bike unique by personalizing it. However, before you make major changes to increase its appearance and worth, you may seek clearance from the ARAI and RTO about all the modifications. As previously indicated, modifications made for safety purposes will not raise insurance premiums, but those made for aesthetic reasons can be pricey. When purchasing or renewing bike insurance online, make sure to inform the insurer of any changes to avoid any hassles at the time of claim settlements.

Click HERE to get the best two-wheeler insurance for your modified bikes.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Know about these cool technologies for safe two-wheeler rides

With increased riders' registrations and two-wheelers plying on the road, motorcycling is becoming more popular in India, thanks to new technologies mainly observed in cars. This digitalization in the automotive industry helps improve fuel efficiency, reduces emissions, and eliminates the possible risk for the two-wheeler and rider.

Manufacturers are steadily researching new technologies to make the bike experience safe. This article will look at a few inventions that have revolutionized how we think about motorcycle safety.

1. Anti-lock Braking System (ABS):

Anti-lock Braking System prevents the wheel(s) of a motorbike from locking up during hard braking. This technology employs speed sensors on both wheels to correctly estimate wheel speed and recognize when a wheel will lock.

This mechanism adjusts the braking pressure to prevent the tyres from locking up and maintain the motorcycle's balance. It also helps to minimize braking distance in several situations. Motorcycles equipped with anti-lock brakes are less likely to meet an accident on the road.

2. Traction Control System (TCS):

Traction control avoids drifting while accelerating on a slippery surface. It limits engine power until the bike can travel without the wheels slipping and provides maximum turning stability.

The sensors and the Electronic Control Unit are the two primary components of a traction control system. The ECU captures data on gravitational forces, lean angles, and other factors. The sensors are constantly updating raw data about the motorcycle's present location. This information helps to adjust the amount of power sent to the back wheels and prevent skidding.

3. Slipper clutch mechanism:

A slipper clutch aims at reducing the effect of engine braking when the rider decelerates. It works by transmitting braking force through the chain drive, making the rear wheel shake and lose traction when the back wheel tries to move the engine quicker than it would under deceleration. The slipper clutch partly disengages the engine until the conditions are suitable for reengaging.

4. Tyre Pressure Monitoring System (TPMS):

This technology works by installing pressure monitoring sensors inside each tyre's valve. These sensors collect data from each tyre, send it to a module that compares it from both tyres and notify the rider if any tyre has low, high, or uneven pressure.

Low tyre pressure can cause slow handling, increasing your chance of meeting an accident. The TPMS technology assists you in avoiding such instances.

5. Ride By Wire technology (RBW):

Ride-by-wire is a new-age acceleration system; it eliminates the need for cables. It's an electronic throttle system that removes the mechanical throttle wire's coupling to the acceleration handlebar. This unique system results in faster and more accurate throttle response.

These cutting-edge technologies are helping bikers with safer riding experiences. As a rider, make sure your bike has these advanced safety features to provide you with a comfortable riding experience and the best possible protection. While you get prepared to upgrade for a bike loaded with these new safety-enhancing features for your bike, also remember to have valid two-wheeler insurance; not only is it necessary, but it is mandatory by the law. Always remember to get ideal 2 wheeler insurance online to improve your safety!

To know about the best 2 wheeler insurance online, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

How to ensure the safety of pillion riders during bike journeys

If you travel daily to work together or plan long rides during holidays, riding with a co-passenger always makes a journey lively and enjoyable.

Riding a two-wheeler demands alertness at all times. But, being accompanied by a pillion rider requires more vigilance. Most riders have a basic understanding of riding a bike safely, however, things change a lot when riding with a pillion rider.

Being a responsible rider, you must ensure the safety of your riding partner too. Any injury to the pillion rider might detract from the enjoyment of your travel. In this space, we’ve emphasized how to safeguard your co-rider during your bike trip.

1. Basic dos and don’ts for the pillion:

Dos:

• Always maintain a constant posture and balance your body weight

• Assist with the navigation

Don’ts:

• Never engage the rider in too many conversations and unnecessary distractions

• Don't shift your body weight to the rider

• Avoid sudden reactions or jerky movements

2. Best use of a seat and a backrest:

An uneasy pillion passenger may shuffle in their seat, resulting in a persistent state of unbalance. Hence, investing in a decent quality backrest can be of great help. It not only guarantees the pillion rider’s comfort but also keeps the bike from losing balance.

3. Check your two-wheeler’s suspension adjustment:

A pillion rider results in a greater centre of gravity, which can affect the bike's handling. As a result, make sure your bike’s suspension is adjusted correctly. For example, installing an adjustable rear shock might assist you in achieving the proper setup for riding with a pillion rider.

4. Pay attention to your braking and turning:

These are the two factors that have a significant influence on a two-wheeler’s balance. Keep your speed under control, specifically on the turns. Also, practice a progressive braking technique rather than grabbing a fistful. These are the two moments in which you should be aware of the presence of a pillion rider and alter your movement accordingly.

5. Communication is the key:

Some co-passengers feel uncomfortable while riding. They are scared of speed or sharp turns and find it difficult to adjust with maneuvering. Your pillion rider must know your motorcycle riding skills and is comfortable while on the road. You should have the transparency to tell the other person to speak out the fear, and you can accordingly adjust the speed to make the co-passenger comfortable. If you are riding with someone, always make sure you both can talk things out comfortably and enjoy the ride without hesitation.

6. Safety should always be a priority:

One cannot compromise safety, especially when riding with a pillion rider. As two-wheelers are more prone to road accidents, it’s your responsibility to take safety measures seriously. Invest in good quality riding gear, purchase ISI-certified helmets for you and your co-rider. Don’t let unfortunate incidents affect the excitement of your ride. Check for bike insurance online, browse through different options, and buy one to avoid financial setbacks in case of damages.

Making your pillion rider feel safe about riding with you is important for a pleasant ride. There has to be trust and understanding between both riders. Take extra care when riding with kids or older people. Cover distances together but keep safety and comfort as the priority.

Looking for bike insurance online, click HERE .

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

How to install WiFi in your car and make it a moving hotspot

The internet is a whole new universe that is opening up several opportunities for people. It is a clear manifestation of innovation and endless possibilities. And WiFi lets us access the internet quickly at reasonable rates.

For almost all the new car buyers, cutting-edge features such as WiFi connectivity is increasingly becoming popular. With WIFI onboard, you feel like resting on the couch at home and accessing social media, working on the go, checking important news, or having quick connectivity with emergency services and navigations.

So, how do you install WiFi in your car? Nearly every new car variant provides an in-built WiFi feature. But if you are not changing your vehicle anytime soon, read through the different ways to install WiFi in your car and make it a moving hotspot.

1. Use your phone as a WiFi hotspot:

All smartphones have the option of enabling personal or WiFi hotspots, and it can be an excellent quick fix. But it is not a long-term solution for a few significant reasons- iPhone allows five devices at a time to connect to a hotspot. In contrast, Android allows ten users, consuming a lot of data from your limited Internet plan. Can an unlimited data plan solve the problem? No, because this is data tethering. Therefore, many Internet-providing companies restrict the amount of data you can transfer through mobile hotspots. Also, switching on the hotspot will drain your cellphone's battery quickly.