General Insurance Blogs, Articles & Updates by - Magma HDI

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY

Understand these tips if planning to send your cargo overseas

With globalisation, the world has become a closely-knit village. It isn't easy to imagine a life without an international supply of goods and services that provide both convenience and luxury. However, while the flow of capital and ideas has been facilitated with the ease of internet transmission, transporting goods and services continues to take time and money.

With the expansion of international trade and travel, there is great emphasis on transporting goods most cost-effectively in the least amount of time. In such a backdrop, freight companies have seen an increased demand for overseas cargo shipments. They pay great care to ensure that your cargo reaches its destination safely by taking adequate measures to minimise risks.

On an individual level, you can ensure that the cargo is protected against any incidental damages by following the tips given below.

1. Proper packaging:

For an international shipment, the most significant issue is the risk of damage while in transit. It is best to take preventive methods while packing the goods instead of blaming the freight company after the loss has been faced. It is essential to choose the right packing supplies and ensure they are securely packed.

Also, consider the handling of the cargo while packing. Since it is known that goods are stacked on top of one another and moved using transporting vehicles like forklifts, ensure that your packaging is resistant to rough handling and is stackable. Keeping these in mind will ensure that your goods remain safe and your packages are easy to deliver.

2. Attention to fragile items:

No matter how much emphasis is placed on fragile items, it is inevitable to discover minimal damage to such delicate goods. While there is no way to eliminate the risk, proper packaging can minimise such losses.

Ensure that the package indicates the delicateness of items inside so that it is handled with care and cushion using adequate protective supplies. Consider purchasing insurance for fragile items offered by freight companies, similar to buying a fire or marine insurance India.

3. Internal cushioning:

It is known that freight companies transport large volumes of cargo daily. With such large numbers, it is difficult to ensure that each package is transported without damage. Therefore, customers should take preventive measures at the packing stage to minimise damages by providing adequate internal cushioning to the goods using bubble wrap, packing peanuts, and extra supplies to ensure the structural safety of the package.

4. Weight limitations:

Transportation charges are based on the weight of your cargo. Ensure you are not penalised by weighing your packages appropriately while filling out documents. A wooden crate may add to the weight of your parcel and increase shipping charges, but it ensures that your goods reach their destination securely.

5. Customs and Duties:

Each country has its own set of rules regarding imports. Ensure that your cargo fulfils the criteria of the destination country, the necessary documentation is filed in the proper order, and prescribed fees are paid.

6. Mode of transportation:

Factor in the cargo's nature, fragility, perishability, and delivery due date before selecting a suitable mode of transport for the goods to be delivered. For example, shipping by sea, although takes longer but is a cheaper option. By considering such factors, it is necessary to determine the best route of transport.

7. Proper insurance:

Since your cargo is set to travel long distances in uncertain conditions, it is best to purchase an insurance policy for your shipment to prevent shouldering any loss of goods in transit. Irrespective of the mode of transport, several policies like air cargo insurance and marine insurance India can minimise such losses.

International transport of goods has become an inevitable part of the modern supply chain. While freight companies are considered risky, however, with mechanisms like marine insurance India, you can share such risk with the insurer and safeguard your finances. Keep the above tips in mind, purchase the right insurance, and get ready to send your cargo overseas.

Click HERE to buy the reliable marine insurance India policy.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Best tips to secure your child’s future with proper financial planning

The foremost priority for any parent is to make their children financially secure by the time they turn eighteen and are ready to take on the world. In the growing years, your children may even decide to start up some business of their own for which they will require funds too. Also, you must consider the high living costs if your child decides to study or work in big cities like the metros. It is crucial to allocate funds to aid your child's education at foreign universities, considering the boost in international education opportunities.

Efficient financial planning is the key to being future-ready and meeting all expenditures to secure your child's future. We have designed our guide to help you plan your finances in the most appropriate way to ensure your child's bright future.

1. Start early and set your goals:

The first tip is to start as early as possible and set realistic and achievable goals. You should decide how much funds you will require to satisfy your child's aspirations. It need not be an exact amount; a close estimate will do. Calculate how much money you can save and put aside every month for your child from your current income.

2. Investing:

Investing your savings will make them grow; hence, you must decide where to invest this money. Ideally, your investment should be more in equity and less in safe-haven assets such as debt funds, fixed deposits, and gold, considering your long-term goals. Equity has the power to give you compounding returns over the years and grow your money exponentially. However, it is associated with risk.

Fixed deposits and debt funds will give you relatively lower returns, but they will be steady and safe. You must make smart decisions while investing your capital into these investment instruments.

3. Choosing the best schemes:

You will need some money for your child in the short term to meet her schooling and living expenses and more money in the long term for meeting her higher education expenditure. Allocate your investment between different asset classes accordingly and choose the best possible schemes available for the same. Invest in avenues that allow withdrawals without a long lock-in period to meet your short-term needs.

You can take the mutual funds route to invest in equity if you are not comfortable with investing in the stock market directly. Equity comes with many options, such as investing in different economic sectors, market capitalisation per your time horizon, etc. You can also buy government bonds and gold directly from outside sources.

4. Appropriate insurance coverage:

Insurance keeps your family secure in case you or your member meets with an accident. Hence, invest in a good insurance policy as per your individual need. What will happen to your child's future if something happens to you? Take a general insurance cover so that your children get fruitful benefits. Similarly, go for a mediclaim or comprehensive health insurance policy from the best health insurance company in India with a full family cover so that you are under no financial stress if anyone from your family meets with an emergency and requires hospitalisation.

5. Nominee appointment:

Never miss out on filling in the name of a nominee while investing anywhere. Fill in your spouse's name or a reliable third person, but do not leave the field blank. Only the nominee will have legal access to your investments in case of your sudden demise.

6. Regular review:

Review your investments regularly. If your investment is not performing as expected, change it to other investment options with higher returns. Similarly, keep checking your mutual funds' scheme performance and change it if it underperforms for a long time.

Proper financial planning will help you to secure your child's future. The above tips will keep you stress-free, and you will have a sufficient corpus ready by the time your child goes for her higher studies or is ready to start a venture. Reliable insurance coverage from the best health insurance company in India and good investments will be the perfect formula to turn your child's dreams into reality while being in their best state of health and well-being.

Click HERE to buy insurance from the best health insurance company in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here is the list of superfoods to add to your kid's diet for better brain health

Raising kids is no picnic. Parents' entire world revolves around their children. Several aspects factor in their upbringing, including education, health, financial aid, culture, tradition, habits, and much more. Nutrition is one of the most critical quotients to take care of during your initial parenting years. Your children's health during the formative years determines several things about the upcoming phases in their lives and how they would reflect in their lifestyles. And amongst the various components of children's health is the development of their brain, which would then influence their learning capabilities, socialisation, co-curricular, ambitions, etc.

Catering to your kids' basic nutrition requirements is essential. But at the same time, have you ever thought about how different types of food can enhance your child's brain? How can it affect their mind and the abilities that come with it? We have the answers. This blog will provide a barrage of options to include in your kids' diets. So, here is the list of superfoods to add to your kid's diet for better brain health.

1. Berry merry:

Your child's diet should include berries rich in antioxidants (strawberries, blueberries, blackberries, cherries, etc.). They are an abundant source of vitamin C, reducing cancer chances in the later stages of life. The brighter and more vibrant the colour of the berries, the more nutrients they are believed to have. So, make sure you give your children the rainbow diet of berries without fail!

2. Yoghurt, please:

It is a snack proven to be rich in protein. Enhance your child's brain health by inculcating unsweetened yoghurt in their diet. Dairy products such as yoghurt are rich in substances like iodine, which has been scientifically proven to help develop your child's brain by improving its cognitive function and growth. Sufficient levels of iodine in your kid's diet can help reduce risks of cognitive impairment compared to children who are habituated to lower than required amounts of iodine.

3. Eggs are a must:

An immense protein source, eggs are essential to your child's diet. Egg yolk contains choline, a significant nutrient source aiding brain development. Eggs can be served in various forms-burritos, rolls, wraps, omelettes, poaches, etc., attracting children to eat without trouble. They also help in providing energy and strengthening the bones in the body, which would help in later stages of life by reducing the risk of the brittleness of bones and injuries.

4. Oranges all the way:

A very popular source of vitamin C, oranges are one of the children's favourite fruits. Besides being rich in vitamin C, they are also a huge booster for your child's cognitive health and development. They enhance blood flow when consumed in the form of juices, fruits, or foods. A boost in the blood flow when it reaches the brain increases nerve activity, thus improving the overall cognitive performance of the brain in the long run.

Other superfoods include beans, oats/oatmeal, fish (rich in omega 3), leafy greens like spinach and lettuce (rich in vitamin E and K1), cocoa, nuts, peanut butter, and many more.

The list of superfoods mentioned above includes food items readily available in the Indian markets and have high nutritional value for your child's brain and body. We hope that the options discussed above provide sufficient alternatives and reasoning behind why you should include these food items in your child's meals and how they enhance their brain health.

We just discussed how essential it is to take care of your children's brain and overall physical health. At the same time, it is also necessary to create an extra layer of protection for you and your loved ones' health against unprecedented circumstances. You must get a robust health insurance policy for family to combat such situations. With the introduction of digital services, you can get an online health insurance policy for family with all the relative information from the comfort of your home.

Click HERE to learn more about how you can buy a reliable health insurance policy for family.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Complete guide on choosing the best biker jacket to make your riding experience safe and stylish

Biker jackets are a must-have safety gear for bike-riding enthusiasts. They provide comfort, protection, and safety and help you make a style statement. Originally biker jackets were made from leather since they provided durability and insulation. However, in recent years, textile and mesh jackets have also evolved as good substitutes for leather in making biker jackets.

Here is a complete guide on choosing the best biker jacket to make your riding experience safe and stylish.

1. Safety:

The main function of a biker jacket is to provide the rider with safety and adequate protection in case you meet with an accident. It equips with a protective layer that a regular shirt or a t-shirt will not provide. Hence, go for a biker jacket that is strongly built to withstand the effect of impact or abrasion. Leather scores over textile or mesh in this department as it can withstand the effect of abrasion and will not tear even if you fall and are dragged on the ground.

A biker jacket should have adequate padding to absorb the energy from the impact and minimise injuries to the rider. Biker jackets are made to protect your spine, shoulder, and elbows to reduce the devastating effects of a serious accident. Some jackets are made with hard plastic armour to provide extra cushioning.

2. Durability:

A biker jacket will usually cost much more than your regular bomber jackets due to their build and quality. A biker jacket made of leather will be more durable than jackets made of textiles or mesh. Spending money on safety is a worthy investment, so make the right choice and the best riding jacket.

3. Comfort with the right fit:

A biker jacket should be comfortable and lightweight, along with being durable. Hefty jackets will make you feel bulky and uncomfortable over long bike rides. Correct fitting is crucial so that you feel comfortable in it. You can opt for jackets with removable soft inserts and use them as needed.

The jacket should allow adequate airflow, which will be helpful on a hot day. Also, the collars or arms should not flap while riding but allow the air to flow through so that the jacket does not become a distraction while riding. Remember that your bike and posture will significantly impact the fit of the jacket you need. While a regular, relaxed fit touring jacket can be great on a cruiser bike in which you need to keep an upright posture, the same jacket can be annoying and of poor fit if you have to ride a sportbike in a crouched position.

4. Style statement:

A biker jacket that lacks style is a big no for any biker. Your jacket should be designed such that you can make a style statement wherever you go. Race jackets or biker jackets should be colour-blocked and of vibrant colours to catch attention even from a distance. They should provide you with a sporty look. Some come with metal skid plates on the shoulder and elbow areas and most come with a reflective piping design to make your jacket look more stylish and provide safety.

A good biker jacket is similar to two wheeler insurance. Jackets save bikers from the impact of the accident, and two wheeler insurance provides them with adequate coverage and protection in case of a mishap. Invest in the best two wheeler insurance in India to be your saviour and true companion in unforeseen circumstances.

Click HERE to buy the best two wheeler insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here are the best ways to diagnose and treat gangrene

With the changing lifestyle and inconsistent routines, more and more people fall prey to various diseases. These diseases can be by the force of genes, environment, lifestyle, or a combination of all. All these diseases can contribute significantly towards the downfall of health. In the long run, it can lead to serious health issues.

One of these diseases is gangrene. This disease occurs when the tissues in the body die due to loss of blood supply by illness, injury, infection, or other health problems. Usually, the area of impact for this disease lies in the toes, foot, fingers, or limbs. When the condition is extreme, gangrene can also be present in muscles or organs. Different types of gangrene exist, and all of them need medical attention immediately.

Such diseases are highly prevalent in the world. You should protect yourself and your family members against these health adversities, especially look after your parents. To ensure safety, you can invest in the best health insurance in India for parents.

What are the symptoms of gangrene?

Here are the symptoms that you should look for in terms of gangrene.

● Severe pain

● Shriveled or dry skin

● Numb skin

● Inflammation

● Shiny or hairless skin

● Presence of blisters

● Fatigue

● Fever

● Discharge from the affected area

● Red, brown, or purple skin

What are the risk factors of gangrene?

The risk factors are:

● Presence of a weak immune system

● Diabetes

● Smoking

● Severe injury

● Artery disease

● Frostbite

● Obesity

How is gangrene diagnosed?

Once your symptoms are in the open, you must seek medical assistance immediately. Your doctor will ask you about all the possible symptoms and suggest a few diagnostic tests to confirm the disease. These are:

1. Imaging tests:

Imaging tests such as CT scans and MRIs are a great way of determining the spread of gangrene in your body. It also helps to know about possible gas build-up in the tissues.

2. Blood tests:

Blood tests are simple yet effective ways to diagnose gangrene. It helps to know the abnormalities in the blood and in looking at signs of possible infections. It is also based on the presence of WBCs or RBCs in the blood.

3. Cultures:

This is yet another way to diagnose the disease. A part of your tissue, blood, or fluid is taken as a sample. It is then viewed under the microscope to determine tissue damage.

4. Surgery:

It is an elaborate procedure that will help you determine the spread of gangrene in the body. It is suitable for the internal spread of the disease.

What are the ways to treat gangrene?

Every treatment for gangrene focuses on preventing infection spread, removing dead tissue, and total recovery. The ways and means to treat gangrene are:

1. Antibiotics:

Antibiotics are effective in preventing the spread of infection in the body. It can be taken orally or injected into the body through a needle.

2. Surgery:

Through surgery, the dead or infected part of the tissue is removed from the body permanently. It helps prevent the infection's spread to other parts of the body.

3. Oxygen therapy:

This method puts you in a special chamber with oxygen at a higher pressure than usual. It contributes to tissue healing and prevents bacteria growth.

These are the possible ways to treat gangrene successfully after you have been diagnosed with it. People with diabetes, especially the population above 40 years, are at a higher risk of gangrene and need to take extra care by regularly checking their blood sugar level and ensuring that it is controlled. Proper diet, enough sleep, less sugar intake, daily walking, and little physical exercise are needed to keep such diseases at bay.

Regardless, it would help if you always had your health insurance in emergencies. It would help if you buy the best health insurance in India for parents and secure their health with the right coverage for their age.

Click HERE to buy the best health insurance in India for parents.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Do you lead a team? Here are the ways you can inspire them to lead a healthy lifestyle

A healthy body caters to a healthy mind, resulting in higher efficiency and productivity at work. Therefore, it is in the best interests of any organisation to motivate its employees to stay fit and healthy. It will promote positivity in the workplace. Moreover, when the leader makes efforts for the health and well-being of the employees, it inspires the team to work harder and stay united as one family.

Here are some ways in which you can inspire your team to lead a healthy lifestyle.

1. Schedule a periodic doctor visit at the office:

The best way to motivate your employees to lead a healthy lifestyle is by scheduling periodic visits to a certified doctor or organising a health camp in the office. A doctor is best to guide every employee according to their individual needs. He can counsel them regarding general health and wellness issues. Moreover, he can prepare a diet chart for them, which is very helpful in promoting a healthy lifestyle and bringing mindfulness to their working routine.

2. Promote healthy eating habits:

Encourage employees to bring healthy meals to the office and avoid junk food daily. Get a couple of microwaves installed in your office so that they are motivated to bring food from home and warm it up in the office.

Give them short breaks between long working hours so they can relax, grab a small bite, have tea or coffee, and come back fresh at their desks or workstations. Encourage your team members to consume healthy food items like fresh juices, soups, salads, and multi-grain cereals. Make arrangements for fresh juice vendors in your office so that employees have a healthy choice of drinks as well.

3. Promote gyms and workouts:

If your office can afford to open a small gym for your employees in the office premises, there is nothing better. You can influence your team to compulsorily work out at the gym at least 3-4 days a week. You can organise small interesting competitions for them at the gym, motivating them to participate.

If a gym at the office is not possible, tie up with some gyms that will provide special discounts with membership to your employees. This will make your team valued, and you will pave the way for their healthy lifestyle.

4. Discourage smoking and drinking in the premises:

Smoking and drinking alcohol frequently and beyond limits can be the worst enemy of your and your employee’s health. Discourage your team from taking alcohol. Guide them about how it can negatively impact their well-being. Do the same for smoking. Encourage them to quit if someone is in the habit of smoking.

5. Destress workshops:

Keep chit-chatting with them at the workplace so that they are comfortable enough to share their problems at work with you or your HR department. Relieving them from stress can be great for their health.

You can encourage them to listen to music for some time or listen to a podcast. If not, you can at least arrange short mind-relaxing activities in the cafeteria and other common areas. These can be good stress relievers and keep your employees cheerful.

6. Health insurance:

Get health insurance compulsorily for all your employees. Ask the insurance provider to offer rebates and discounts if an employee wants to increase his cover. An insurance cover provides your employees with security in case they or their family members meet with some health emergency.

Also, they feel emotionally safe and are dedicated to their employer for care and health insurance coverage provided to them. This can result in higher productivity and efficiency of employees, resulting in higher profits for the business.

Employees are the lifelines of any organisation, and as a good leader, you need to guide them to excel in their professionalism and develop a good work-life balance. Hence, you need to take care of them and their health. Along with promoting a healthy lifestyle, educate your employees about the importance of a good health insurance policy that provides them with the required financial assistance in case of any mishap.

Click HERE to buy health insurance for your loved ones.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Factors that you must consider to add more value to your motor insurance policy

A motor insurance policy is a must as it provides you with a safety net in case your vehicle meets with an accident, gets damaged by unforeseen events such as floods and earthquakes, or is stolen. It's a way of showering your concern for your valuable asset and investing in its longevity.

Also, it is mandatorily required by the law to have all the essential documents such as a valid Driving License, Car Insurance Certificate, Registration Certificate, and Pollution Under Control Certificate before you drive your vehicle on Indian roads. So, now that we understand the importance of motor insurance India, how can we add more value to it? Let us have a look at some of the factors that can help us do the same.

1. Insured Declared Value (IDV):

Most of us get lured by the policy with the lowest premium amount and opt for it blindly. We usually fail to check our policy's Insured Declared Value (IDV). The IDV is the sum for which the insurance company is insuring our vehicle, and it puts a cap on the insurance company's liability to reimburse us in case of total damage or theft. The lower the IDV used by the insurance company or the agent, the lower will be the premium amount.

Never go for a low IDV of your vehicle just to pay a lesser premium amount. Always ensure that the IDV in the policy reflects the fair value of your vehicle. This will ensure you get an appropriate reimbursement in the unfortunate incident of theft or complete damage to your vehicle.

2. Emergency Assistance Cover:

You can opt for this cover if you don't want to get stranded in case of a breakdown. Such cover will help you to get assistance such as refueling, towing, flat tyre change, or repair of any mechanical failure by the insurer in the city and even on highways within a specified time.

3. Engine Protection Cover:

This cover will add value to your motor insurance India policy in case you reside in areas that are prone to heavy waterlogging and flooding. It will cover damage or failure of your vehicle's engine due to water ingression or oil spill. However, insurance companies usually provide this cover only to vehicles not older than five years.

4. Zero Depreciation Cover:

This add-on cover is highly recommended for high-end vehicles or vehicles with expensive spares. It excludes the depreciation part from the coverage amount. Thus, you get full coverage and can claim the full cost of the vehicle parts that have been damaged in an accident. Without this cover, you will get reimbursed only for the depreciated value of your vehicle parts.

Your motor insurance premium will go up by 15%-20% with this cover. But it can help you save a lot of money if your vehicle meets an accident and gets damaged. Insurance companies usually provide this cover only up to the first five years of a vehicle, and only a few provide it after that in lieu of a higher premium.

5. No Claim Bonus (NCB):

Insurance companies provide a No-Claim Bonus or NCB for the year you do not make any claim on your motor insurance India policy. This is initially 20% in the first year and increases to 50% in the subsequent years if you do not make a claim.

You can also avail the benefit of NCB in your new policy if you have accumulated it in your previous motor insurance policy. This may happen if you sell your car or change your insurance service provider. Therefore, do not raise a claim with the insurance company if the damage is minimal or the repair amount is lesser than the NCB you will earn on your policy.

6. Personal Belonging Cover:

What will you do if your expensive gadgets, such as a laptop, smartphone, or tablet, get damaged when you meet with an accident in your vehicle? Go for a "Personal Belonging Cover," and you can get your personal belongings covered under your motor insurance policy.

Your motor insurance policy can give you standard protection against accidents, damages, or theft. However, if you are wise enough, go for add-ons in your policy like those mentioned above and enjoy complete protection from any damage that may arise in the future. Be secure, be wise, and choose the motor insurance India policy that provides you with the best overall package at the lowest premium amount.

Click HERE to buy a reliable motor insurance India policy to safeguard your vehicle.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

How can customer-centric innovation bring revolution in the insurance industry

This is the era of personalisation. Consumers demand insurance services that can be customised according to their needs. It's no more just shop talk and several policies they need to purchase to cater to all their insurance demands. And in such saturated markets with various available alternatives, customers choose those with a customer-centric approach and excellent after-sales services.

According to various consumer surveys, more than half of the potential and current customers are willing to pay more if the customer service and customisation needs seem lucrative. This mainly involves millennials and gen z's. In that case, almost all the brands are now serving consumer needs in every possible way- content marketing, social media, products, and services.

Are you trying to understand the insurance sector's take on personalisation and centralising their services around their customer base? This blog will discuss several pointers regarding customisation in insurance industries to provide customers with precisely what they need.

1. Future analysis:

It is essential to analyse the current patterns to predict the future projections about the product, the consumer demand, and the scope for improvement with more policy features. These specific parameters are strong values that help determine your business's appearance five years later

2. Simplifying the processes:

While product-based industries will find it a little easier to customise their customer experience, the insurance sector still demands a lot of technical understanding from the customers' ends to avail of the insurance services. It makes it a little difficult for the potential consumers who are new to the insurance world and have just started adulting and taking money matters and investments into their own hands.

And a lack of technical understanding and knowledge can often lead to mistrust in the budding relationship between the insurance company and their customers. Insurance services with 24*7 human and virtual assistants, digitisation of various application processes to help people complete the procedure from the comfort of their homes, etc., have helped the insurance sector boost their customer-centric strategies and receive excellent feedback.

3. Conversations with customers:

Apart from digitising the services and making them convenient, the insurance companies need to have a transparent dialogue with their existing and potential consumers about their services and operations to curate a trustworthy relationship. The insurers need to have an informative dialogue about the markets and their

vulnerabilities so that the second party does not feel strange about the entire process. This will further benefit consumers and insurers as they can have easy conversations about various investments.

Curating reliable customer services and a dash of empathy and trust would do wonders for a better consumer relationship. Reputed insurance companies keep updating their services in line with market trends, current financial trends, critical customer demands, and personalisation options.

Customers can reap similar benefits and personalisation while purchasing general insurance plans. The introduction of technology and customer-centric strategies have made it convenient for customers to invest in their desired insurance plans. The online buying process is helping insurers and customers build a strong connection with a hassle-free process, quick response time, and no involvement of intermediaries. This digital revolution will shape the insurance industry's future for more years to come.

Click HERE to know more about how you can analyse various general insurance plans.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

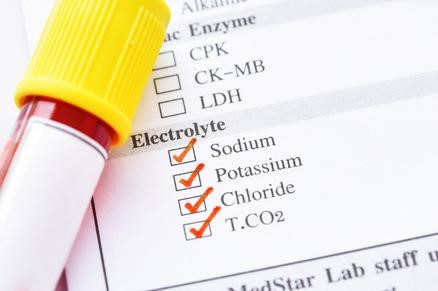

Everything about electrolyte imbalance – from cause to cure

Electrolyte imbalance is a frequent issue resulting from a poor diet or excessive physical activity. Our body fluids dissolve electrolytes, which are essential for the efficient operation and coordination of our muscles and brain. Some people are more prone to develop this condition than others. You may be experiencing an electrolyte imbalance if you wake up with muscle cramps at night. It may potentially be fatal if this ailment is not treated in time.

The best way to determine if you have an electrolyte imbalance is to perform a complete health checkup and understand your medical history. Ask your doctor about your current medications, including antacids and diuretics. This will help you determine if a particular medication or condition may be causing the problem.

The next step is to get your body checked out with a comprehensive metabolic panel blood test. An arterial blood gas test will determine the acid-base balance of your body, which can also indicate an electrolyte imbalance. Does all of this sound too costly? If yes, make sure that you have good health insurance plans in India well in advance to cover you up.

In this blog, we have covered everything from symptoms to treatment. So, stay tuned till the end.

Causes:

● Several factors can contribute to an electrolyte imbalance in the body. These include diuretics, cancer treatments, and certain medications. In severe cases, electrolyte imbalance can lead to cardiac problems or even death.

● In addition, hypokalemia can be caused by drugs that dilute the body's water, such as lithium.

● It is important to seek medical attention for electrolyte imbalance immediately when you notice symptoms. Rehydration can help relieve the symptoms and restore proper electrolyte balance. A blood chemistry test can diagnose electrolyte imbalance.

● Dry tongue, weakness, and dizziness can all be signs of electrolyte imbalance.

● Another cause of electrolyte imbalance is a faulty diet or a deficiency of certain minerals.

● Excessive loss of fluids is a major result of an electrolyte imbalance. Treatment for an electrolyte imbalance often involves adjusting your water intake and administering electrolyte fluids or medications.

Treatment:

Electrolyte impacts the body's ability to perform many vital functions, including regulating body temperature, easing blood circulation, and digestion. The human body needs high blood plasma electrolytes to keep these functions balanced and normal. Abnormalities in the levels of minerals like sodium, potassium, or calcium result in the imbalance of electrolytes.

The best electrolyte imbalance treatment is to increase fluid intake. This can be done through intravenous fluids or by drinking concentrated electrolyte replenishing drinks. These drinks contain 15 naturally-sourced electrolytes and vitamins. They also prevent the development of electrolyte deficiencies. Further, you should consult a health care professional for diagnosis and treatment if your symptoms don't subside after a prolonged time.

Electrolyte imbalance can be a troublesome issue in the long run, so it's recommended that you stay prepared in advance for yourself and your loved ones. Wondering how? Simply maintain the appropriate electrolyte levels and invest in reliable health insurance plans in India. This may sound like preparing well in advance for the danger and being negative. If you are ready beforehand, you wouldn't have to worry about the arrangement of resources at the end if anything as such ever comes up in your life.

Click HERE to buy the best health insurance plans in India as a safety net for you and your family.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here's everything you need to know about cancer health insurance policy

An estimate suggests that there are about twenty million people in the world who suffer from chronic cancer illness. Over the years, the numbers have risen, and cancer has become a common illness amongst the masses. Doctors and scientists have worked tirelessly to find a drug that can cure cancer. But with modern medicines and state-of-the-art facilities, people opt for expensive treatments that can help them combat cancer. With the treatment costs constantly rising, regular health insurance often fails to cover these treatments.

This is where cancer health insurance acts as a boon. If you are confused about what cancer insurance is and if it is beneficial to get one, then this article will help you.

What is cancer health insurance?

Insurance companies provide covers to you during cancer treatment and medication stages. This is known as cancer health insurance. This policy covers stages, including diagnosis, treatment, and post-care for all cancer stages. However, if the policyholder already has cancer, they are not liable to initiate a new cancer health insurance policy.

What are the benefits of cancer health insurance plans?

Opting for a cancer health insurance plan helps the policyholder cover various cancer stages. The premium amount can sometimes be waived if you are diagnosed with early-stage cancer. You can also opt for a monthly spread income depending upon the severity of your illness and the varying treatment requirements.

Why should you opt for cancer health insurance plans?

Compared to other health insurance plans or critical illness plans, cancer health insurance covers all costs starting from the very beginning, even in the case of first-stage cancer. Critical illness plans are targeted towards certain severe illnesses such as stroke, transplants, heart attacks, blindness, and some instances of terminal cancer.

Cancer health insurance also ensures that any complications arising due to cancer are covered. Cancer treatment is expensive irrespective of the cancer stage, so getting cancer health insurance becomes a must.

When should you consider getting a cancer health insurance plan?

Cancer is arguably one of the most dangerous diseases as there is no cure with a hundred percent success rate. So, getting cancer health insurance is imperative to safeguard yourself and your family from the exorbitant costs of treatment. However, if you are contemplating whether to get cancer insurance or not, some of these points might help you in reaching a decision. You may look for online health insurance, which will make your search more convenient with multiple options.

A recent survey has suggested a list of professionals with high cancer risk. Some of these include people working in shifts, specifically graveyard shift causing irregular sleeping patterns and uneven heartbeat, professionals in agriculture, forest, and rubber manufacturing units who are exposed to a high amount of UV rays and sun, and construction and mining workers who breathe toxic air daily are people who are susceptible to increased risk of cancer.

If you or your family members are part of such working environments or have a history of cancer in the family, you must consider getting cancer health insurance. If you do not have the money to fund your medical expenses and your regular health insurance does not cover the cost of cancer, then cancer health insurance can be a good investment.

These are some reasons to consider buying cancer health insurance for yourself and your loved ones. Do not forget to add cancer health insurance to your online health insurance profile.

Click HERE to buy online health insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here are the advantages of having ORVM in your car

Any car driver wants a clear view of their surroundings in the front and back to judge traffic properly. This helps him to drive without any roadblocks or hesitation and minimizes the chances of a possible accident. But how will a driver have a clear view of what is behind his car while driving?

A driver gets eyes on the back of the car with the help of ORVMs and IRVM. ORVM means the “Outer rear-view mirrors,” while IRVM is the Inside rear-view mirror. ORVM is a compulsory part of any car in India. It is mounted to the outside of a vehicle near the driver’s gate and the gate of the front passenger.

Let us go through the advantages of having ORVM in our car.

1. Clear visibility:

ORVMs are an excellent solution for having a clear view of the rear sides of the car. A driver can glance at any of the ORVM and have a view of that respective side of the car. This helps him to know about the traffic behind his car. ORVMs are especially useful while changing lanes on streets and highways. Also, they help us see if there is any vehicle in our proximity while taking a turn or reversing our car.

2. Prevents accidents:

ORVMs eliminate blind spots and give us a clear picture of what is behind us. This helps us to make quick decisions about when and how to change lanes, take a turn or reverse our car. A driver can easily access and operate it while driving. Without ORVMs, it can be difficult to know if obstacles and vehicles are behind us, and the chances of an accident get very high.

3. Convenience:

Older cars had manual ORVMs, and we had to open and close them by hand, making their operation and use inconvenient. But with advancement of technology, cars of the modern age come equipped with electric and auto-fold ORVMs. They are very convenient to use.

Whenever we unlock our car with the remote, the ORVM opens up automatically and gets closed when we lock our car with the remote in case of auto-fold ORVMs. Automatic ORVMs come with adjusters that the driver can easily operate to ensure a perfect vision.

4. Turn-signal repeaters:

Side turn-signal repeaters are usually installed on the ORVMs in cars these days. They give a fancy look to the car and do their job of signaling to other vehicles that the car will take a turn. Also, they are more effective in giving a turn signal than indicators installed on the body of a car.

5. Cameras:

Cars nowadays come with a 360-degree view that enhances our safety and visibility of any obstacle around the entire car and not just one of its sides. Now, how does this feature work? A 360-degree view is possible with the help of multiple cameras installed in the car.

Cameras on the rear bumper are a common feature in many cars. However, besides the front bumper, ORVMs come equipped with cameras that give us a clear side view of the car on our screen. Thus, ORVMs act as the eyes of the car on the sides and provide us with enhanced safety and security.

As we have seen, there are multiple advantages to having ORVMs in our cars. They are not just show-piece but are meant to be used extensively while driving. Having the perfect vision of the outside of the car is paramount while driving, and ORVMs justify this objective. They make our journey safer, and a lot easier and minimize the chances of an accident.

Private car insurance India offers similar safety, security, and protection to any car owner during emergencies. You should not just go blindly with any car insurance coverage. Your car is priceless, and your lives are even more priceless. Hence, you should do your best research, compare various policies, understand their terms, and choose the best private car insurance India that promises you comprehensive coverage at the best premium.

Click HERE to buy robust private car insurance India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here are the best five car cleaning accessories you may want to have

Every car owner wishes to keep the vehicle in prime condition to maintain its sleek look. However, it is challenging to do so considering the high levels of pollution and poorly maintained roads. With the hectic daily schedule, finding time to keep your car clean takes time and effort.

Car cleaning is a part of the car ownership experience that you cannot ignore. It is just as essential to keep your car clean inside out as to have regular car servicing, a pollution certificate, and a car insurance policy. Always research the best car insurance company in India to purchase adequate insurance coverage that safeguards your finances against damages.

While a weekly car wash can keep your car clean for a short period, having the right cleaning accessories can ensure that your vehicle stays clean during the week.

Here are five car cleaning accessories that are easy to use and effective.

1. Wireless handheld vacuum cleaner:

While vacuum cleaners for homes have picked up demand in the past two decades, they are also an effective cleaning solution for your car. Picking up a compact car vacuum cleaner is a quick solution to keep your car’s interiors clean at all times.

It does not take up too much space, operates efficiently, and helps keep your vehicle free of dust or waste particles of any size with minimal effort. It is incredibly convenient if you have kids since keeping them from spilling food or drinks and dirtying the car floor and seats is impossible.

2. Microfibre cloth:

A microfibre cloth is an essential cleaning supply in most spaces, and a car is no exception. They speed up the cleaning process and pick up even the smallest particles. You can restore the shine of the car’s paint underneath the dust by running the cloth on your seats, windows, and exteriors.

Another benefit is that they absorb liquids rapidly, which helps deal with accidental spills on leather seats. While you need additional supplies to eliminate any odour or deal with the stickiness a drink spill may cause, a microfibre cloth is a basic necessity in dealing with the situation.

3. Liquid glass cleaner:

While the other accessories help maintain your car’s cleanliness, this is essential to ensure proper visibility and prevent mishaps. Keeping your mirrors and windshield clean are primary requisites that help maintain perfect vision for the driver, which can reduce the possibility of accidents. Therefore, a microfibre cloth, if needed, and some glass cleaning solution goes a long way in keeping your mirrors and glasses clean to facilitate better visibility of the incoming traffic.

4. Wheel cleaner:

An often overlooked part of a car is the tyres. Newly purchased and well-maintained cars have shiny alloy rims that cause envy to most car enthusiasts. A little bit of wheel cleaner and a quick wipe with a microfibre cloth take care of any grease or dirt accumulating on your tyres and make them shine like new with minimal effort.

5. Rust remover spray:

Rust and stain remover spray comes in handy when your car needs a quick. It eliminates the squeaking of rusted parts, prolongs the life of parts, and helps remove sticky particles from the exterior. Spray some onto the sticky residue you wish to get rid of and wipe it off with a microfibre cloth to ensure that there are no scratches on the paint and that the look of your car is maintained.

Maintaining your car may seem like a daunting task. Using basic supplies and spending a few minutes can help maintain your car. Additionally, purchase a car body cover to protect your vehicle from dust, sun exposure, falling leaves, and bird droppings. Lastly, don’t overlook the benefits of having reliable car insurance. Look for the best car insurance company in India and assure yourself of coverage that provides maximum security to your valuable asset during emergencies.

Click HERE to buy insurance from the best car insurance company in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Complete guide to intellectual property insurance

How often have you heard the phrase intellectual property? Any creation that stems from one's mind or intellect is called intellectual property. It can take any form, starting from a painting, a design, an invention, or a tune. There is no set category for intellectual property.

An intellectual property, more commonly known as IP, is the foundation of a new creation. It is imperative to protect your IP to avoid fraudulent use or reproduction. There are many ways in which one can ensure that their ideas are not plagiarised or used without proper consent. Patents, copyrights, and trademarks are a few ways to protect IP.

Did you know that there exists an insurance for intellectual property? This article will shed light on intellectual property insurance and everything you need to know about it.

Let's understand what intellectual property insurance is:

Intellectual property insurance helps companies or individuals to cover the cost of litigation and court trials in case of being accused of IP violation. It also covers those who want to sue a company with an IP violation lawsuit. With the growing number of startups, IP has become a valuable asset. It is the foundation of a company's ethics, and a solid IP can help it reach new heights.

The increasing competition and the need to leave a mark in the venture capital market have led to various fraudulent cases of IP infringement. Since IP is one of the most valuable assets in recent times, the cost of IP litigation is expensive. Intellectual property insurance is a must to cover the cost of the exorbitant court proceedings.

Types of IP insurance:

Let's take a look at the kinds of IP insurance available –

1. Infringement defence:

This policy is for those who need to be safeguarded against a party who claims IP infringement against them. This defensive insurance policy acts as a safety net for companies that are held accountable for infringing patents, trademarks, or copyrights. Since the litigation costs for these cases can be very high, the policyholder need not worry about the costs. The policy provider is bound to make payments for all litigation expenses, settlement amounts, and other damages.

2. Abatement enforcement coverage:

This policy is for those IP holders who need assistance and resources to enforce their IP rights and claim infringement against others. This enforcement coverage enables the company to proceed with the legal proceedings without worrying about the legal fees. This policy also ensures that any damage is paid in full to the policyholder if the opposing party decides to counter-sue.

Big and small companies have claimed that the biggest challenge they face at the beginning of a new product launch is intellectual property risk. Various trade secrets, product building, and marketing strategies fall under intellectual property. IP insurance cover will protect your product in the market and help evade baseless lawsuits.

Intellectual property insurance offers a wide range of covers, including but not limited to infringement liability, contractual liability, enforcement, intellectual property rights protection, and other disputes. Add covers, and customise your insurance needs depending on the company or product you intend to launch in the market.

Over the years, we have seen various technological advancements bloom, with start-ups shaping the country's future. Putting in years of hard work only to realise that your work or idea has been copied by someone else can be one of the most frustrating and painful experiences. To avoid such situations for yourself and your company, do not forget to buy general insurance online. As discussed above, these insurances will significantly help anyone looking to claim or deny an infringement. All one needs to do is in-depth research on the insurance category to invest and look out for the best available options. Hard work has no substitute, and so does security.

Click HERE to buy general insurance online.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Have you heard about insurtech and the seamless opportunities it brings

Technology has taken the world by storm, and new inventions and innovations every day are seamlessly becoming part of our daily lives. In this article, we will talk about the emerging technology trend of insurtech in the world of insurance and understand how it will change insurance in the coming times.

What is insurtech?

Insurtech is a combination of the terms insurance and technology. This term was coined to define the culmination of digitalisation, technology, and insurance. Insurtech is the modern-day solution to all insurance-related qualms and queries. Applying novel technology trends such as machine learning, artificial intelligence, and extensive data analysis has helped insurance make advancements in leaps.

What are the benefits of insurtech?

The benefits of technology have been countless over the years. Combine that with insurance, and you have diverse opportunities in the insurance sector. Not only has the involvement of technology made it a more straightforward and less cumbersome process for the policy provider, but it also has made buying insurance a quick and easy task for the consumer.

Technology intervention has aided the insurance provider in calculating the overall credibility of the customer. The mammoth task of manually analysing and decision-making by policy providers has taken a back seat as technology like machine learning has made the process faster and more accurate.

Insurance companies can now target a wider audience and cater to their specific needs while sitting miles away with the help of technology. Factors such as customer acquisition and onboarding, global expansion of business, and enhancing the user experiences help companies draw more happy customers. It also has allowed insurance companies to handle and process claims efficiently.

When it comes to the customers, what better than sitting in the comfort of your home and buying online general insurance? Thanks to AI, insurance prices are tailor-made per the customer's needs. This gives a chance for companies to ditch their standard pricing methodology and stick to a more dynamic cost analysis.

What are the components of insurtech?

Insurtech has a variety of components, but it can be broadly divided into two components –

1. Technology-based:

● Artificial Intelligence: The process of automation to yield better and more accurate results.

● Machine Learning: The collection, collation, and analysis of vast chunks of data to determine a pattern.

● Internet of Things: Objects with sensors or processing abilities that can aid in risk assessment.

● Apps: For a better customer relationship experience.

● Blockchain: To improve security and protect sensitive information.

2. Solutions based:

● Appetite Solutions: Helps to find the best policy for a client across existing policies in the market.

● Data Solutions: Easy access to personal actionable data for respective users.

● Payment Solutions: Digitised payment solutions help for a better customer experience.

● Quoting solutions: Automated quote generation, thus reducing the waiting time for customers and policy providers.

What are the applications of insurtech?

1. Customer verification:

The KYC or "know your customer" is a process that all insurance companies must follow. A huge amount of data needs to be processed to ensure the legitimacy of the customer. Insurtech has made the process hassle-free by storing data directly from the issuing authority.

2. Claim management:

With automated analysis of claim documents, standardised records evaluation is maintained and later verified by agents or policymakers.

3. Detecting fraud:

Insurtech can verify policyholders' claims and crosscheck any duplicate transaction or third-party interference to ensure that no fraudulent claims are made.

These were a list of some key elements of insurtech. As mentioned above, technology is a boon to customers and policymakers alike and can benefit both parties. Customers can also use general insurance plans to safeguard their assets with the best coverage. Checking out online general insurance plans can be a smart way to explore various options and select the ones with more advantages, good premiums, and the ones that will give the best returns on your investment.

Click HERE to know more about online general insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Here’s how you can avoid getting fined due to over-speeding

The penalties for traffic defaulters have increased steeply with the passage of the Motor Vehicles (Amendment) Bill in the year 2019 in India. For instance, the fine for driving without a licence has been increased from INR 500 to INR 5000. Similarly, the penalty for over-speeding has increased from INR 400 to INR 2000.

Also, the police have been extra vigilant, and as a result, the issuance of traffic challans has significantly increased in the last couple of years. Do you wish to stay protected and avoid draining your hard-earned money by paying for hefty traffic challans due to over-speeding your vehicle? Let us see how you can achieve this and prevent over-speeding.

1. Be mindful of the speed limit:

Although fast driving seems thrilling to some people, driving over the speed limit has grave consequences. The speed limit has been put in place by city traffic police with many factors in mind, including the friction of the surface of the road and whether it has schools or hospitals nearby. Be careful and pay attention to board signages alongside the roads. Ensure to drive your vehicle within the speed limit as per the signage on the respective road.

Over-speeding might not only affect your life but also put the lives of others at risk. According to a report by the Ministry of Road Transport and Highways in 2020, 71% of accidents were related to over-speeding on Indian roads, resulting in 66% of fatalities. Pay close attention to signboards when driving, or you might incur a fine of up to INR 4000.

2. Yellow lights mean slow down:

Everyone is in a hurry to reach their destination. Although jumping a light might seem like a minor offense at any given moment, it causes severe accidents in India. To deter the public from jumping a red light, fines have been levied that range up to INR 5000, and the driver can even be sent away up to a one-year prison sentence for this offense with the suspension of their driving licence.

To avoid such consequences, be prepared to stop right when the yellow light comes on, and stop a few metres before the stop line. Try not to block the zebra crossing and create inconvenience to the pedestrians.

3. Speed camera alert applications:

You will be surprised to know that there exist applications that can alert us of upcoming speed cameras from a few hundred metres in advance. Moreover, most of these applications are free and convenient to operate.

However, use these devices as a reminder that you are over-speeding your vehicle, not as an escape from speed cameras. Make a habit of following the speed limit set by the traffic police.

4. Never drink and drive:

Often drinking provokes you to do things you don't usually do when sober. And, one very common concern among drivers is rash & fast driving. Driving under the influence of alcohol is a punishable offense in India, and you will get a hefty traffic challan for drunken driving and over-speeding when intoxicated. Moreover, it can lead to serious accidents and cause property loss and lives.

Hence, do not drive when you have consumed alcohol or are heading out for a party. Book a cab to get back home if you are drunk, even if you came in your car. Otherwise, ensure that a non-drinking friend takes the wheel for you.

Another important thing is never to run away or escape the spot if a police officer finds you guilty of violating a rule and stops you. Always accept that you’ve made a mistake and support the officials doing their work.

You should always follow the above steps to avoid getting traffic challans and paying fines. Receiving challans is not a good feeling, and repeated mistakes can make you face severe consequences. So, be a responsible driver and ensure the above traffic practices that help you avoid getting fined due to over-speeding. In addition, car insurance online India can protect your car with adequate coverage against any possible damage due to an accident.

Click HERE to buy car insurance online India and stay protected while driving.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Let's understand the psychology behind honking and the ways to tone it down

Honking while driving on the road is a serious topic and a primary source of noise pollution. Persistent noise from honking can lead to stress, annoyance, depression, and hearing impairment. It also causes road accidents due to sudden distractions. If you are wondering why people honk so much, you should understand the psychology behind it.

Reasons why people honk their horns so much.

Generally, it would be best to use a horn to avoid collisions, when necessary. However, drivers also honk for other reasons, such as

1. Honking by habit:

Most Indian drivers honk just because they feel like it, even if it is unnecessary. You may find honkers honking at turns, at blind corners, and at pedestrians walking or crossing the roads. Drivers also honk recklessly during a traffic jam to move the traffic. In this behaviour, the driver needs to show more awareness and patience.

2. Honking as a way to communicate:

In India, drivers use horn honking to communicate without words with other drivers on the road. Drivers use several horn-honking patterns, each with a different meaning. For instance, drivers use single honking when waiting outside their friend's house or when someone is in front of their vehicle, which means "I'm here".

The double horn means, "please don't be dumb", and the triple horn means, "I am upset that traffic has not moved". Some aggressive drivers use the repeater triple horn to tell other drivers that they are more important and ask them to get out of their way.

Another form of aggressive horn honking used by large vehicles is the big blast, meaning "I can do whatever I want because I am mighty".

3. Continuously honking at high speeds:

You may have seen a reckless driver going forward and constantly honking, leaving everyone behind. Such drivers are always in a hurry to arrive on time for work, meetings, or other events. However, irresponsible driving habits are dangerous and can cause more havoc on traffic.

You should avoid driving in a hurry or using a horn unnecessarily. While talking about safety, buying online motor insurance is essential to protect your vehicle from damages.

How to reduce unnecessary honking while driving:

● Most people need to learn the severity of unnecessary honking and its disadvantages. You should spread awareness about honking and noise pollution to your friends, family, and neighbours.

● Take driving lessons from renowned driving schools to learn the basics of honking etiquette, like avoiding honking at no-honking zones, near hospitals, schools, forest areas, etc.

● Unnecessary honking can also lead you to pay a ticket (challan). You should learn about when and where you should not honk.

● The government should impose strict laws against unnecessary honking and a maximum dB limit for large vehicles.

There are many reasons why drivers and riders like to honk so much. If you are like most drivers in India, you should learn the reasons behind drivers honking their horns and ways to reduce them. Once you understand the basics of honking etiquette, you should tell others to spread awareness.

In addition to honking etiquette, it is also essential for drivers to have motor insurance to protect them from fines and damage costs in the future. You can get online motor insurance quickly with minimum documentation and without the hassle of physically visiting the insurance company's office or paying a commission to an agent.

Click HERE to buy new car insurance.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Best tips to lower your health insurance premium

India is home to some of the best healthcare facilities in the world. Be it some government hospitals or super-specialty hospitals, they are equipped with state-of-the-art facilities and highly skilled doctors. However, with the rising costs of treatments and healthcare, buying health insurance is necessary for everyone. Even with all the facilities, timely treatment is often not easily accessible, so people keep turning to premium healthcare.

Super-specialty hospitals promise premium services at the cost of steep expenses, and most people from middle-class backgrounds cannot afford these treatments. This is also the reason why most people invest in health insurance. But, with increased services, the cost of premiums will also significantly rise.

If you want to reduce your health insurance premium without compromising on the services, this article is just for you.

1. Start early:

Since most health insurance plans consider your age and medical history to calculate premiums, starting early can save you a lot of money on premiums. A younger body has a better immune system, and thus the risk of diseases or illness is significantly low. If you are someone who has already been diagnosed with age-related issues such as diabetes, blood pressure, or other heart conditions, then your premium amount will also increase. To ensure that you are getting a policy at the best rates, start early and invest in the best health insurance in India.

2. Online health insurance:

Online health insurance has a lot of benefits, but the most significant of them is how cost-effective it is. With online insurance, you can avoid broker fees and other administrative charges. You also can buy health insurance from anywhere, with the freedom to choose the desired policy by comparing multiple plans.

3. Compare plans online:

There are many health insurance policies in the market and deciding on the one that suits your choices can be overwhelming. But in the long run, having an informed idea of various aspects of your insurance policy will be helpful. You can compare insurance covers, premiums, and add-on costs online. With the internet at your disposal, comparing various insurance companies is a smart way to ensure that your company is not overcharging.

Another great alternative is to use the online insurance calculator. Different companies have a calculator that helps you calculate the overall cost of your insurance. Once you enter all the covers you need, this calculator will give you a rough estimate of your health insurance plan. Compare different prices online to choose the best option for you.

4. Extended validity:

Most insurance plans have a validity of one year. However, some companies provide significant discounts on policy periods of two to three years. Not only you reap the benefits of fantastic deals but getting a policy that extends to three years also helps you evade the annual renewal costs on your policy.

5. Family plans:

Health insurance is mandatory not just for ourselves but also for our families. However, the cost of buying health insurance for every family member can add up to a lot. This is why insurance companies have initiated family health insurance plans. Family plans provide comprehensive coverage to your family members. A family insurance plan is a smart way to cut costs on individual premiums while also maintaining the scope of various covers.

These are a few ways in which you can ensure cost-effective insurance planning. Thorough research on different insurance companies and their policy plans can help you make an informed decision that suits your budget and provide maximum coverage. Remember that health insurance is essential, but what is more important is to take good care of your health. Regular exercise and healthy eating habits are a simple start to leading a healthy and happy life. Invest in the best health insurance in India for your loved ones to safeguard yourself against any expenses you might incur in hospital and medical bills.

Click HERE to buy the best health insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Understand these five car parking rules to avoid traffic violation

Car parking has always been a major challenge in most metro cities. The number of cars on the roads is constantly increasing while the parking space and the available supporting infrastructure have yet to develop at a matching pace.

A traffic challan for violation of parking rules is very pinching and bothering. What do we do if there is not much free legal space available for parking our car? The legitimate answer is understanding the car parking rules to avoid traffic violations.

Let us go through the five car parking rules that one must know.

1. Way of parking:

According to section 122 of the Motor Vehicles Act, 1988, a car owner should always park his car in a manner that does not cause any inconvenience to other road users. Also, the way of parking the car should not be dangerous, nor should it cause any obstruction to other vehicles and users of the road.

If there is a signboard depicting the correct manner of parking your car on the roadside, you should abide by it and park your car accordingly.

2. An abandoned or unattended car:

According to section 127 of the Motor Vehicles Act 1988, you cannot abandon your car or leave it unattended at a public place where you cannot legally park it.

A police officer with jurisdiction in that area can tow your car away or make it immobile by using methods such as clamping the wheels. Also, you or the person in charge of your car will be responsible for paying the towing charges.

3. Prohibited parking:

You cannot park your car in a no-parking zone or any spot where parking is prohibited, on a footpath, on the wrong side of the road, on private property without the owner's permission, alongside a parked vehicle so that you do not obstruct the traffic flow, in front of any gate that blocks the entrance to any place, in front of a school or hospital entrance, near a bus stop, a traffic signal, or a road crossing.

Also, your vehicle should not obstruct the view of a signboard. You are not permitted to park at a bend, at the top of a hill, or even near or on a bridge so that you do not obstruct incoming traffic.

4. Parking restrictions at home / society:

Even your housing societies or homes have car parking rules you must follow. You should park your car so that it does not obstruct or block your neighbour's gate.

It is illegal to park your car at the boundary of your own house if your parking style obstructs the neighbour's gate in any way. He may be unable to open the gate of his house fully. In such a case, he can file a case, serve you a legal notice and obtain an injunction restricting you from blocking his gate.

5. Blocking a parking lot exit:

You cannot park your car in front of another vehicle in a parking lot in such a way that his way is obstructed, and the owner of that vehicle is unable to take his car out. In such a case, he can call a cop, and you will have to pay a fine for blocking his way.

Parking fines differ from one city to another in India. Understanding the parking rules in your respective cities is crucial to avoid traffic violations. So, abide by these parking rules to avoid catching yourself in chaotic situations and save on fines and penalties.

Similarly, having a good car insurance policy will help you save on other penalties, as car insurance is mandatory to drive legally in India. Also, it will provide coverage in case of an accident, a mishap involving your car, or even if it gets stolen. Hence, go for the best car insurance in India and forget the stress of expenses involved in unexpected situations.

Click HERE to buy the best car insurance in India.

Disclaimer: The information provided above is for illustrative purposes only. To get more details, please refer to policy wordings and prospectus before purchasing a policy.

Best tips to detect fraud in your health insurance plan

The time of a health crisis is a vulnerable time for you and your loved ones. And this moment of panic is where most frauds occur, where mischievous minds exploit your vulnerability with their fraudulent strategies. Everyone can't look into the small details of fraud unless they understand how it takes place beforehand.

Medical emergencies are a time of great financial insecurity. A lifetime of savings can be drained due to your loved one getting into a sudden accident or the unexpected detection of chronic disease. In this time of need, health insurance is a great boon. It can provide you and your dear ones with much-needed protection from financial disaster. However, it is imperative to have the correct information to avoid falling into the trap of health insurance fraud. You won't ever want your hard-earned money to go to waste by falling prey to frauds or scams.

This blog gives you some pointers you can keep in mind to safeguard yourself from health insurance frauds.

Most common types of fraud:

Before getting into how to protect yourself from this deceit, here are some of the most common ways people can swindle money from your health insurance policy –

1. Medical identity theft: This type of fraud involves scammers using your personal information to charge fraudulent bills or make health insurance claims in your name.

2. Marketing scams: If you do not do adequate research about the company's reputation and decide to buy insurance, it may result in the company taking a high premium from you but not responding to any claims. These companies give out forged insurance documents to individuals and then become untraceable.

3. Ambulance fraud: Holding the spot of being the most overlooked type of fraud, ambulance fraud comes in the form of unnecessary charges and facilities you might not have taken, paying huge dividends to scammers.

Tips to safeguard yourself from scammers –

1. Take your time: The biggest red flag in an insurance company is when they ask you to make hasty decisions. Avoid schemes that promise you a lesser premium or better claim if you sign immediately. It is advisable to take your time with the decision-making process and be sure what kind of policy is necessary for you.

2. Be wary of unsolicited calls: Reputed insurance companies rarely call individuals to market their health insurance policies; if they do, they never pressure a customer. Be cautious of aggressive salespeople. However, even if the salesperson seems to be from a reputed company, you must never share your personal information or documents without proper research about the company.

3. A hard copy of policy and seller's signature: Request a copy of the policy they offer, complete with the company's seal and seller's signature.