2 Wheeler Insurance Online | Bike Insurance Online | Buy Best Two Wheeler Insurance Online in India | Two Wheeler Insurance Rate - Magma Insurance

Additional Covers

Two-wheeler rides are great fun. But there is also a higher probability of injury or death in case of an accident. It’s essential to include additional covers in your bike insurance to stay protected from risks. With us, you can buy these at a nominal extra cost.

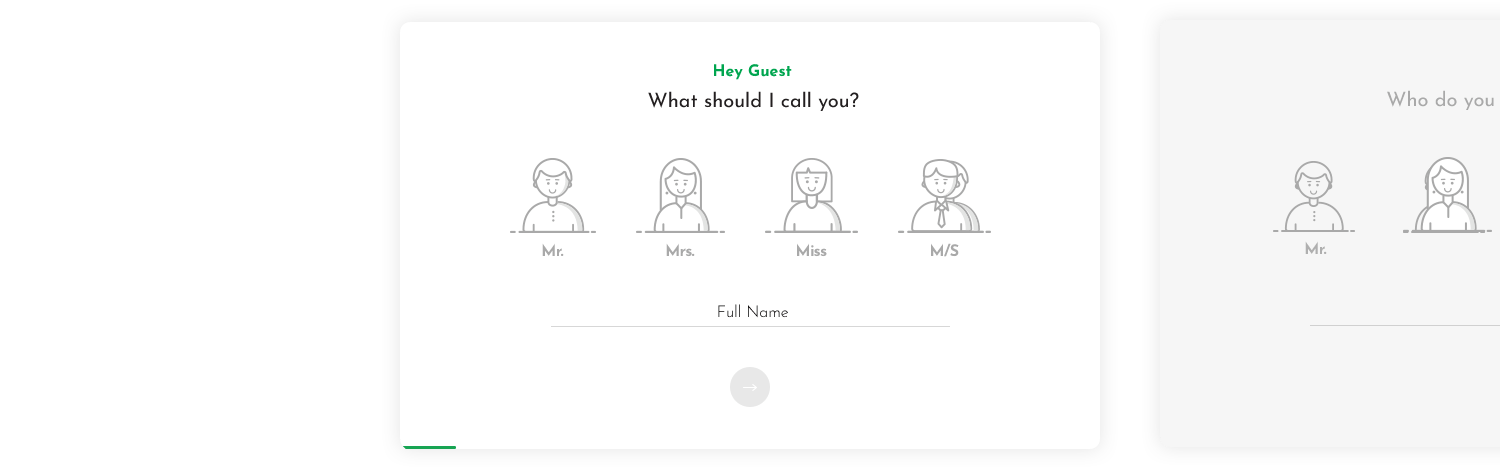

Get your two wheeler insurance online in few easy steps

Available Discounts

No-claims bonus

If you do not make a claim during the policy period, a No-Claims bonus (NCB) is offered on renewals. This discount can go as high as 50% (NCB will only be allowed provided the policy is renewed within 90 days of the expiry date of the previous policy).

Transfer of NCB: You can also transfer full benefits of No-Claims bonus when you shift your 2 Wheeler Insurance Policy from one insurer to another.

Anti-Theft Devices

If you have installed anti-theft devices approved by the Automotive Research Association of India (ARAI) in your two-wheeler, you can avail 2.5% discount (or up to Rs. 500) on your own-damage (OD) Premium.

• Third-party liability

Bike Insurance policy protects you and your bike against any legal liability towards third parties, arising out of its use, leading to any bodily injury or death of a person and any damage caused to the third-party property.

• Loss or damage to the vehicle

The package also provides cover against any loss or damage caused to your two-wheeler or its accessories due to the following occurrences:

- Fire, explosion, self-ignition, accidental damage by external means

- Any damage in transit by road, rail, air, inland waterway, lift or elevator

- Lightning, earthquake, flood, typhoon, hurricane, storm, tempest, inundation, cyclone, hailstorm, frost, landslide and rockslide

- Burglary, theft, riot, strike, malicious act, terrorist activity

While we make every effort to give you the best possible services, any loss or damage to your two-wheeler and / or to its accessories will be not be covered if caused by any of the following:

• Normal wear and tear as well as general ageing of the two wheeler

• Depreciation or any consequential loss

• Mechanical / electrical breakdown

• Damage to / by a person driving the two wheeler without a valid licence

• Damage to / by a person driving the two wheeler under the influence of drugs or liquor

• Loss / damage due to war, mutiny or nuclear risk

• Use of the vehicle in violation of the ‘limitation as to use’ clause, mentioned in the policy

Sum Insured

We insure your two-wheeler at a fixed value called the Insured's Declared Value (IDV). The IDV is calculated on the basis of the manufacturer's listed selling price of the two-wheeler (plus the listed price of any accessories) after deducting the depreciation for every year as per the following rates:

05%

Depreciation for vehicle

NOT EXCEEDING 6 MONTHS

15%

Depreciation for vehicle

EXCEEDING 6 MONTHS BUT NOT EXCEEDING 1 YEAR

20%

Depreciation for vehicle

EXCEEDING 1 YEAR BUT NOT EXCEEDING 2 YEARS

30%

Depreciation for vehicle

EXCEEDING 2 YEARS BUT NOT EXCEEDING 3 YEARS

40%

Depreciation for vehicle

EXCEEDING 3 YEARS BUT NOT EXCEEDING 4 YEARS

50%

Depreciation for vehicle

EXCEEDING 4 YEARS BUT NOT EXCEEDING 5 YEARS

Have us call you

- RENEW YOUR POLICY

- BUY NEW POLICY